Market Outlook -Spetember 7, 2010

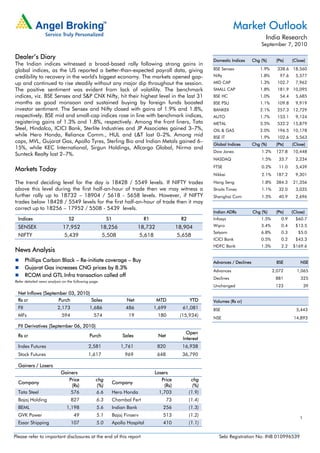

- 1. Market Outlook India Research September 7, 2010 Dealer’s Diary Domestic Indices Chg (%) (Pts) (Close) The Indian indices witnessed a broad-based rally following strong gains in global indices, as the US reported a better-than-expected payroll data, giving BSE Sensex 1.9% 338.6 18,560 credibility to recovery in the world's biggest economy. The markets opened gap- Nifty 1.8% 97.6 5,577 up and continued to rise steadily without any major dip throughout the session. MID CAP 1.3% 102.7 7,962 The positive sentiment was evident from lack of volatility. The benchmark SMALL CAP 1.8% 181.9 10,095 indices, viz. BSE Sensex and S&P CNX Nifty, hit their highest level in the last 31 BSE HC 1.0% 54.4 5,685 months as good monsoon and sustained buying by foreign funds boosted BSE PSU 1.1% 109.8 9,919 investor sentiment. The Sensex and Nifty closed with gains of 1.9% and 1.8%, BANKEX 2.1% 257.3 12,729 respectively. BSE mid and small-cap indices rose in line with benchmark indices, AUTO 1.7% 153.1 9,124 registering gains of 1.3% and 1.8%, respectively. Among the front liners, Tata METAL 3.5% 532.2 15,879 Steel, Hindalco, ICICI Bank, Sterlite Industries and JP Associates gained 3–7%, OIL & GAS 2.0% 196.5 10,178 while Hero Honda, Reliance Comm., HUL and L&T lost 0–2%. Among mid BSE IT 1.9% 102.6 5,563 caps, MVL, Gujarat Gas, Apollo Tyres, Sterling Bio and Indian Metals gained 6– Global Indices Chg (%) (Pts) (Close) 15%, while KEC International, Sirgun Holdings, Allcargo Global, Nirma and Dow Jones 1.2% 127.8 10,448 Sunteck Realty lost 2–7%. NASDAQ 1.5% 33.7 2,234 FTSE 0.2% 11.0 5,439 Markets Today Nikkei 2.1% 187.2 9,301 The trend deciding level for the day is 18428 / 5549 levels. If NIFTY trades Hang Seng 1.8% 384.3 21,356 above this level during the first half-an-hour of trade then we may witness a Straits Times 1.1% 32.0 3,035 further rally up to 18732 – 18904 / 5618 - 5658 levels. However, if NIFTY Shanghai Com 1.5% 40.9 2,696 trades below 18428 / 5549 levels for the first half-an-hour of trade then it may correct up to 18256 – 17952 / 5508 - 5439 levels. Indian ADRs Chg (%) (Pts) (Close) Indices S2 S1 R1 R2 Infosys 1.5% 0.9 $60.7 SENSEX 17,952 18,256 18,732 18,904 Wipro 3.4% 0.4 $13.5 Satyam 6.8% 0.3 $5.0 NIFTY 5,439 5,508 5,618 5,658 ICICI Bank 0.5% 0.2 $43.3 HDFC Bank 1.3% 2.2 $169.6 News Analysis Phillips Carbon Black – Re-initiate coverage – Buy Advances / Declines BSE NSE Gujarat Gas increases CNG prices by 8.3% Advances 2,072 1,065 RCOM and GTL Infra transaction called off Declines 881 325 Refer detailed news analysis on the following page. Unchanged 123 39 Net Inflows (September 03, 2010) Rs cr Purch Sales Net MTD YTD Volumes (Rs cr) FII 2,173 1,686 486 1,699 61,081 BSE 5,443 MFs 594 574 19 180 (15,934) NSE 14,893 FII Derivatives (September 06, 2010) Open Rs cr Purch Sales Net Interest Index Futures 2,581 1,761 820 16,938 Stock Futures 1,617 969 648 36,790 Gainers / Losers Gainers Losers Price chg Price chg Company Company (Rs) (%) (Rs) (%) Tata Steel 576 6.6 Hero Honda 1,703 (1.9) Bajaj Holding 827 6.3 Chambal Fert 73 (1.4) BEML 1,198 5.6 Indian Bank 256 (1.3) GVK Power 49 5.1 Bajaj Finserv 513 (1.2) 1 Essar Shipping 107 5.0 Apollo Hospital 410 (1.1) Please refer to important disclosures at the end of this report Sebi Registration No: INB 010996539

