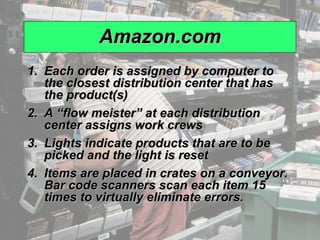

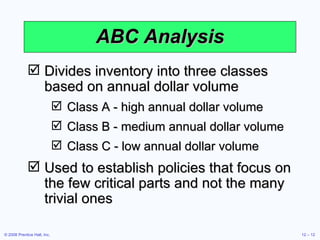

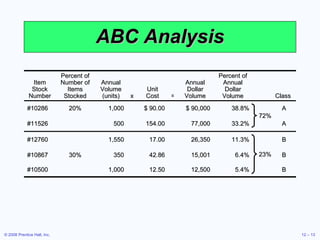

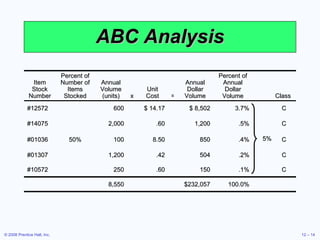

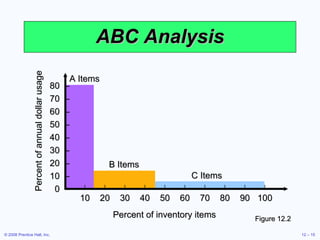

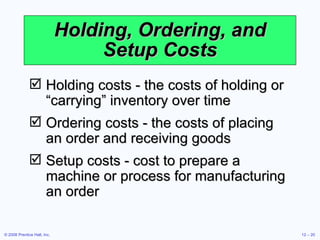

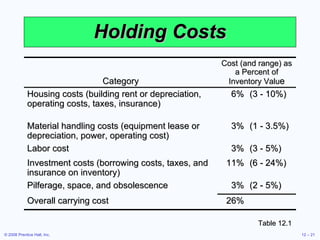

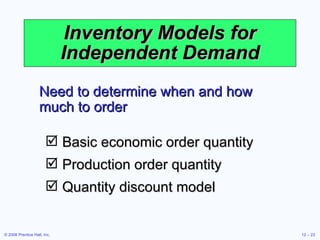

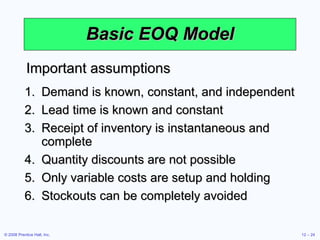

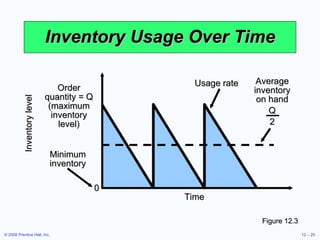

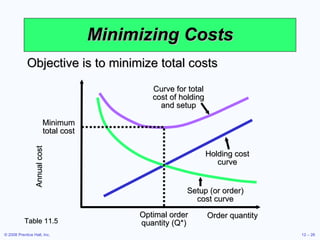

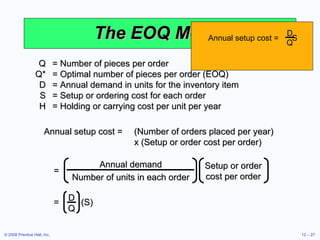

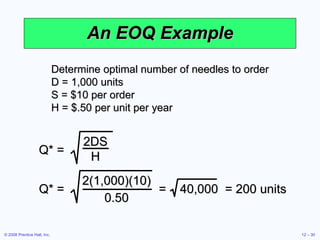

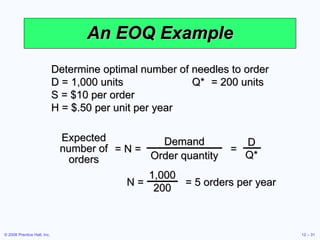

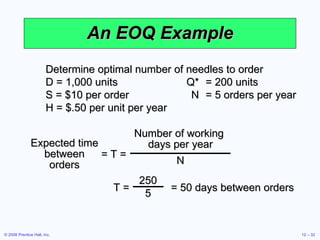

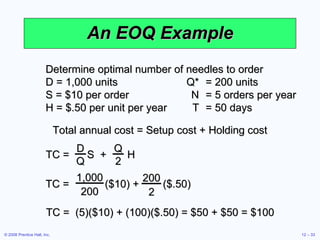

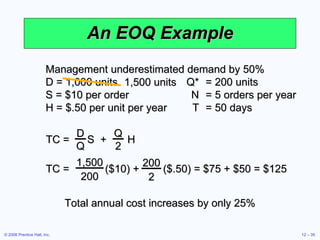

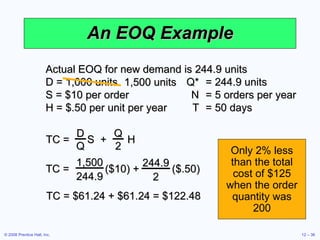

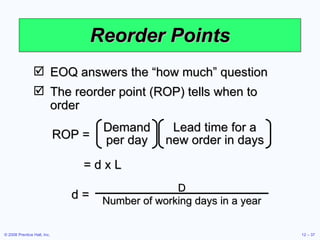

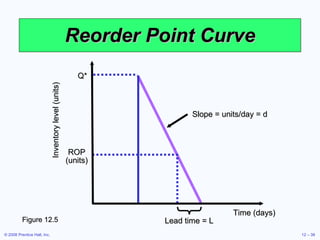

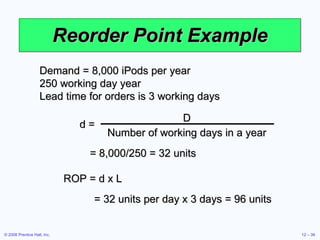

This document discusses inventory management concepts and models. It begins by outlining learning objectives related to ABC analysis, cycle counting, economic order quantity (EOQ) models, reorder points, and other topics. It then provides details on Amazon's inventory