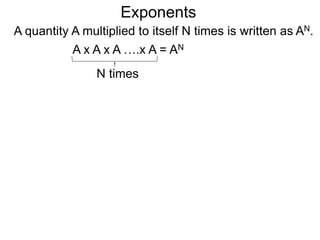

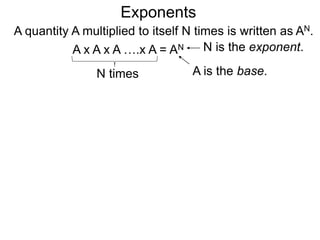

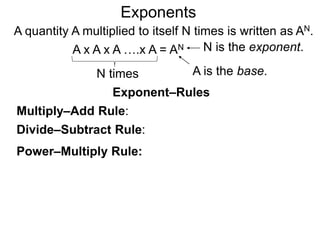

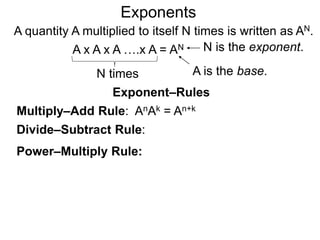

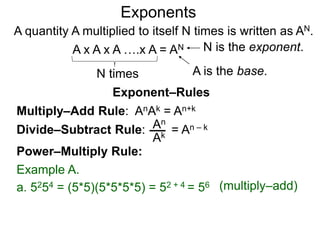

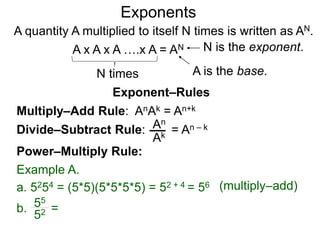

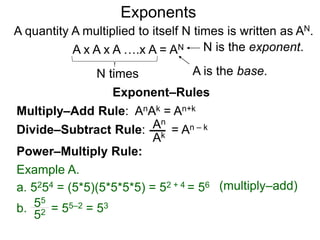

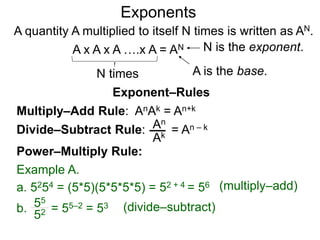

The document discusses exponential functions and their properties. It defines exponential functions as functions of the form f(x) = bx where b > 0 and b ≠ 1. Some key points made in the document include:

