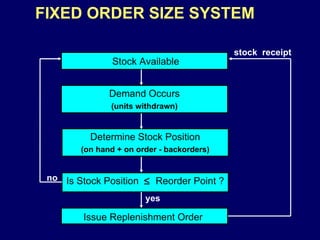

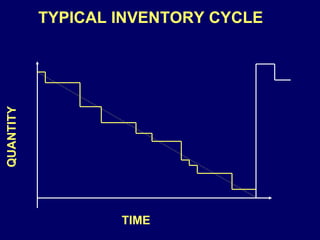

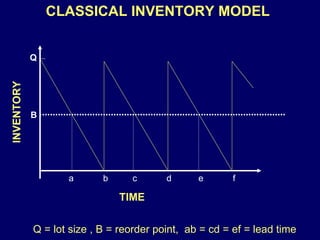

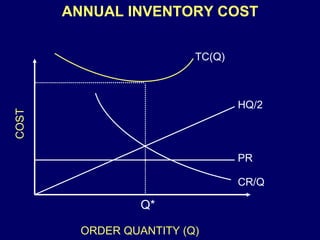

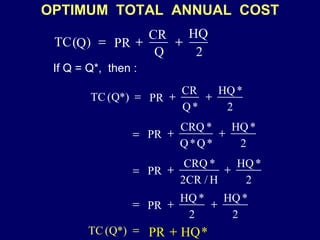

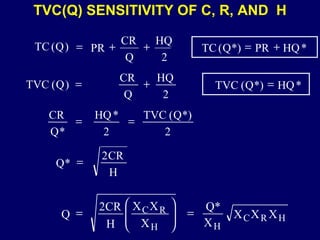

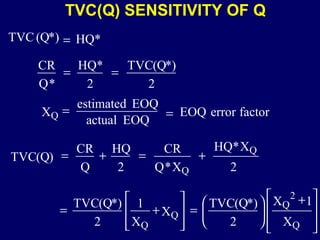

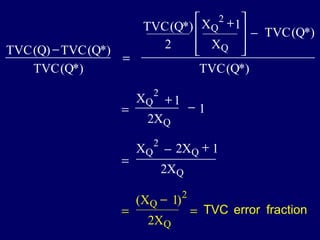

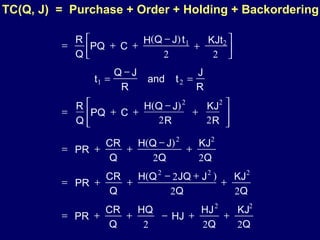

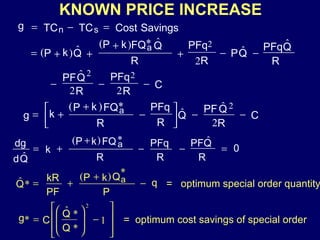

The document discusses inventory management models including the classical inventory model, economic order quantity (EOQ) model, sensitivity analysis of parameters in the EOQ model, backordering inventory model, quantity discounts, and handling known price increases. It provides formulas for determining optimal order quantities and total costs under different assumptions.