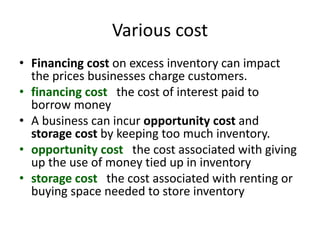

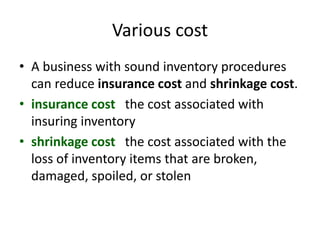

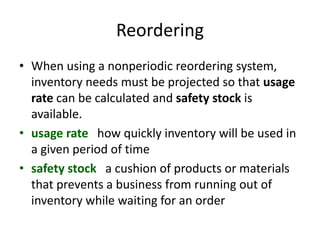

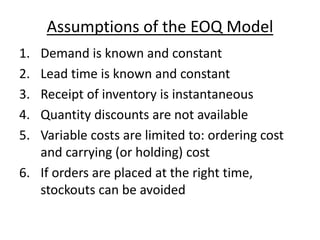

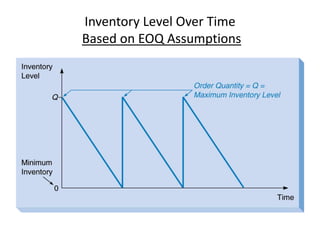

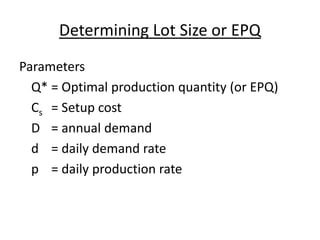

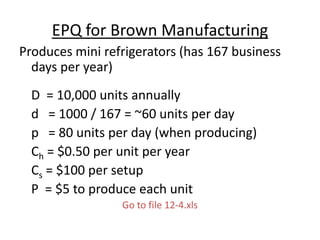

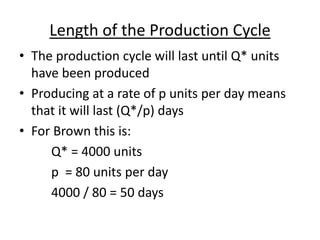

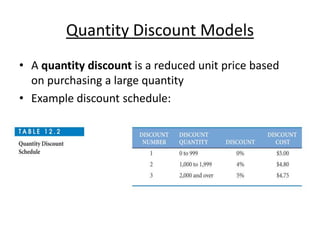

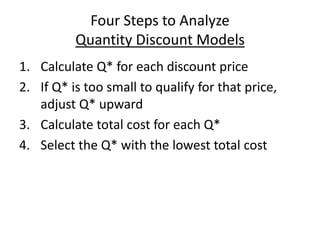

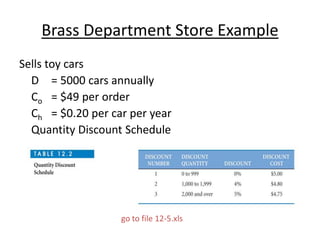

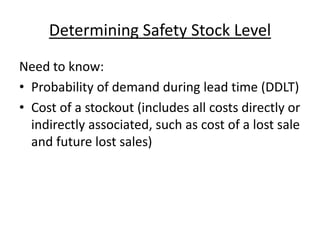

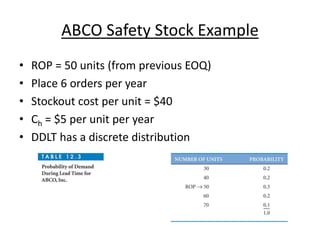

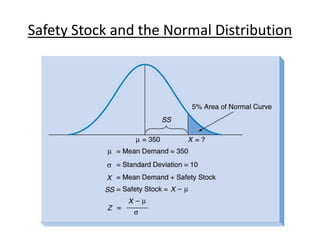

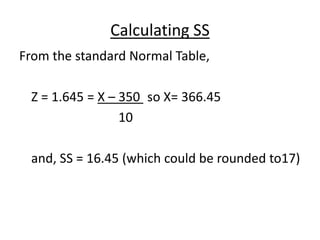

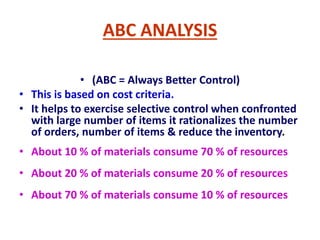

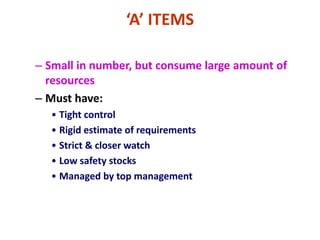

This document discusses inventory management concepts including the costs associated with holding too much inventory, different inventory control systems, determining reorder points and economic order quantities, quantity discounts, and using safety stock. It provides examples to demonstrate how to calculate the optimal order quantity using the economic order quantity model, determining reorder points, applying the economic production quantity model, analyzing quantity discount schedules, and determining appropriate safety stock levels.

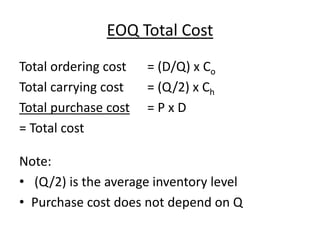

![Total Cost

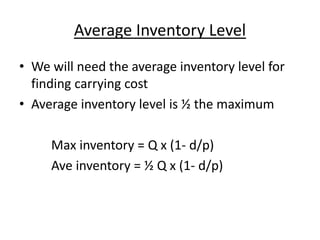

Setup cost = (D/Q) x Cs

Carrying cost = [½ Q x (1- d/p)] x Ch

Production cost = P x D

= Total cost

As in the EOQ model:

• The production cost does not depend on Q

• The function is nonlinear](https://image.slidesharecdn.com/mbaiipmomunit-3-150318051404-conversion-gate01/85/eMba-ii-pmom_unit-3-1-inventory-management-a-35-320.jpg)

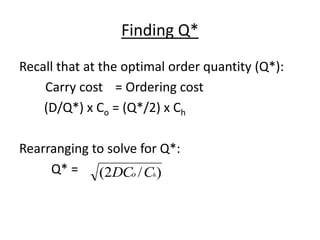

![Finding Q*

• As in the EOQ model, at the optimal quantity Q*

we should have:

Setup cost = Carrying cost

(D/Q*) x Cs = [½ Q* x (1- d/p)] x Ch

Rearranging to solve for Q*:

Q* = )]/1(/[2( pdCDC hs ](https://image.slidesharecdn.com/mbaiipmomunit-3-150318051404-conversion-gate01/85/eMba-ii-pmom_unit-3-1-inventory-management-a-36-320.jpg)

![20000050020

19950050019

19900050018

19850050017

19800050016

19750050015

19700050014

19650050013

196000150012

194500150011

193000175010

19125027509

18850040008

18450045007

18000050006

17500075005

16750075004

160000200003

140000500002

90000900001

CUMMULATIVECUMMULATIVE

COSTCOST [Rs.]

ANNUAL COSTANNUAL COST

[Rs.]

ITEMITEM COST %COST %ITEM %ITEM %

70 %70 %

20 %20 %

10 %10 %

10 %10 %

20 %20 %

70 %70 %

ABC

A

N

A

L

Y

S

I

S

WORK

SHEET](https://image.slidesharecdn.com/mbaiipmomunit-3-150318051404-conversion-gate01/85/eMba-ii-pmom_unit-3-1-inventory-management-a-56-320.jpg)