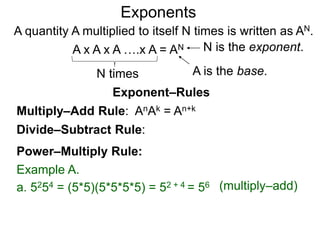

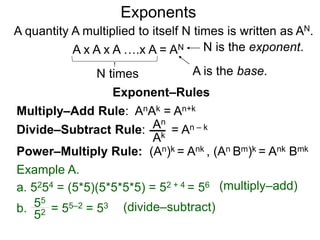

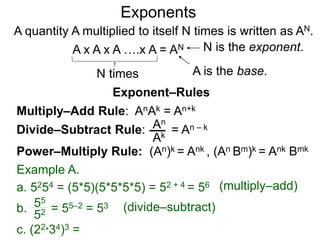

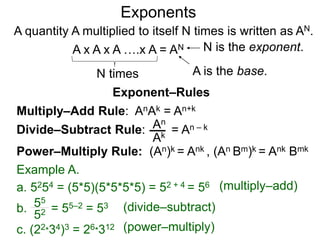

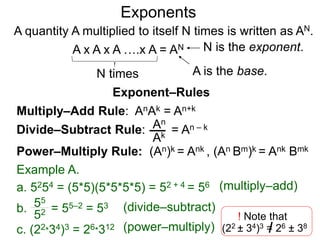

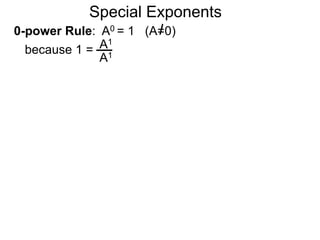

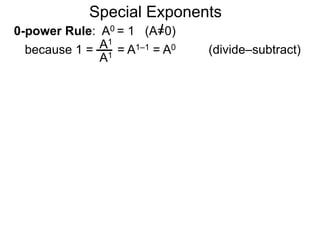

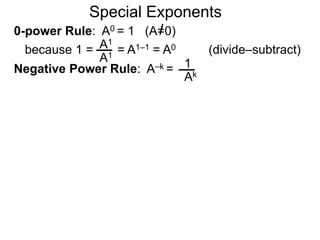

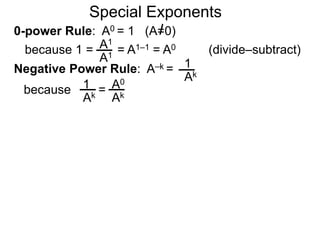

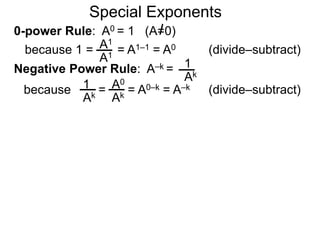

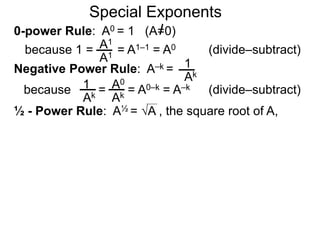

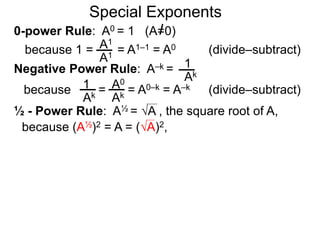

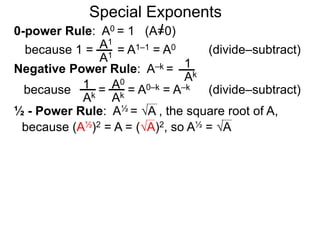

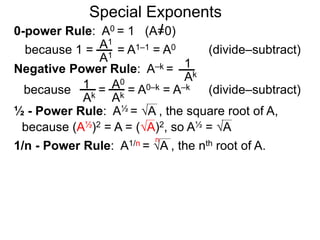

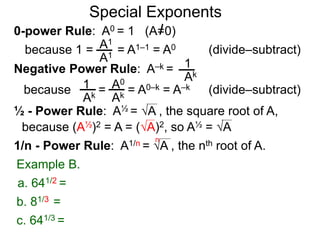

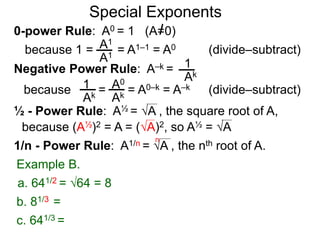

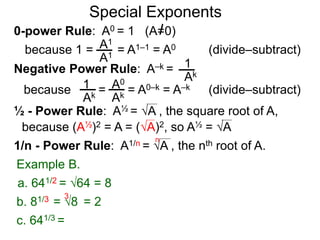

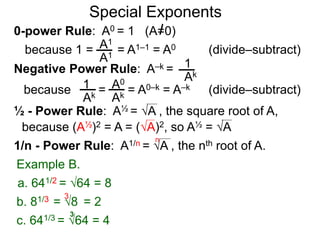

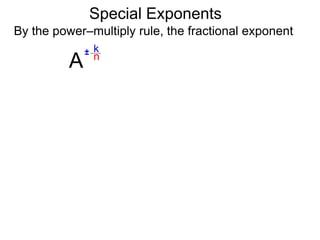

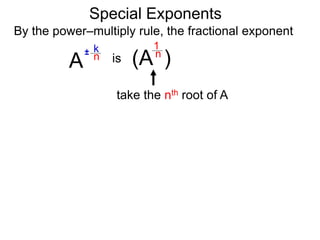

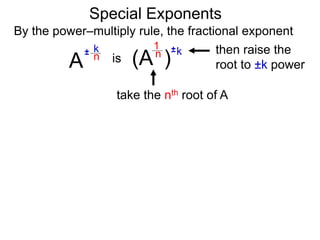

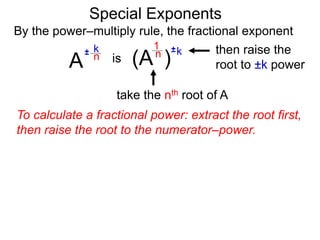

