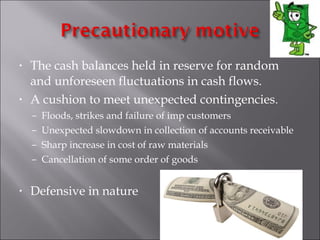

The document discusses cash management. It defines cash in both narrow and broad senses and explains the motives for holding cash, including transaction, precautionary, speculative, and compensating motives. It then covers managing cash flows, maintaining optimal cash levels, and investing surplus cash. Methods for accelerating cash collections and controlling disbursements are also summarized. Key factors that influence a firm's cash balance are discussed.