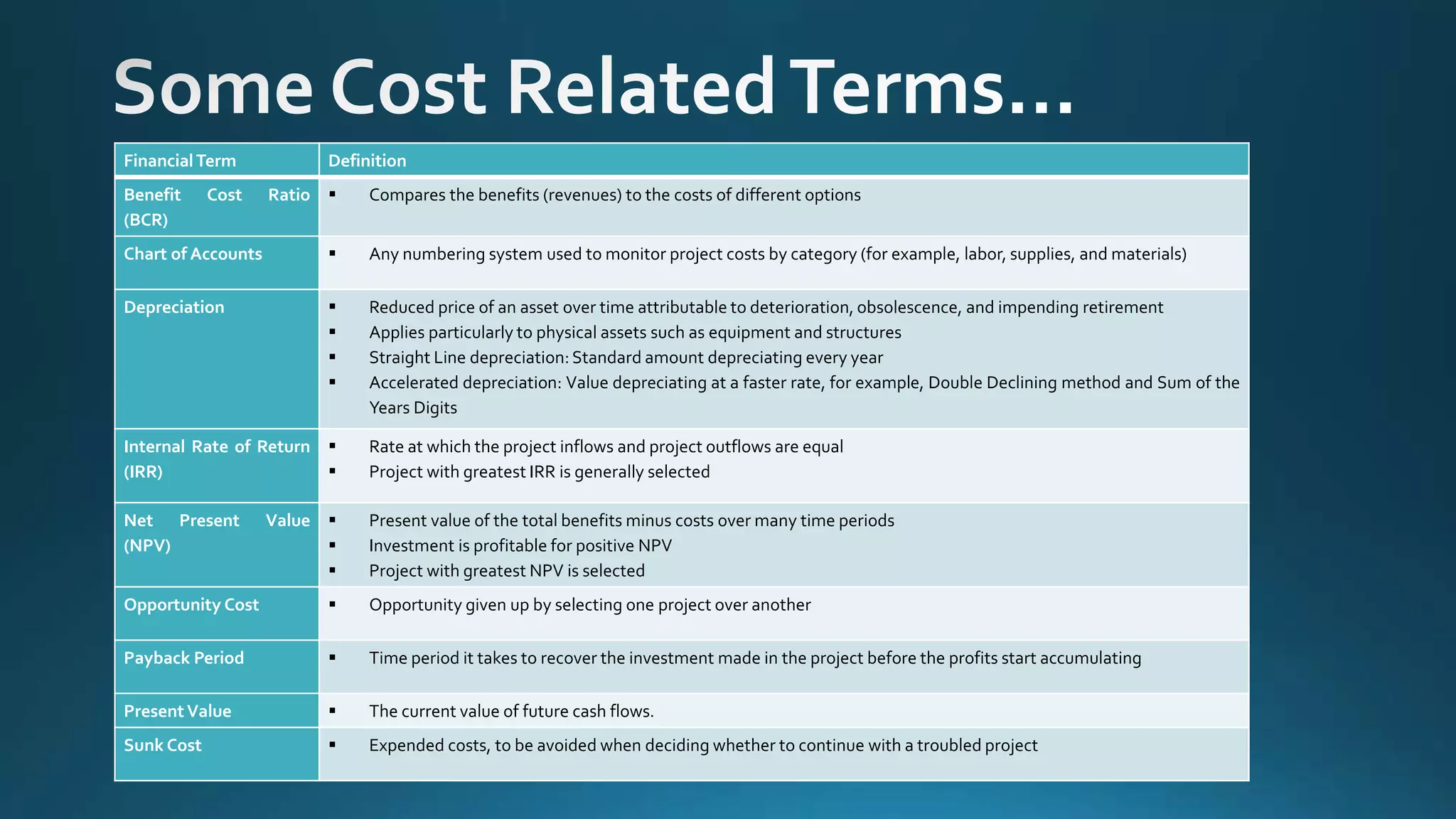

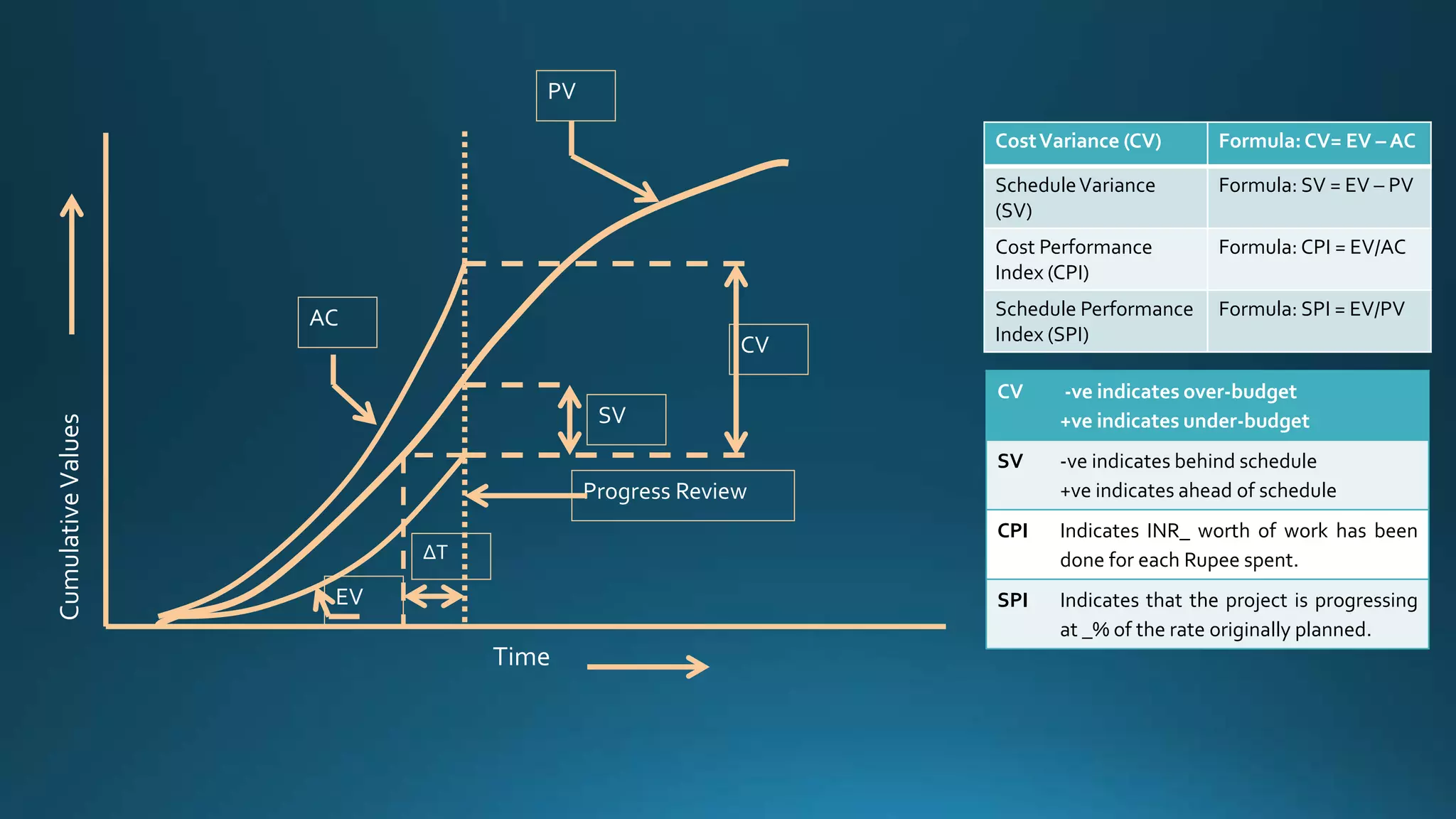

The document outlines key financial performance metrics used in project management, including cost variance (CV), schedule variance (SV), cost performance index (CPI), and schedule performance index (SPI), along with their formulas and interpretations. It also explains concepts related to project budgeting and financial evaluation such as estimate at completion (EAC), net present value (NPV), internal rate of return (IRR), and opportunity cost. By analyzing these metrics, project managers can assess budget performance and project progress critical for decision-making.

![Item Formula Remark

Cost Variance (CV) EV – AC Negative value indicates over budget and positive

value indicates under budget

ScheduleVariance (SV) EV – PV Negative value indicates behind schedule and positive

value indicates ahead of schedule

Cost Performance Index (CPI) EV / AC Lesser than one indicates over budget and greater

than one indicates under budget

Schedule Performance Index (SPI) EV / PV Lesser than one indicates behind schedule and greater

than one indicates ahead of schedule

Estimate at Completion (EAC) BAC / CPI Considering that the rate of spending remains the

same

AC + ETC Considering that the current estimate is fundamentally

flawed

AC + (BAC – EV) Considering atypical variances

AC + [(BAC – EV) /CPI] Considering typical variances

Estimate to Complete (ETC) EAC – AC Considering that the current estimate is fundamentally

flawed

BAC – EV Considering atypical variances

(BAC – EV) / CPI Considering typical variances

Variance at Completion (VAC) BAC – EAC Considering the status of the budget expected at the

end of the project](https://image.slidesharecdn.com/unit-iv-150401071907-conversion-gate01/75/Project-Monitoring-and-Controlling-Processes-10-2048.jpg)