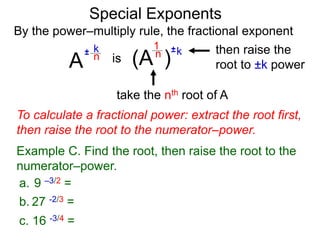

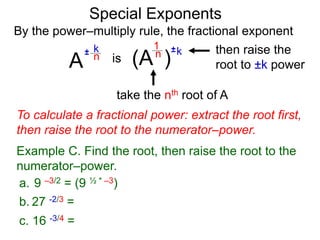

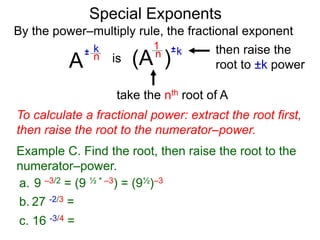

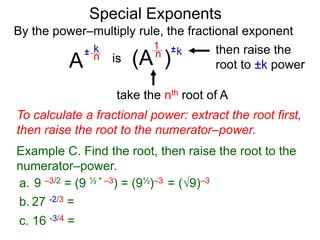

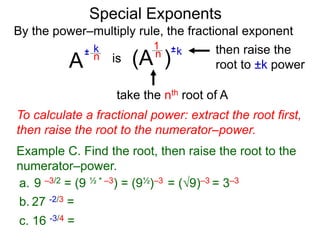

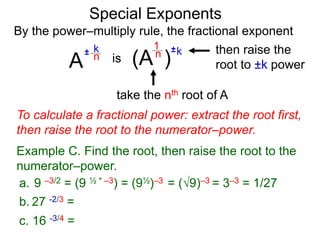

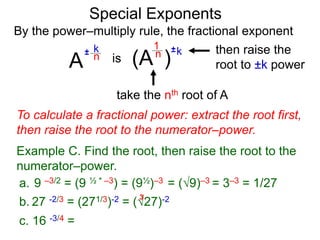

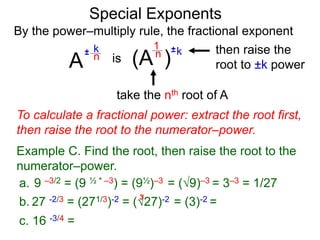

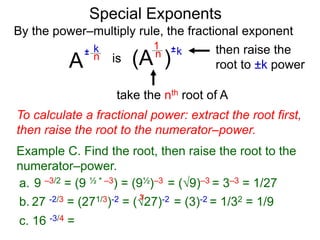

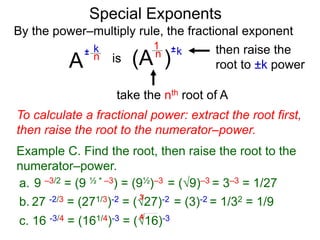

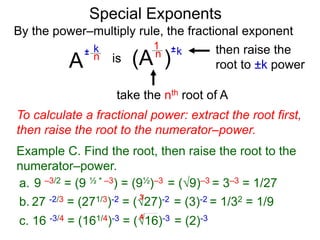

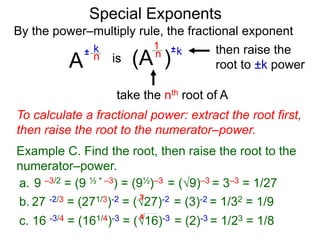

- The rules for exponents such as b0, b-k, (√b)k, and (b1/k) are explained.

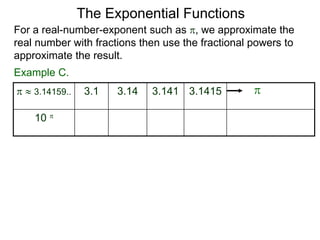

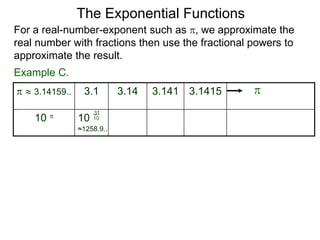

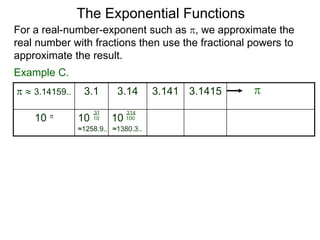

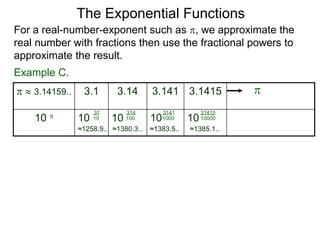

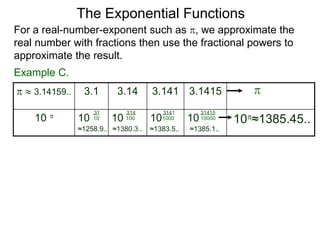

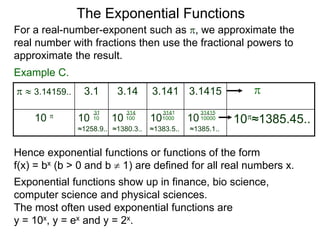

- Exponential functions are defined for all real numbers x.

