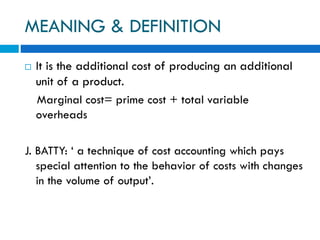

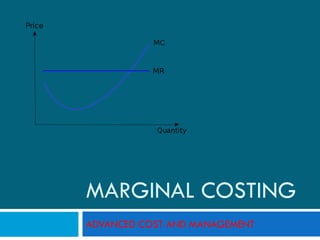

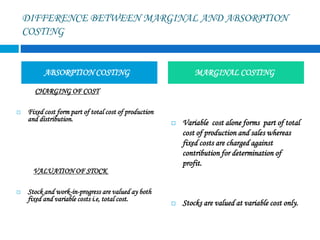

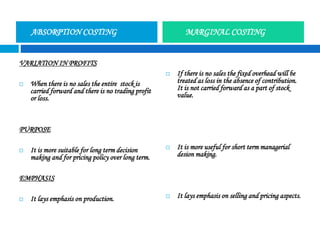

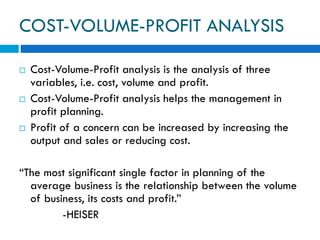

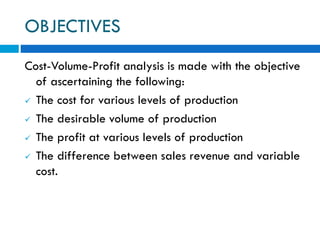

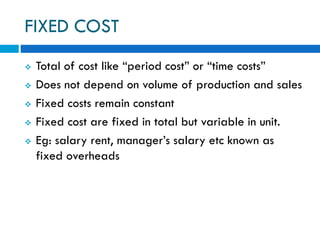

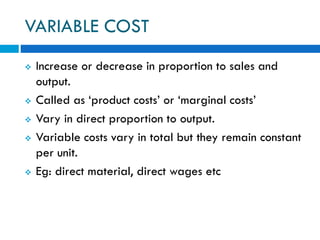

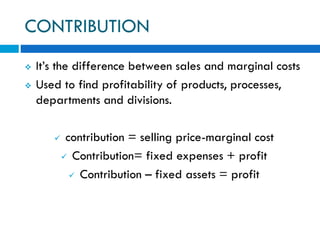

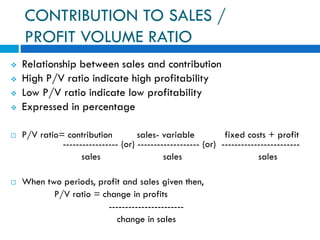

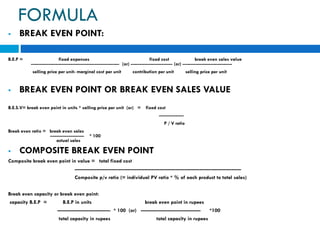

This document provides an overview of marginal costing and cost-volume-profit (CVP) analysis. It defines key terms like marginal cost, contribution, fixed and variable costs. It explains the differences between marginal and absorption costing approaches. The objectives and concepts of CVP analysis are outlined, including break-even point, margin of safety, contribution ratio and angle of incidence. Formulas for calculating items like break-even sales, break-even point and composite break-even point are presented. Advantages and limitations of marginal costing are listed.