The document discusses various methods and concepts in cost accounting, including:

1. Different types of costing methods like unit costing, job costing, contract costing, batch costing, operating costing, process costing, and multiple/uniform costing.

2. The need to reconcile cost and financial accounts when they are maintained separately, to check for differences in reported profit/loss.

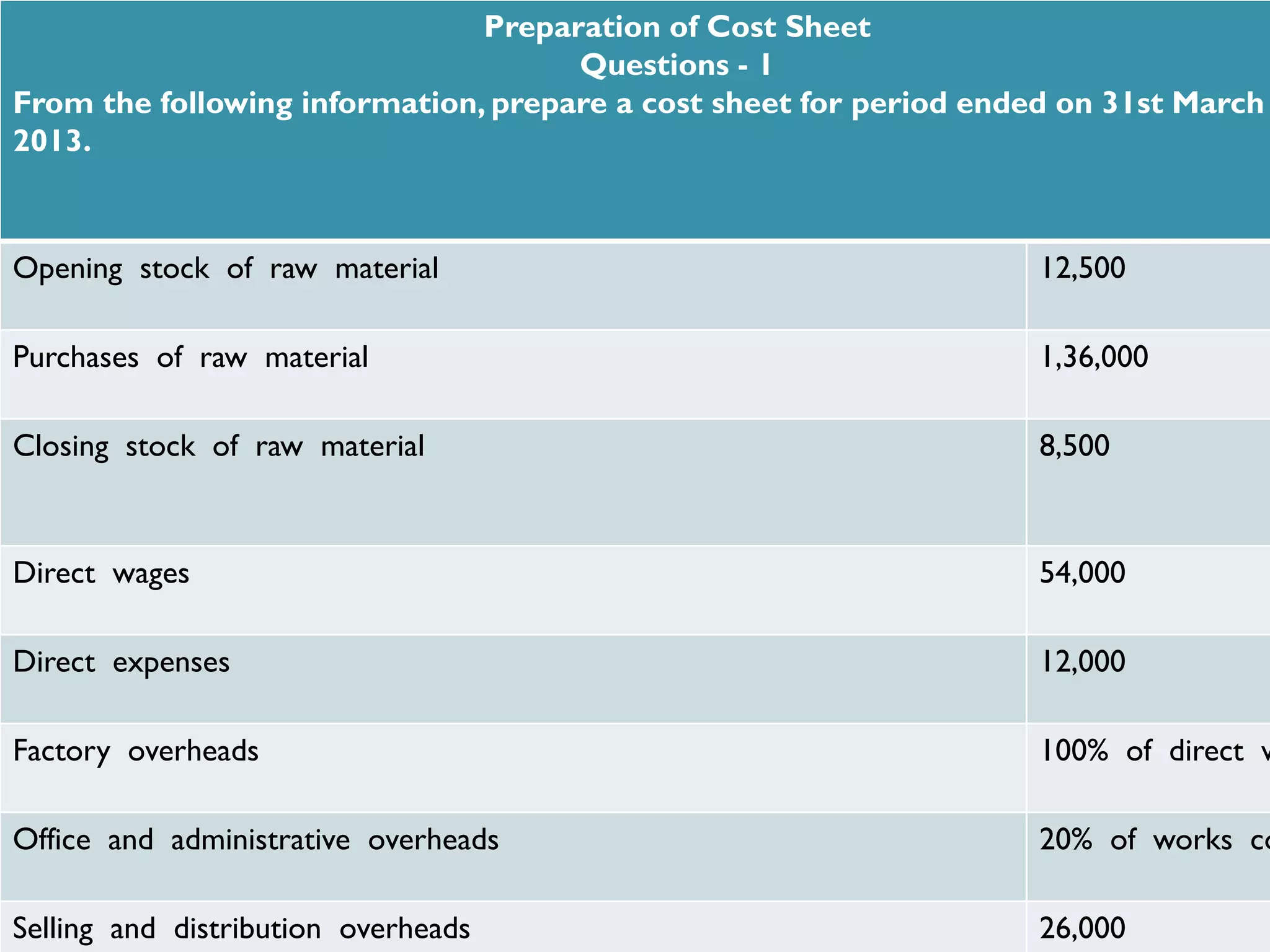

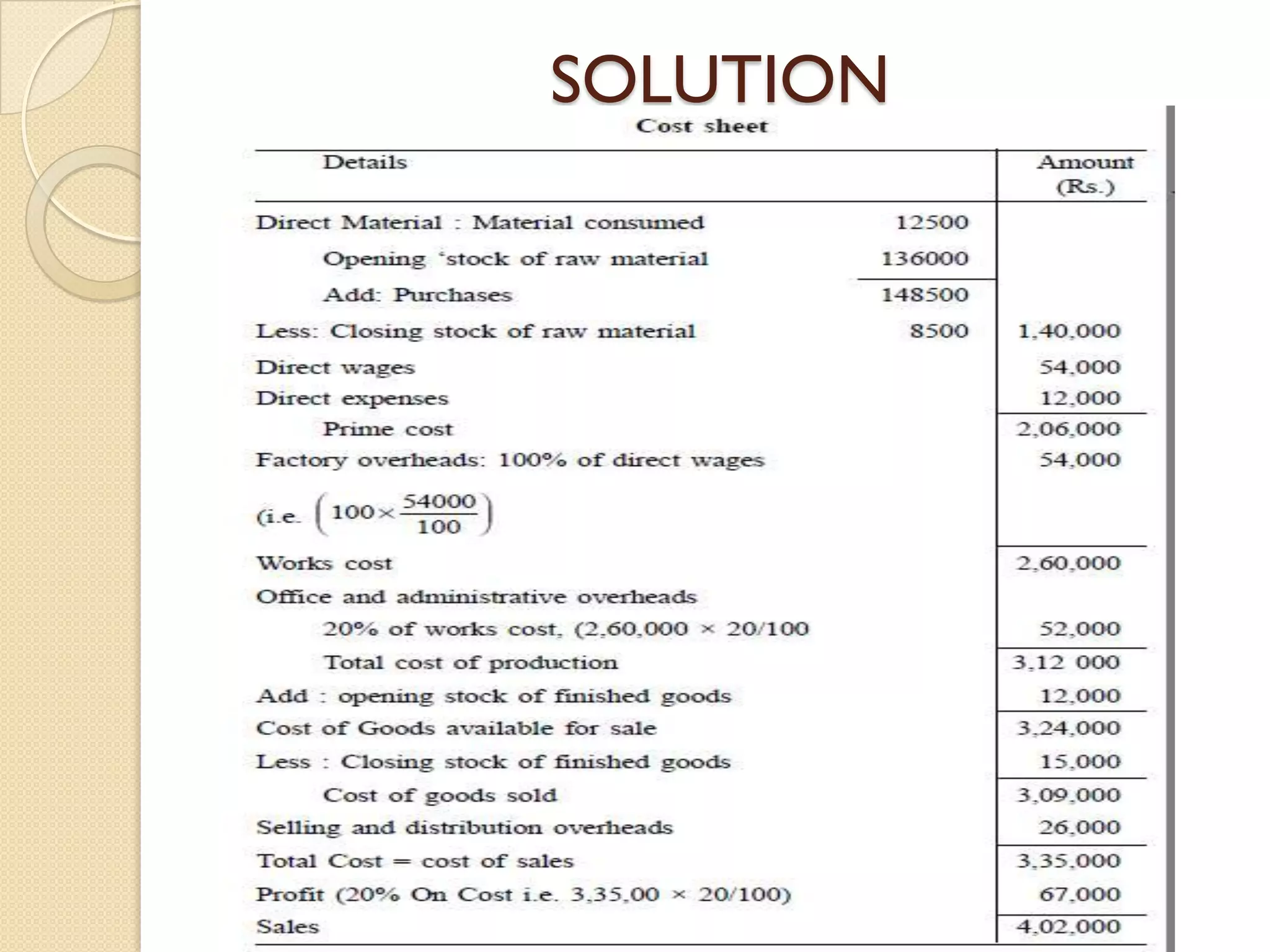

