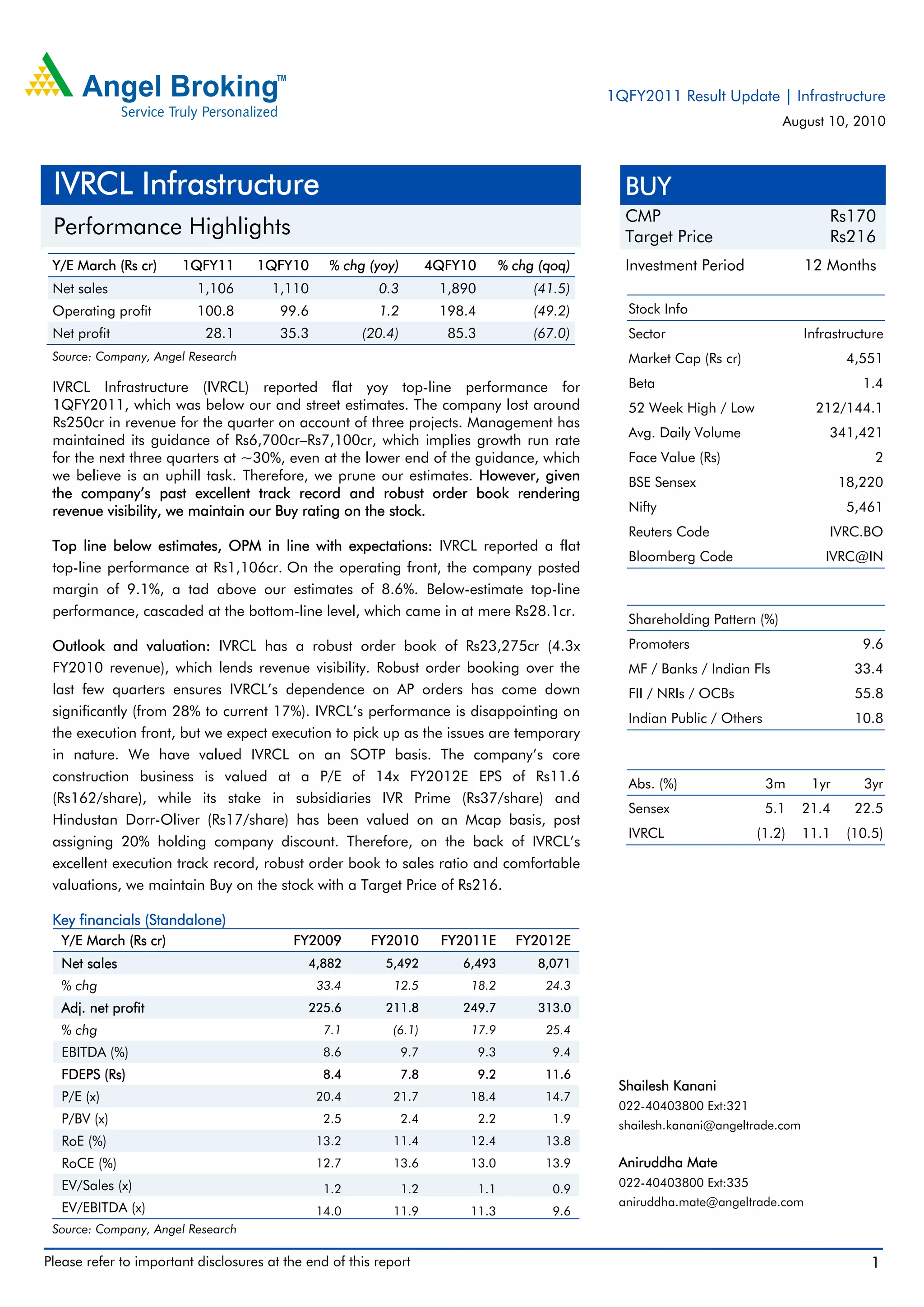

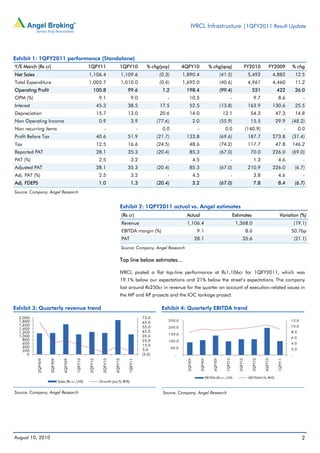

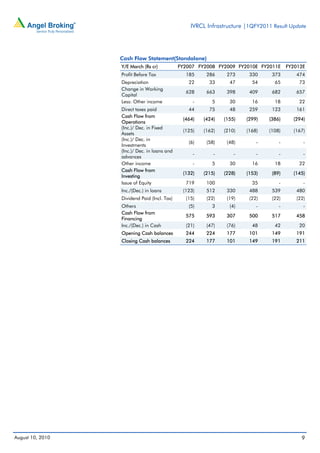

IVRCL Infrastructure reported flat year-over-year revenue growth of 0.3% for the first quarter of fiscal year 2011, which was below analyst estimates. Operating profit increased slightly by 1.2% year-over-year, but net profit declined by 20.4% due to higher interest and tax expenses. Although top-line and bottom-line results disappointed, the analyst maintains a 'Buy' rating due to IVRCL's strong order backlog, which provides revenue visibility, and comfortable valuations.