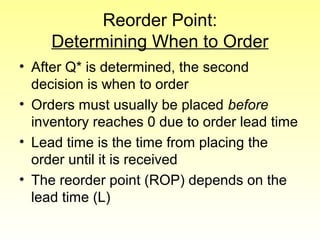

This document discusses inventory control models and techniques for determining optimal order quantities and reorder points. The Economic Order Quantity (EOQ) model is introduced as a method to determine how much of an item to order to minimize total inventory costs. The EOQ model balances ordering costs and carrying costs. It assumes demand is known and constant. The Economic Production Quantity (EPQ) model extends the EOQ model to situations where inventory is produced rather than ordered. Safety stock models account for uncertain demand by holding extra inventory to prevent stockouts. ABC analysis classifies inventory items into important and less important groups.

![Total Cost

Setup cost = (D/Q) x Cs

Carrying cost = [½ Q x (1- d/p)] x

Ch

Production cost = P x D

= Total cost

As in the EOQ model:

• The production cost does not depend on Q

• The function is nonlinear](https://image.slidesharecdn.com/chapter12-181012021716/85/INVENTORY-CONTROL-29-320.jpg)

![Finding Q*

• As in the EOQ model, at the optimal quantity

Q* we should have:

Setup cost = Carrying cost

(D/Q*) x Cs = [½ Q* x (1- d/p)] x Ch

Rearranging to solve for Q*:

Q* = )]/1(/[2( pdCDC hs −](https://image.slidesharecdn.com/chapter12-181012021716/85/INVENTORY-CONTROL-30-320.jpg)