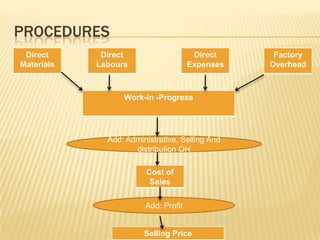

Job costing and process costing are two types of costing methods. Job costing is used when production is done in small batches to meet specific customer orders, with identifiable units tracked through production. Process costing is used for continuous production like chemicals, where costs are averaged over total units produced. Key differences are job costing tracks individual jobs while process costing averages costs over production batches. Both aim to determine accurate costs to measure profitability.