The summary is:

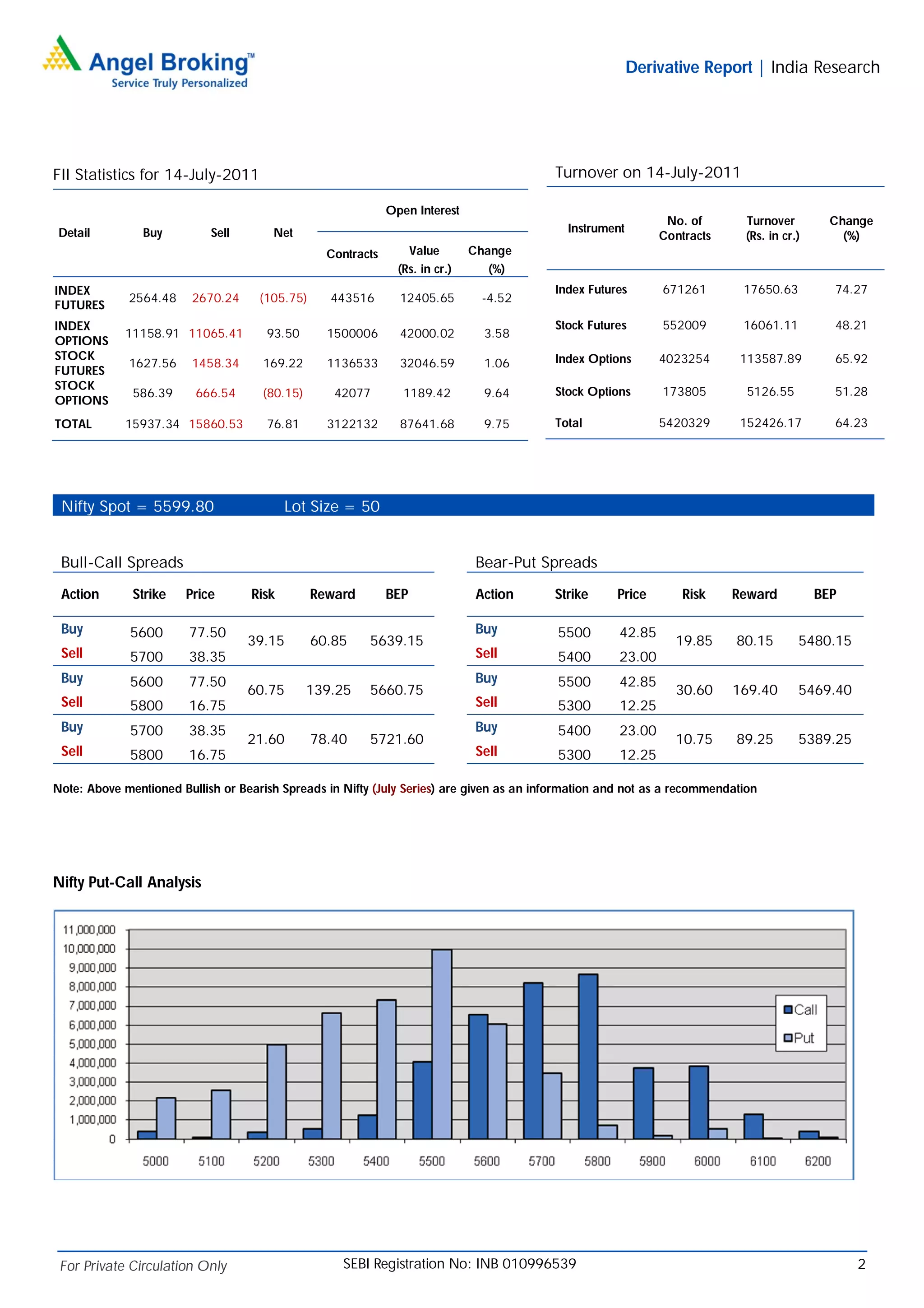

1) The derivative report analyzes the movement in Nifty futures, options, and individual stocks between July 14-15, 2011.

