The summary of the Derivative Report for India dated July 30, 2010 is as follows:

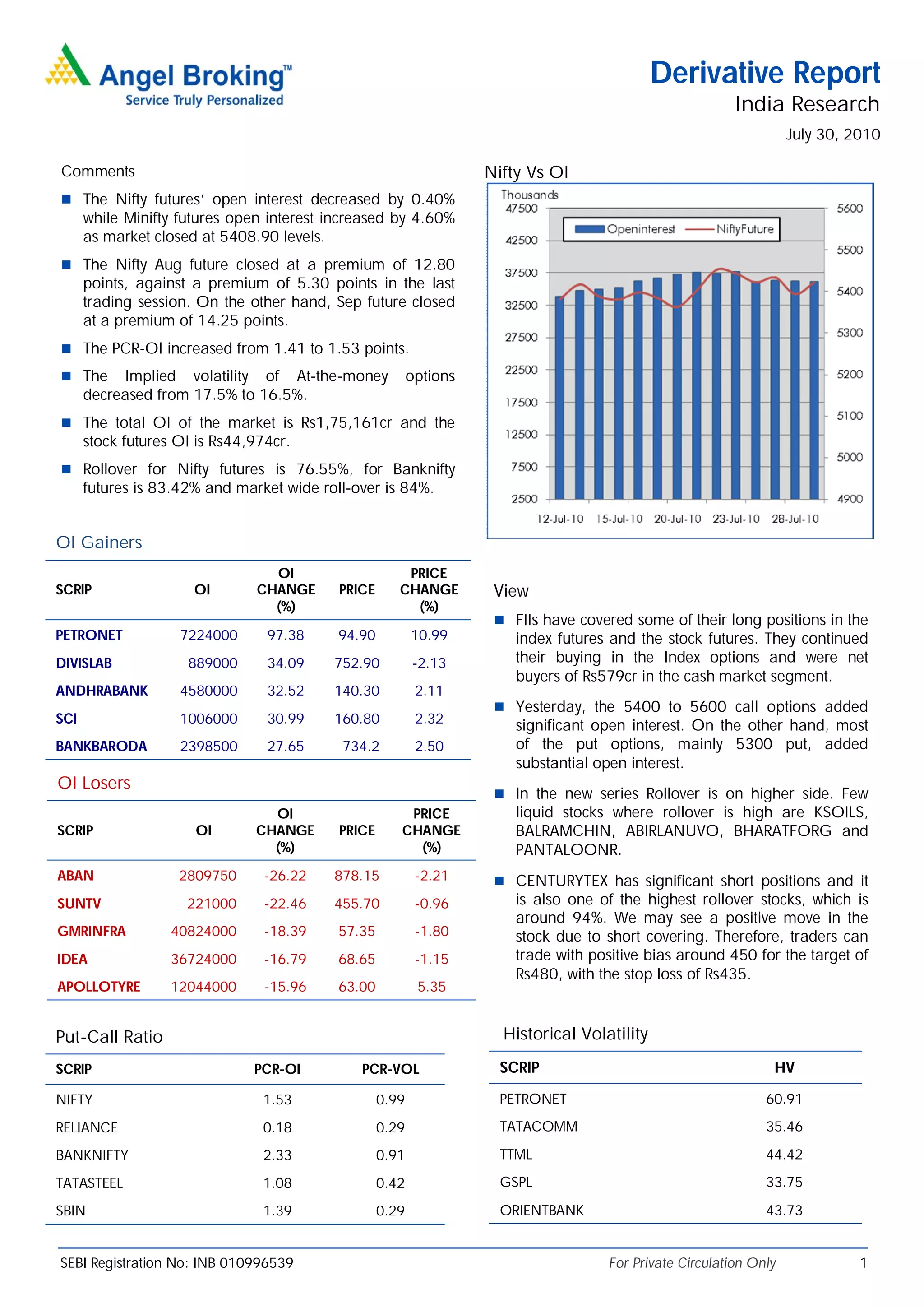

1) The Nifty futures open interest decreased slightly while the Minifity futures open interest increased. The Nifty August future closed at a premium and the September future also closed at a premium.

2) Implied volatility of at-the-money options decreased and total open interest in the market was over Rs. 1.75 lakh crores with stock futures open interest at Rs. 44,974 crores.

3) Rollover for various contracts like Nifty, Banknifty and overall market were high percentages. Some stocks with high rollover included KSOILS, BALRAMCHIN