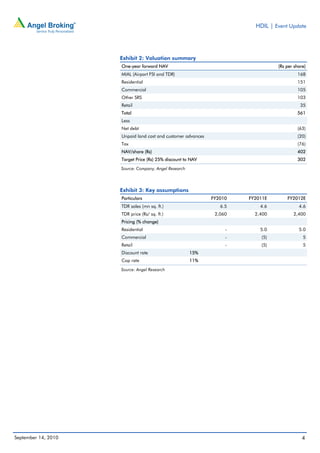

HDIL has successfully raised 250 million USD through a share issuance to part finance the second phase of an airport project and acquire new land. The equity dilution could pressure stock prices in the near term. However, faster execution of the airport project and winning new land redevelopment projects could boost share prices. While a planned increase in development limits could impact land prices, analysts believe HDIL is well positioned to execute successful new projects and see long term demand for real estate in Mumbai remaining strong. The analyst maintains an "Accumulate" rating on HDIL stock.