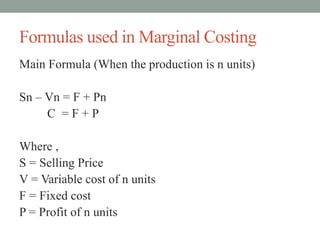

Chapter 07 discusses the concepts of marginal costing and its applications, highlighting key differences between marginal and absorption costing. It covers how marginal costing aids in decision-making, including topics like breakeven analysis and contribution margins. The chapter also illustrates practical examples and limitations of various costing methods.