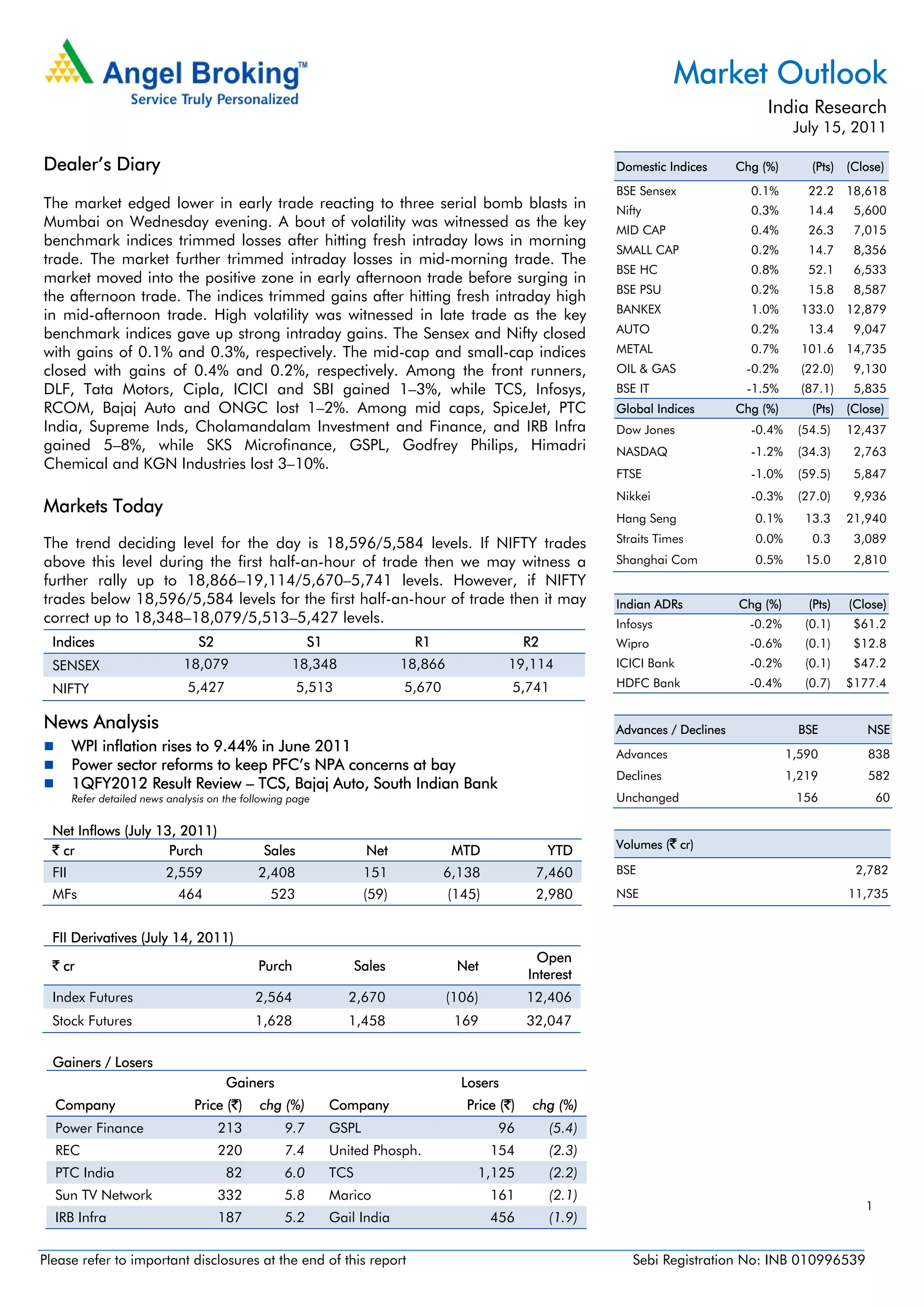

The document summarizes the Indian stock market outlook and performance on July 15, 2011. It reports that domestic indices closed with modest gains of 0.1-0.4%, while global indices declined. Wholesale price inflation in India rose to 9.44% in June 2011, above estimates and persisting above 9% for seven months, driven by increases in primary articles and fuel costs. Key benchmark levels are identified for determining if the market may continue rallying or correct in the near term.