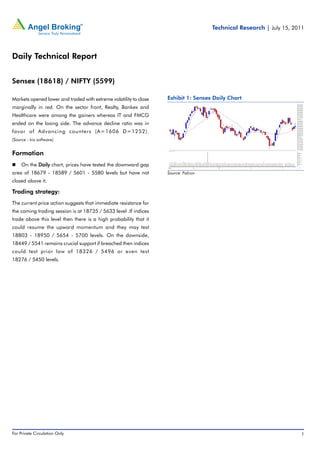

The Sensex and Nifty indices opened lower and traded with volatility, closing marginally lower. On the sectoral front, Realty, Banks and Healthcare gained while IT and FMCG fell. The advance-decline ratio favored advancing stocks. On the daily chart, prices tested but did not close above the downward gap area of 18,679-18,589/5,601-5,580 levels. Immediate resistance is seen at 18,735/5,633, while 18,449/5,541 is crucial support.