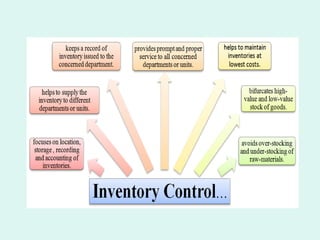

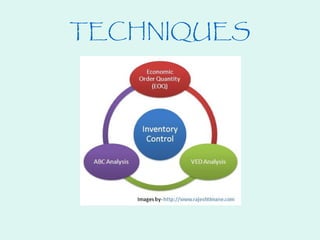

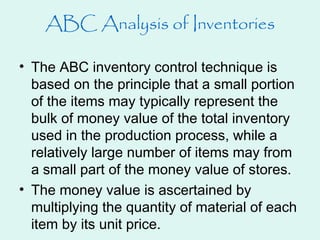

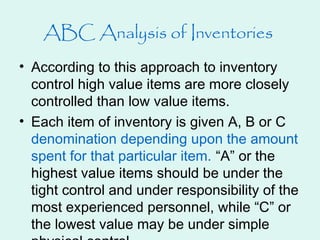

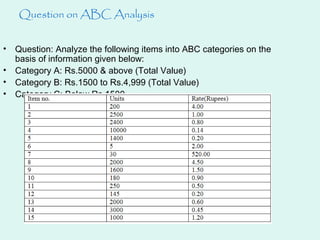

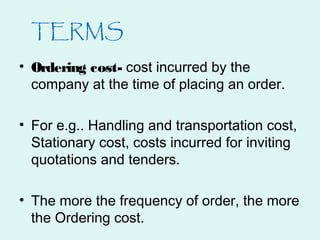

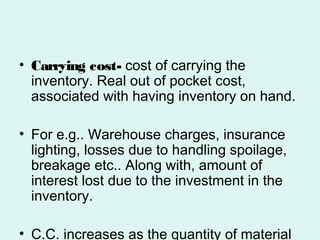

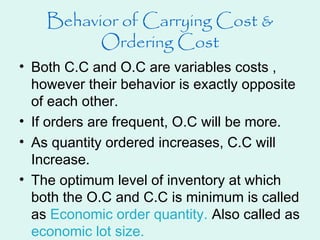

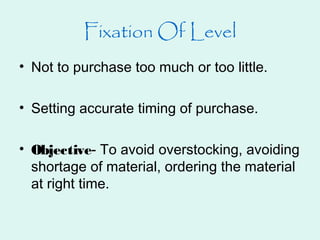

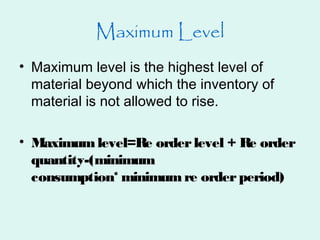

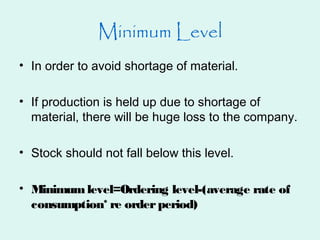

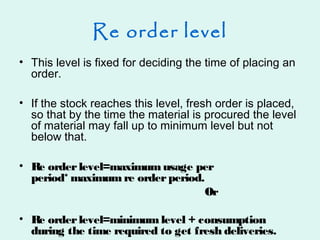

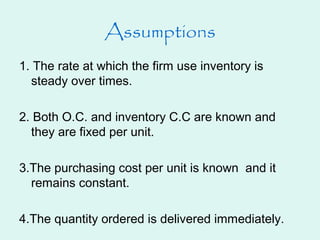

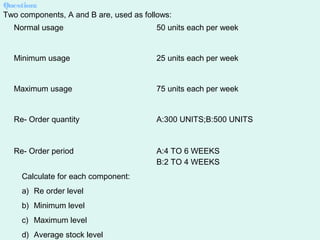

1. The document discusses inventory management techniques like ABC analysis and economic order quantity model. ABC analysis classifies inventory items into A, B and C categories based on their value and economic order quantity determines the optimal order quantity that minimizes total inventory costs.

2. It also discusses receivables and its management. Receivables refer to credit sales where payment is received later. The objectives of receivables management are to create, preserve and collect accounts receivable through effective credit policies, credit analysis and collection policies.

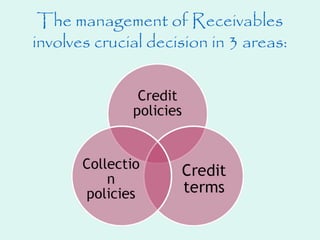

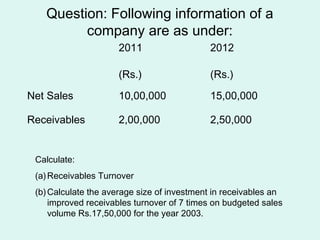

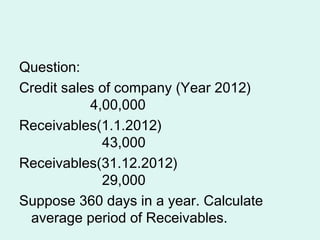

3. Key aspects of receivables management are setting credit standards, analyzing creditworthiness of customers, determining appropriate credit terms and collecting dues through various procedures. This helps minimize bad debts and