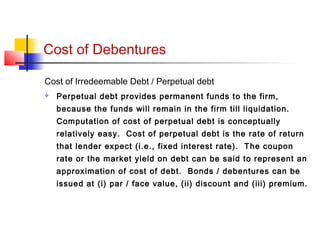

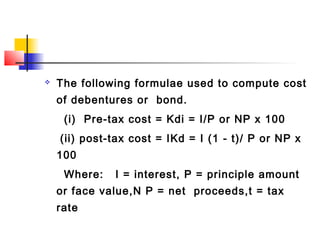

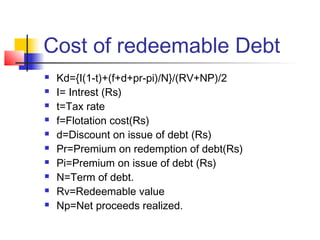

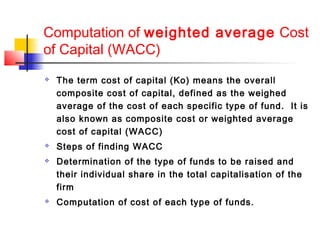

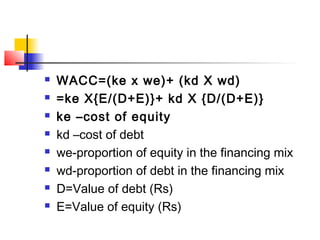

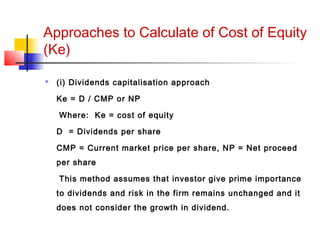

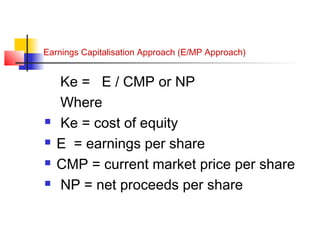

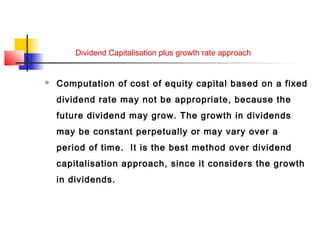

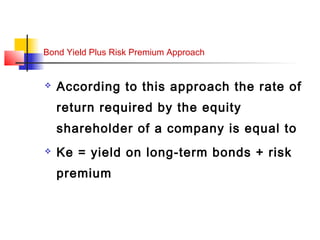

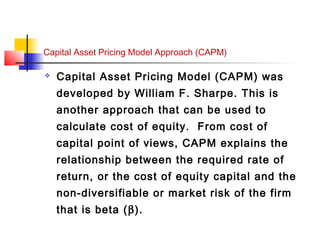

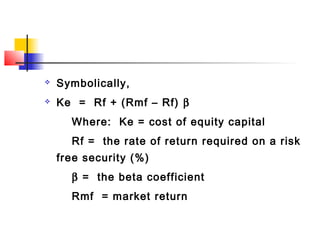

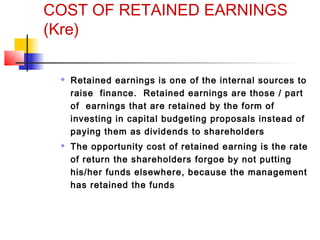

The document discusses the concept of cost of capital. It defines cost of capital as the minimum required rate of return on funds committed to a project or firm based on the riskiness of cash flows. It then covers the basic aspects of cost of capital including it representing a rate of return rather than an actual cost, and comprising a risk-free rate, business risk premium, and financial risk premium. The document also discusses approaches to calculating the cost of different sources of capital like equity, debt, and retained earnings, as well as weighted average cost of capital and marginal cost of capital.

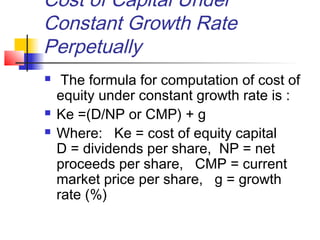

![ The opportunity cost can be computed with the following formula

Kre = Ke { (1 – Ti) / (1 – Tb)} x 100

Where: Ke = cost of equity capital [(D / NP )+ g]

Ti = tax rate

Tb = cost of purchase of new securities / brokerage

commission

D = expected dividend per share

NP = net proceeds of equity share / market price

g = growth rate in (%)](https://image.slidesharecdn.com/costofcapital-130705020036-phpapp02/85/Cost-of-capital-16-320.jpg)