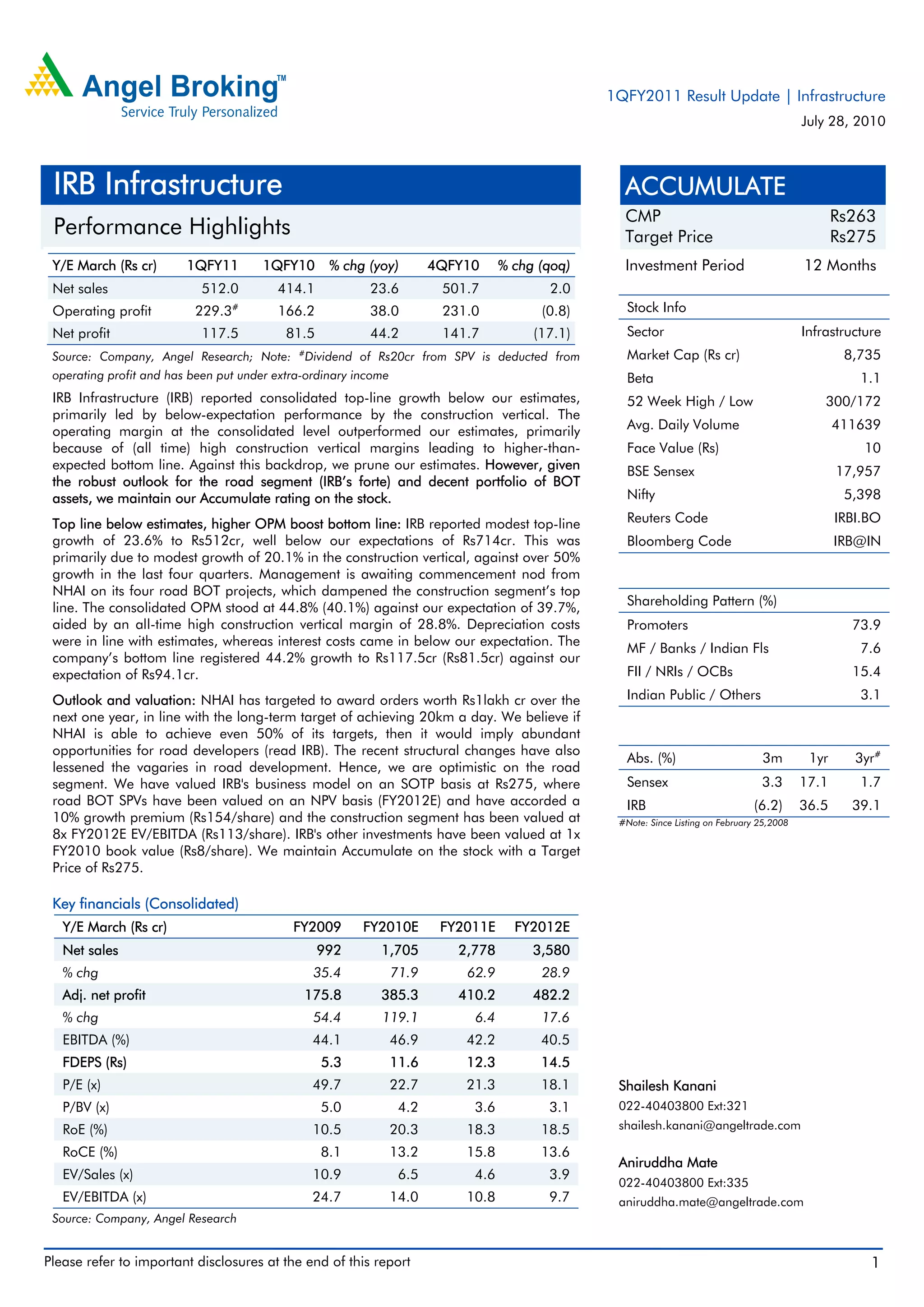

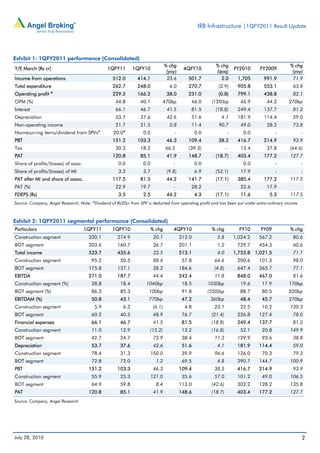

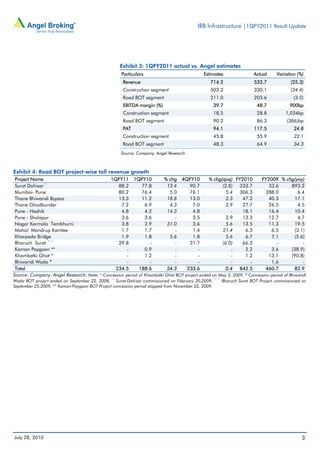

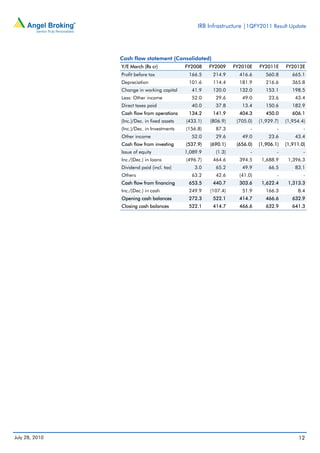

IRB Infrastructure reported a 23.6% increase in net sales to Rs. 512 crore for the first quarter of FY2011 compared to the same period last year. However, this was below the analyst's estimates of Rs. 714 crore due primarily to lower than expected performance in the construction segment. The operating margin of 44.8% outperformed estimates due to record high margins in the construction segment, leading to higher than forecasted net profit of Rs. 117.5 crore. While revising down their estimates, the analysts maintain an Accumulate rating given IRB's strengths in the road segment and portfolio of BOT assets.