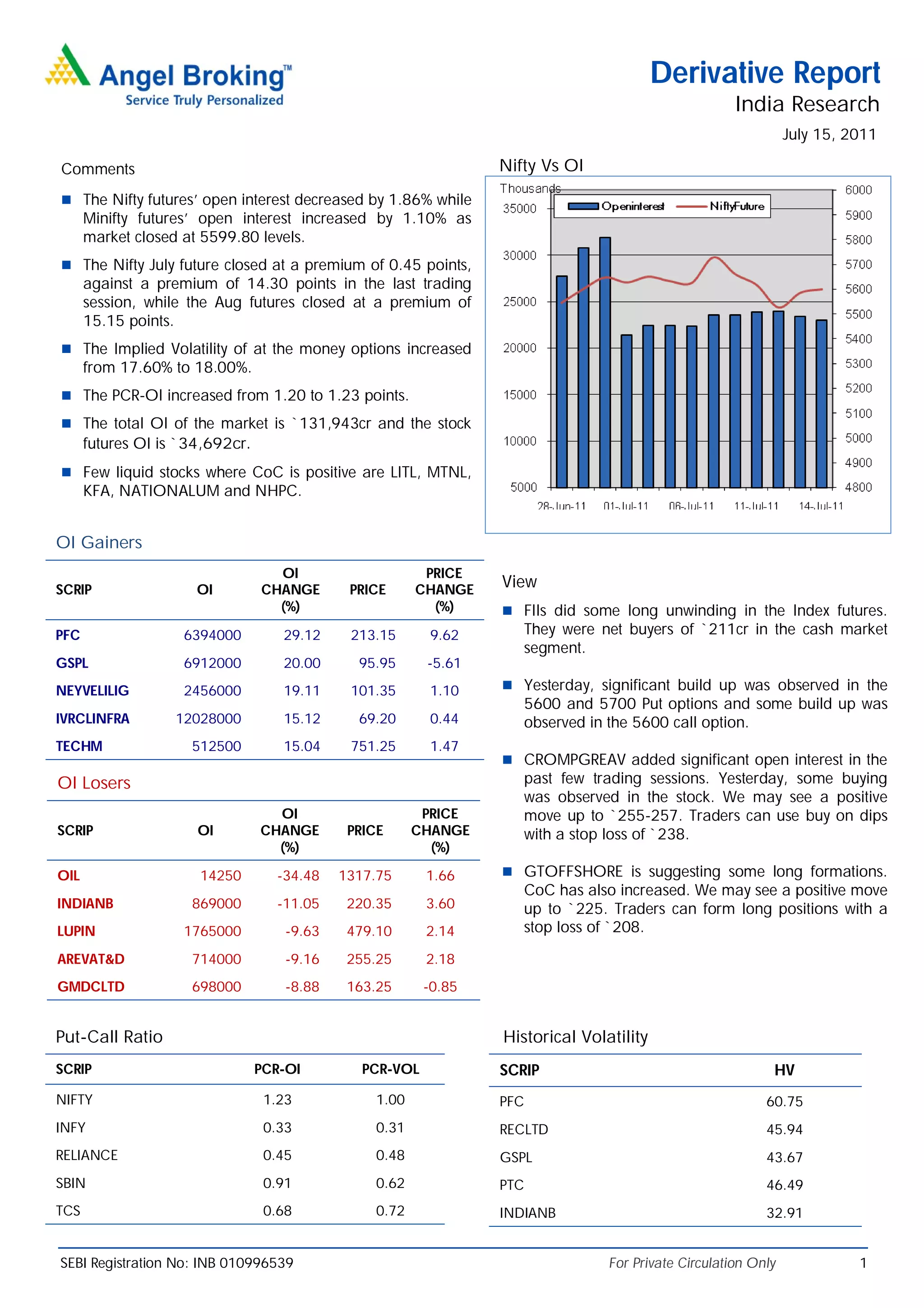

2) Nifty futures open interest decreased while mini Nifty open interest increased as the market closed at 5599.80.

3) Implied volatility of at-the-money options increased from 17.6% to 18%.