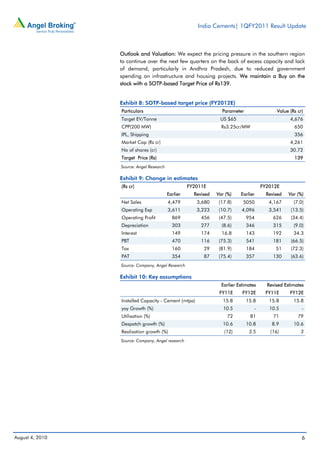

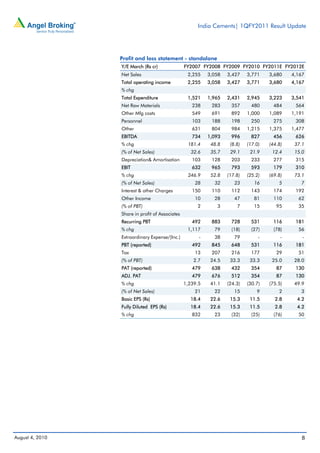

India Cements' net sales and profits declined significantly in the first quarter of fiscal year 2011 compared to the same period last year. Net sales decreased 8.1% and operating profit declined 71.2% due to a substantial decline in cement prices in Andhra Pradesh, which accounts for around 45% of the company's revenues. Net profit dropped 82.7% to Rs25cr as a result of the poor operating performance, despite a profit from selling shares in another company. The company expects pricing pressure to continue in the southern region in the coming quarters due to excess capacity.