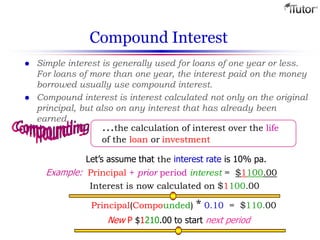

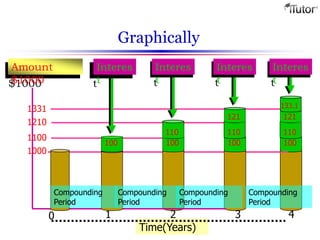

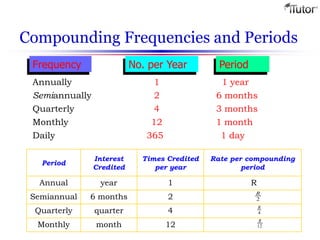

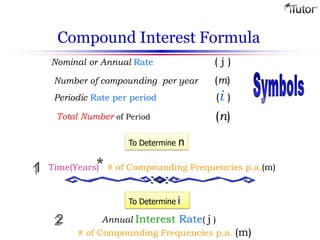

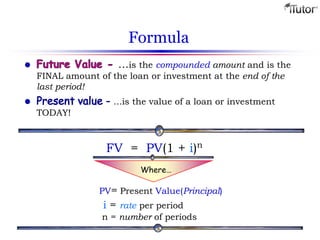

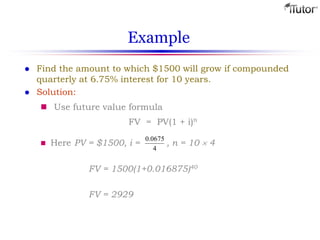

Compound interest is interest calculated on both the principal amount and on any interest that has already been earned over multiple periods. It is usually used for loans of more than one year. Compound interest is higher than simple interest because the interest earns interest. The compound interest formula can be used to calculate the future value (FV) of an investment given the present value (PV), interest rate per period (i), and number of compounding periods (n). An example calculates that $1500 compounded quarterly at 6.75% annually for 10 years results in a future value of $2929.