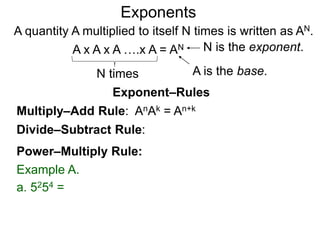

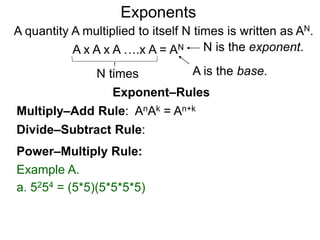

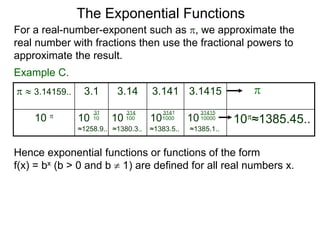

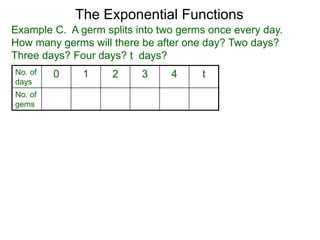

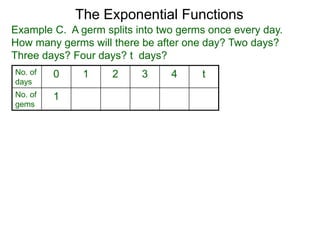

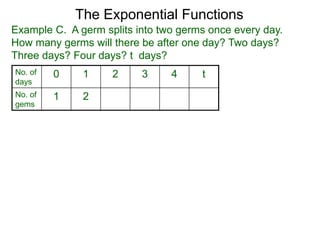

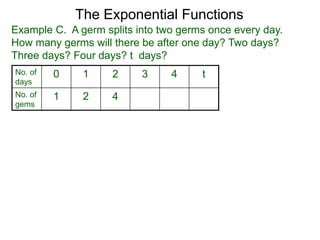

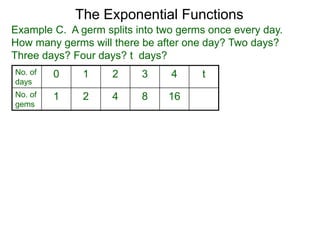

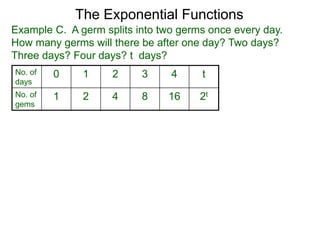

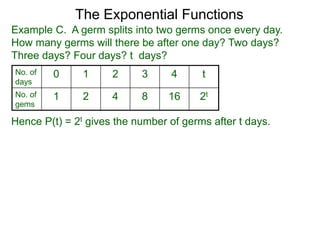

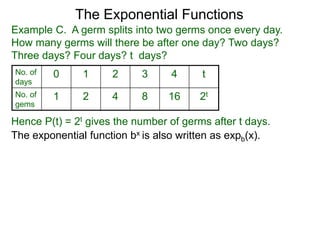

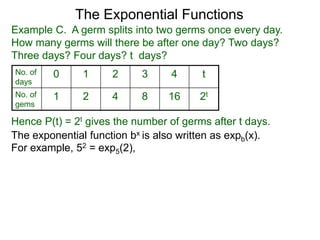

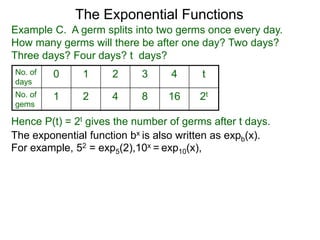

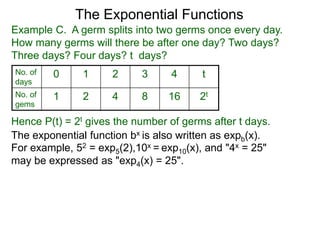

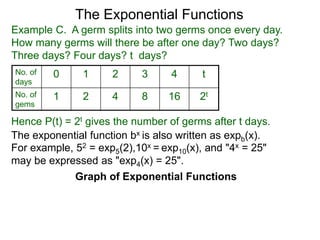

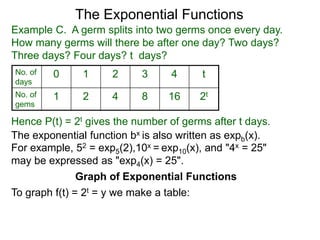

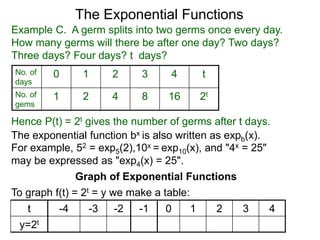

- Examples are provided to illustrate calculating exponential expressions and functions with integer, fractional, decimal, and real-number exponents.

- Exponential functions appear in various fields like finance, science, and engineering. Common exponential functions mentioned are y = 10x, y = ex, and y