- 2. Market Outlook | India Research Phillips Carbon Black – Re-initiate coverage – Buy Phillips Carbon Black (PCBL), part of the RPG Group, is the leading producer of carbon black in India, with ~48% of the total installed capacity in FY2010. Currently, with ~65% of the total carbon black production in the country being consumed by the tyre industry, PCBL is well poised to benefit from the rising demand for tyres going ahead. Moreover, we expect the company’s power segment to start contributing substantially to its bottom line in FY2011 and FY2012 and provide stability to its earnings. We have valued PCBL on the sum-of-the parts valuation methodology and have arrived at a Target Price of Rs270, wherein we have valued PCBL’s carbon black segment at Rs144/share (1x FY2012E P/BV) and the power segment at Rs126/share (NPV method). We Re-initiate Coverage on PCBL with a Buy recommendation. Gujarat Gas increases CNG prices by 8.3% Gujarat Gas has hiked CNG price by Rs2.49 per kg (an increase of 8.3%), following the increase in its input (gas) costs and other operational expenditure. The hike was effective from Sunday. The revised CNG price now stands at Rs32.45 per kg against the earlier price of Rs29.96 per kg in Bharuch, Ankleshwar and Surat. The company had last revised its CNG price in December 2009 (at that time price was increased by Rs2.46 per kg to Rs29.96 per kg). The price hike in December 2009 was done to cover the negative impact of the weakening Indian rupee against the US dollar and the upward revision in electricity tariff. The price hike is almost in line with the other companies in the CNG business in Gujarat. Gujarat-based Adani Energy Limited is offering CNG at Rs32.67 per kg, followed by GAIL at Rs32.10 per kg, HPCL at Rs32.00 per kg and GSPC at Rs31.60 per kg. The revised price will increase the running cost of over one lakh CNG vehicles operating in Bharuch, Ankleshwar and Surat. CNG still continues to remain a cheaper fuel compared to petrol and diesel. Also, CNG price continues to remain cheaper compared to other cities such as Lucknow, Bareilly, Agra, Hyderabad, Vijaywada, Indore and Ujjain. The price hike points towards the company’s effort to maintain its margins and can be viewed as a positive development. However, as the CNG segment contributes around 10% of total sales volume of Gujarat Gas, the impact of the move on the company’s financials will not be that significant. We are surprised with a steep rise in the stock price yesterday, following the news. Currently, Gujarat Gas is trading at 4.4x CY2011E P/BV and 18.2x CY2011E P/E. The stock is currently under review. September 7, 2010 2

- 3. Market Outlook | India Research RCOM and GTL Infra transaction called off Reliance Communications Ltd. (RCOM) and GTL Infrastructure Ltd. (GTL Infra) had in- principle approved on June 27, 2010, a demerger of Reliance Infratel’s (a subsidiary of RCOM) tower assets into GTL Infra to create the world’s largest independent telecom infrastructure company that would have had an enterprise value of over US $11bn and 80,000 towers in the merged entity. Through this deal, RCOM was expected to receive cash infusion, which would have been utilised for substantial reduction of its debt, whereas about 2mn RCOM shareholders were expected to receive free listed shares of GTL Infra. However, the non-binding term sheet signed by RCOM and GTL Infra expired on August 31, 2010, and despite subsequent efforts, both parties have neither extended the term sheet nor entered into any definitive transaction agreement. Subsequent to the failure of this transaction, RCOM has made a statement that it is in talks with other strategic and financial investors to sell a stake in the business. However, it declined to comment on the failure of its deal with GTL Infra. We believe this transaction was vital for RCOM as the cash infusion would have helped it to lower the huge debt (debt position as on June 30, 2010, stood at Rs33,216cr) piled up on the balance sheet and the demerger of the tower business would have resulted in value unlocking of its core mobile business. At the current levels, we maintain Neutral on RCOM. Economic and Political News Decision on Cairn-Vedanta deal in 4–6 weeks: Murli Deora Govt. planning IOC, ONGC stake sale in March quarter Direct tax collections up 14% during April–August 2010 Marine exports jump about 22% in July 2010 Corporate News PFC to raise US $240mn loans in Japan and China HDFC Bank hikes BPLR by 50bp to 16.25% Firstsource inks outsourcing deal with Axis Bank Aurobindo Pharma in licensing pact with Astra Zeneca Source: Economic Times, Business Standard, Business Line, Financial Express, Mint September 7, 2010 3

- 4. Market Outlook | India Research Research Team Tel: 022-4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Address: Acme Plaza, ‘A’ Wing, 3rd Floor, M.V. Road, Opp. Sangam Cinema, Andheri (E), Mumbai - 400 059. Tel : (022) 3952 4568 / 4040 3800 Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302 September 7, 2010 4