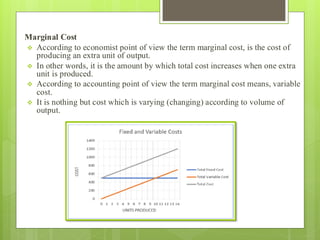

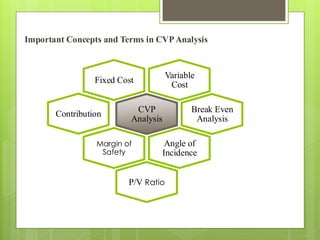

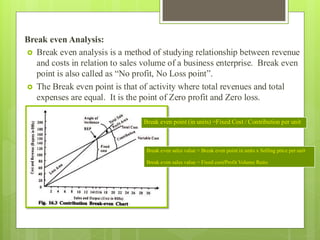

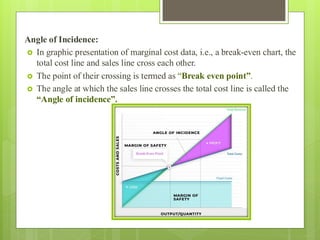

The document explains costing techniques, emphasizing absorption and marginal costing, which differentiate between fixed and variable costs during product costing and decision making. It introduces cost-volume-profit (CVP) analysis as a tool for profit planning, defining key concepts such as fixed and variable costs, contribution margin, break-even analysis, and margin of safety. Understanding these principles is crucial for managing costs, maximizing profitability, and navigating business fluctuations.