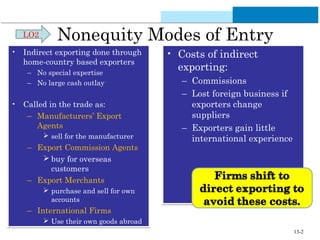

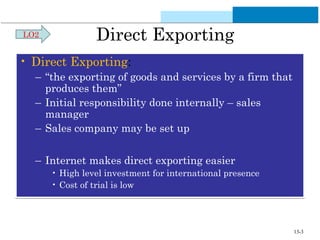

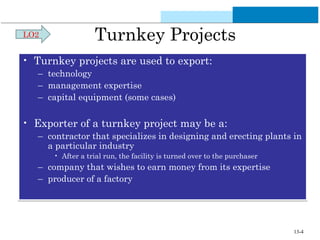

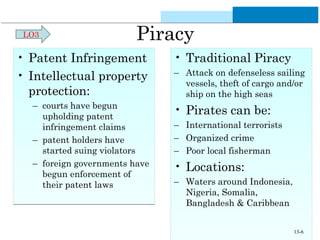

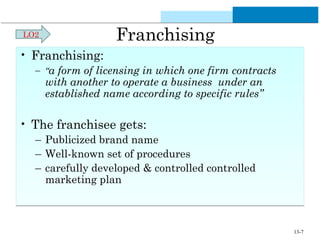

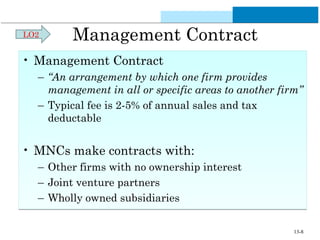

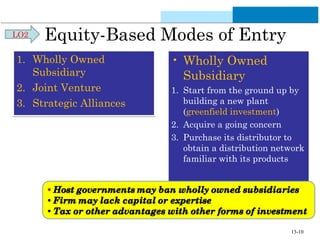

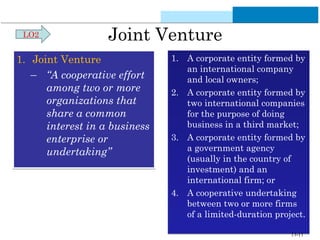

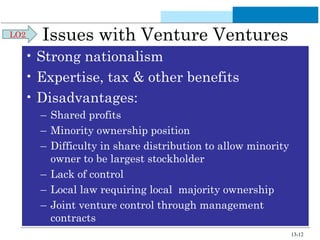

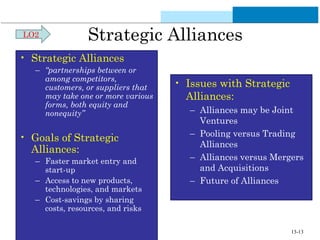

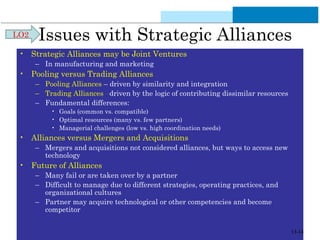

The document discusses various non-equity and equity-based modes for foreign manufacturing strategies without direct investment. Non-equity options include indirect exporting, direct exporting, turnkey projects, licensing, franchising, management contracts, and contract manufacturing. Equity-based options are wholly owned subsidiaries, joint ventures, and strategic alliances. Each option is described along with associated costs, control levels, and other considerations for using the different entry strategies without full foreign direct investment.