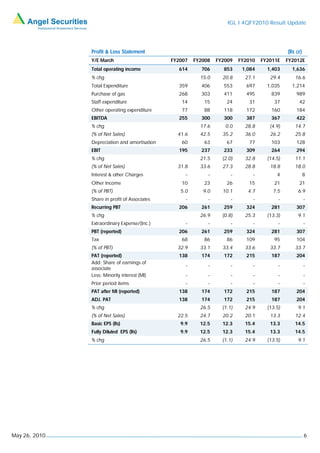

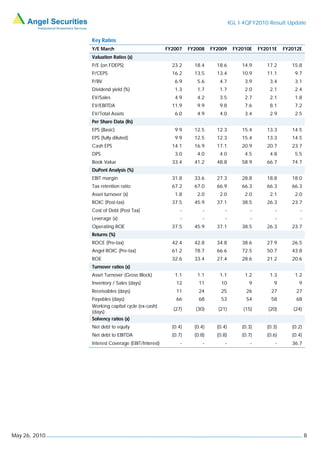

IGL reported a 27.7% year-over-year increase in net profit to Rs51.5cr for the fourth quarter of FY2010, which was lower than expected due to lower gross gas margins and slower CNG volume growth quarter-over-quarter. Operating margins expanded by 75 basis points year-over-year to 32.6% due to revenue growth and recovery of overdrawl charges. However, concerns remain regarding the sustainability of high margins given IGL's reliance on subsidized gas prices. The analyst recommends reducing exposure to the stock and sets a target price of Rs210.