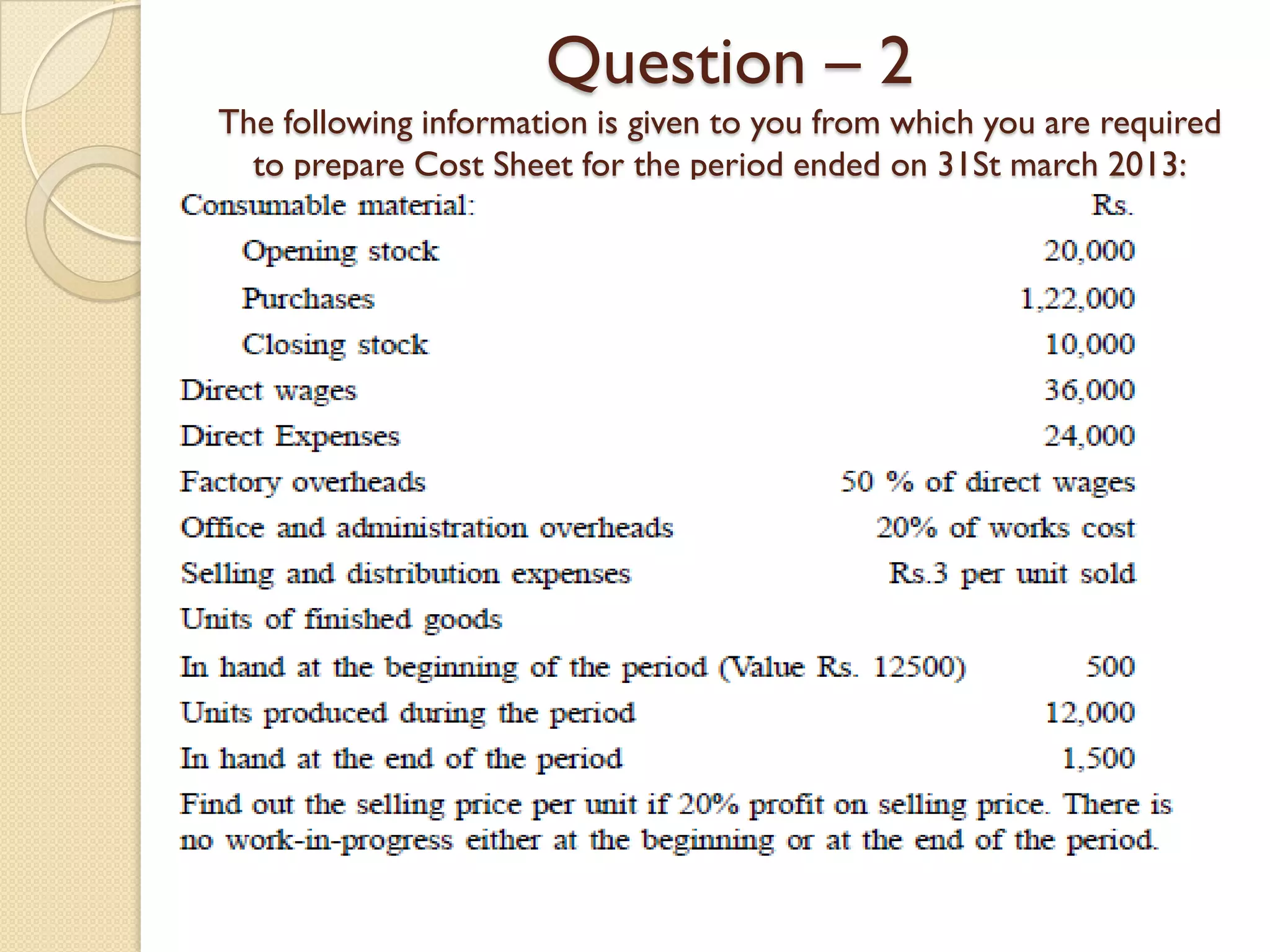

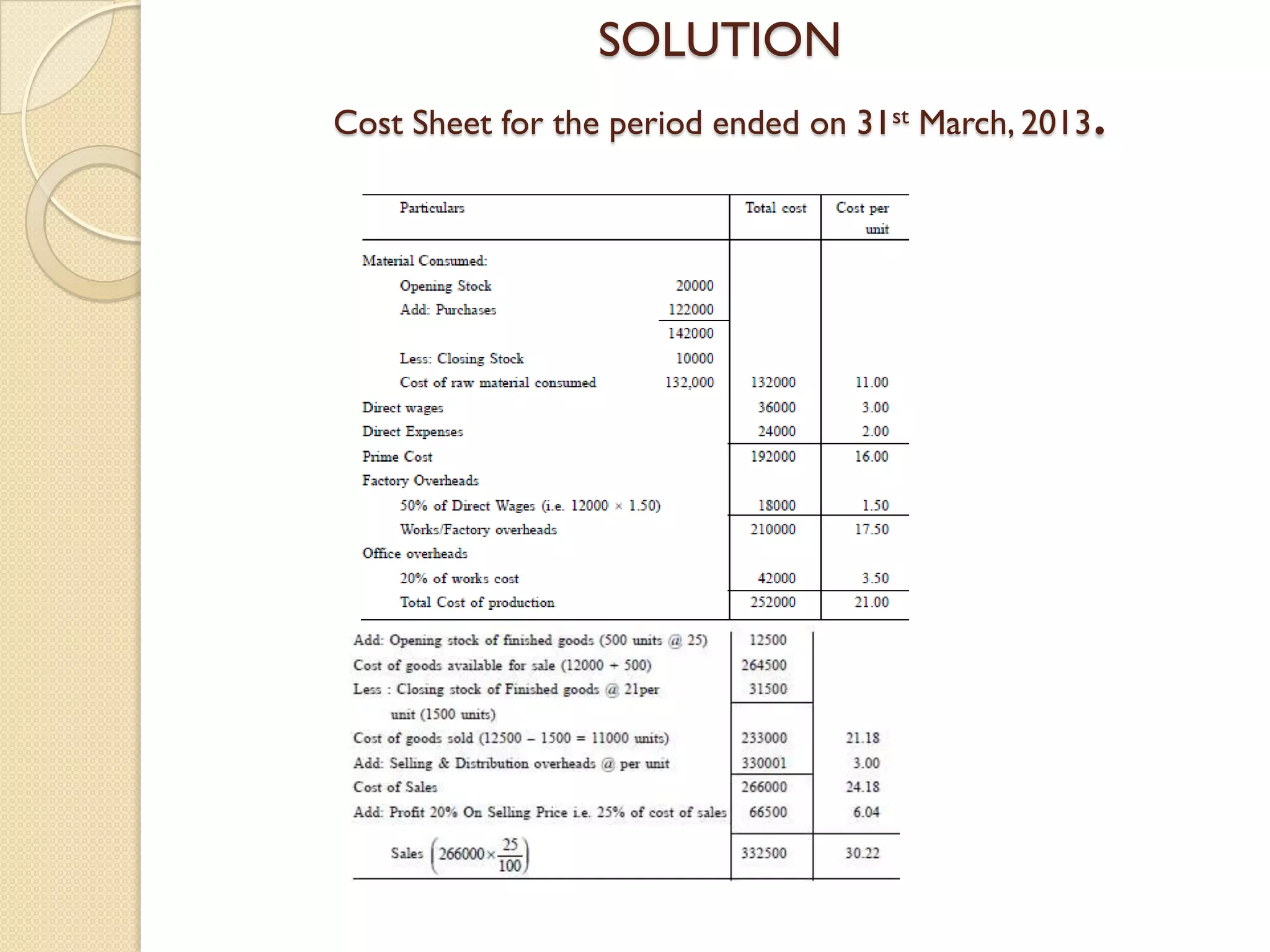

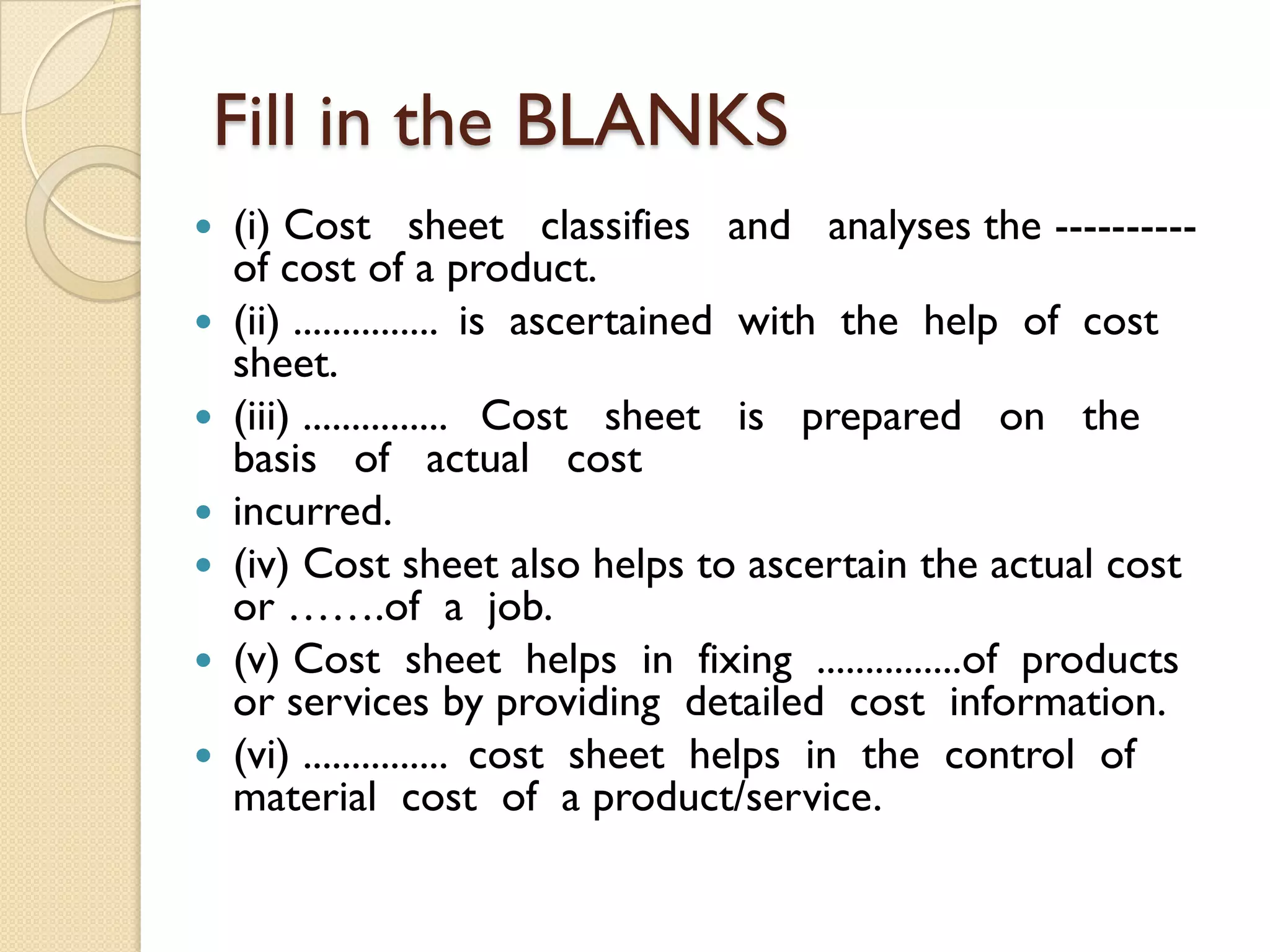

3. Key aspects of cost sheets like classifying cost components, ascertaining product costs, fixing selling prices, and aiding cost control and management decisions.