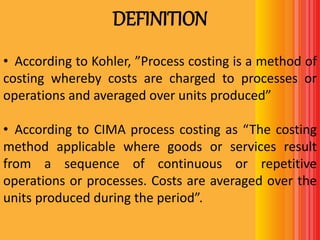

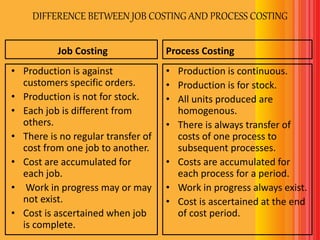

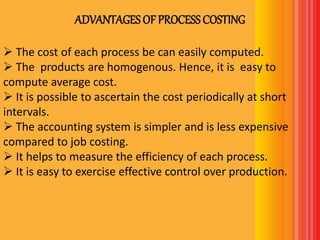

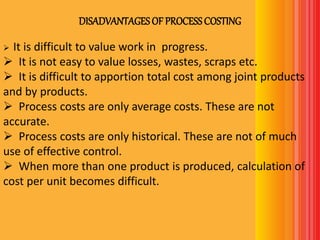

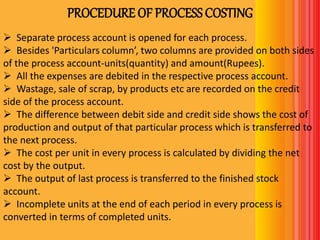

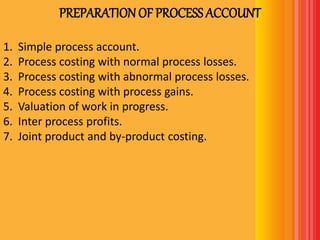

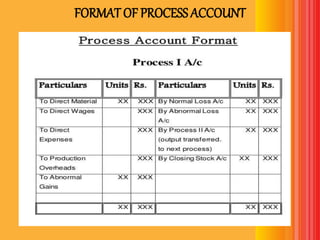

The document explains process costing, a method where costs are averaged over units produced in continuous and standardized production. It contrasts process costing with job costing, highlighting differences in production nature, cost accumulation, and work in progress. Advantages include easier cost computation and efficiency measurement, while disadvantages mention challenges in valuing work in progress and accuracy of average costs.