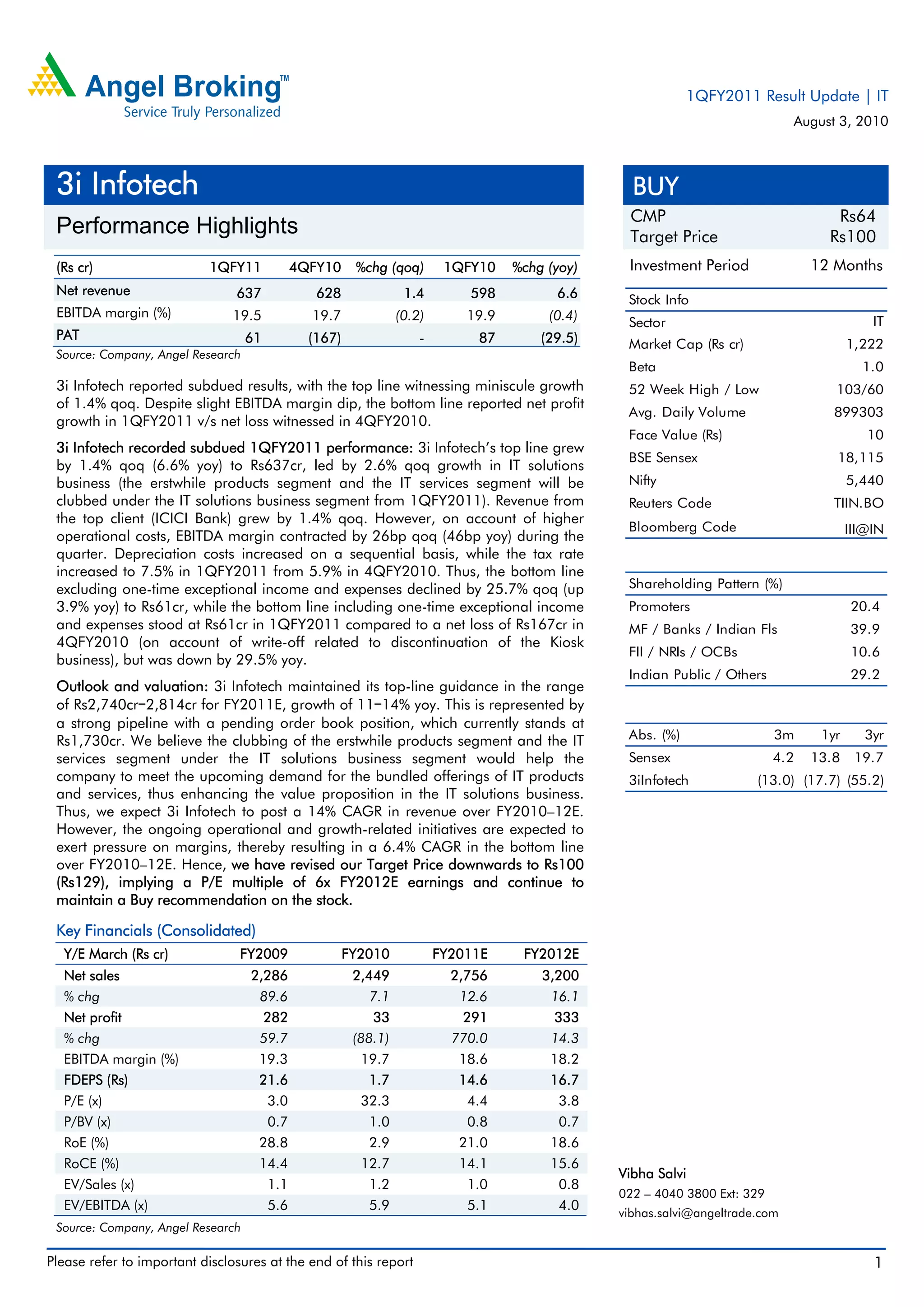

3i Infotech reported subdued quarterly results with a 1.4% increase in revenue. EBITDA margins declined slightly despite a 10% wage hike. The bottom line declined from the previous quarter due to higher costs and taxes, though it improved year-over-year. The company maintained its full-year revenue guidance, expecting growth of 11-14% driven by a strong order backlog. While initiatives to boost integrated offerings are expected to drive long-term growth, margins may be pressured in the near-term from operational investments. The report maintains a Buy recommendation based on a revised target price implying a 6x forward P/E multiple.