management practices and types of inventory. The bulk of the document explains ABC analysis for classifying inventory, techniques for maintaining accurate records, factors that influence holding and ordering costs, and the EOQ model for determining optimal order quantities. It concludes by noting the robustness of the EOQ model and introducing the concept of reorder points.

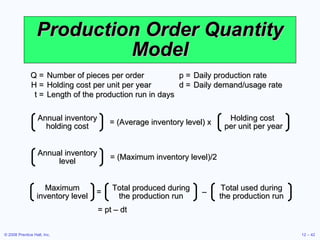

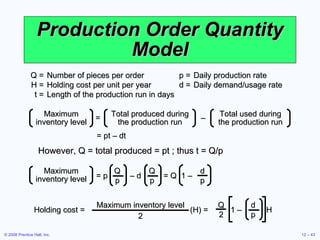

![Production Order Quantity Model Q = Number of pieces per order p = Daily production rate H = Holding cost per unit per year d = Daily demand/usage rate D = Annual demand Q 2 = 2DS H[1 - (d/p)] Q* = 2DS H[1 - (d/p)] p Setup cost = (D/Q)S Holding cost = HQ[1 - (d/p)] 1 2 (D/Q)S = HQ[1 - (d/p)] 1 2](https://image.slidesharecdn.com/chapter-6-1228181849443219-8/85/Chapter-6_OM-44-320.jpg)

![Production Order Quantity Example D = 1,000 units p = 8 units per day S = $10 d = 4 units per day H = $0.50 per unit per year Q* = 2DS H[1 - (d/p)] = 282.8 or 283 hubcaps Q* = = 80,000 2(1,000)(10) 0.50[1 - (4/8)]](https://image.slidesharecdn.com/chapter-6-1228181849443219-8/85/Chapter-6_OM-45-320.jpg)