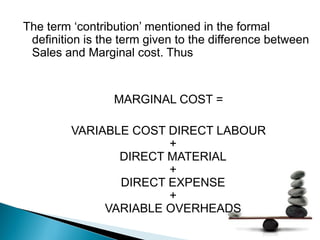

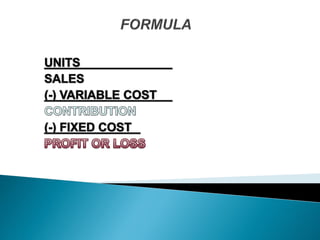

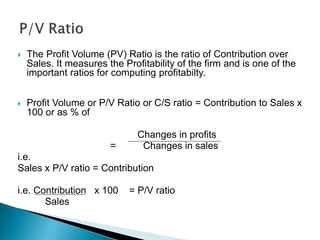

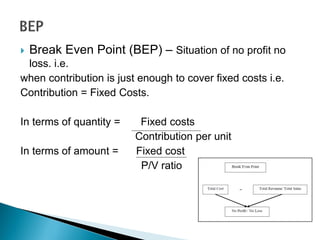

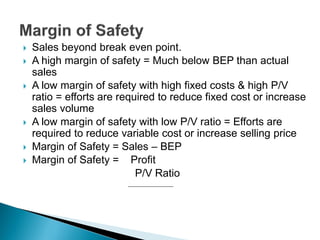

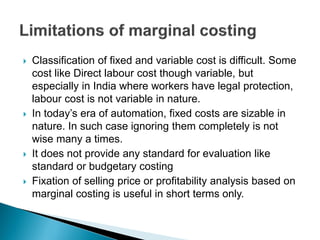

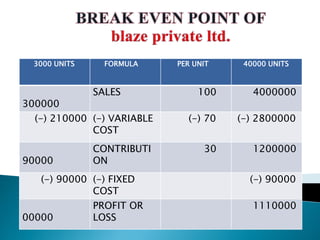

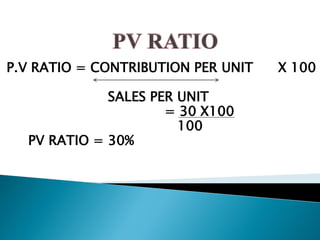

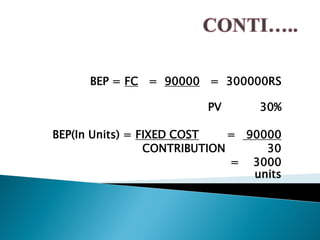

Marginal costing considers fixed costs as period costs and does not apportion them. It reduces total period costs from total contribution to arrive at net profit. The results are the same as total costing, only the presentation differs. Semi-variable costs have fixed and variable components. Marginal costing is defined as accounting that charges variable costs to cost units and writes off fixed costs against aggregate contribution. Contribution is sales minus marginal costs. Profit-volume ratio measures profitability as contribution over sales. Break-even point is when contribution equals fixed costs. Marginal costing supports managerial decision making by evaluating a concern's position.