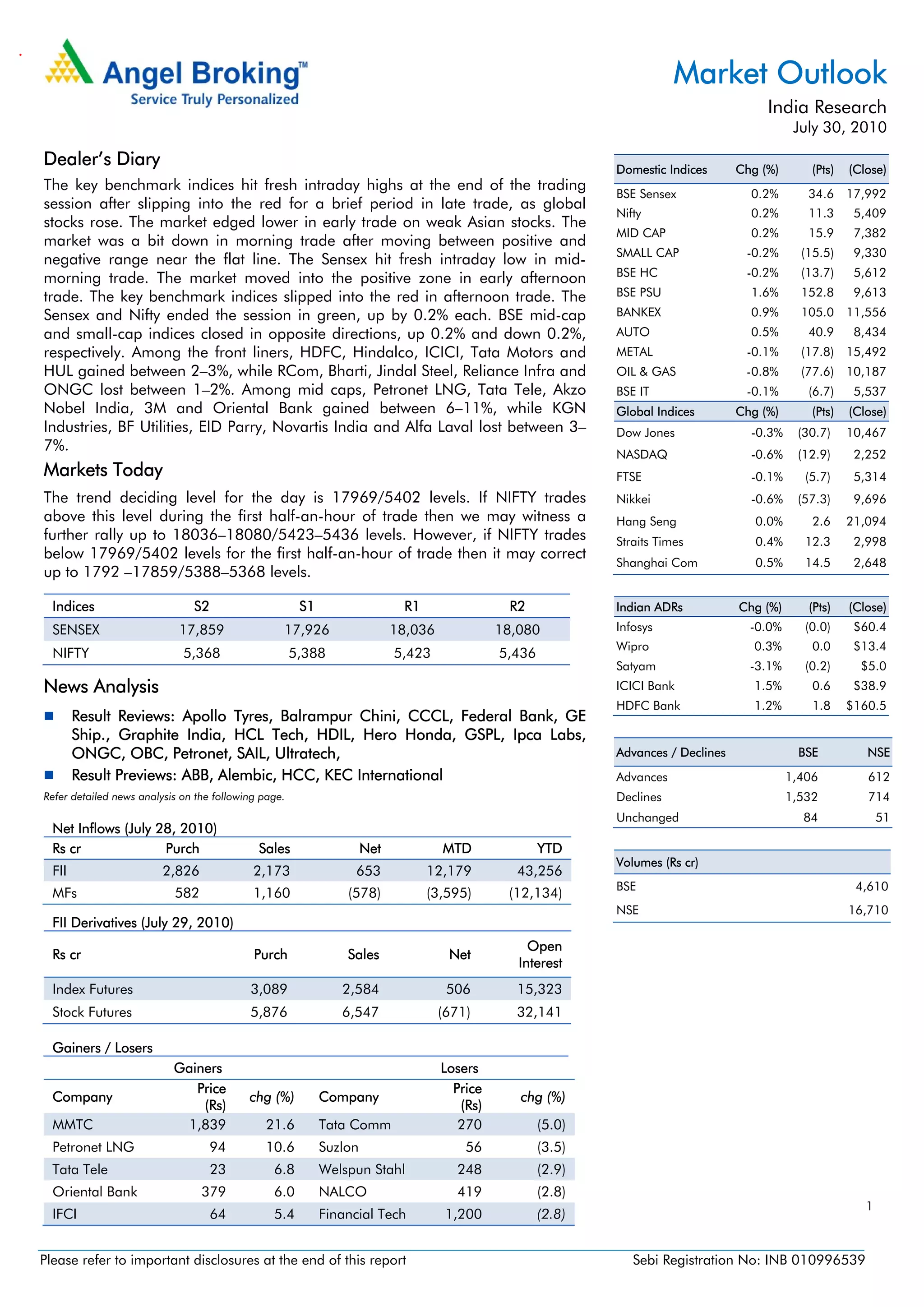

The document provides an analysis of market performance and outlook for India on July 30, 2010. It summarizes key index performance with the Sensex and Nifty ending up 0.2% each. It also reviews results from several companies and previews others. The text provides support and resistance levels for the indices and analyzes foreign institutional investor flows and derivatives.