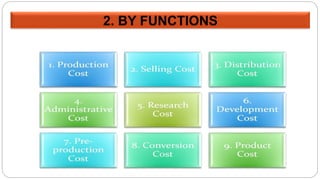

Cost accounting involves classifying costs according to their nature, function, variability, and controllability. There are several types of costs:

- Direct costs like materials and labor that are clearly traceable to production. Indirect costs like utilities that are not directly traceable.

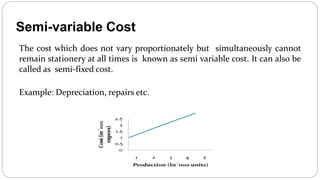

- Fixed costs that do not vary with production like rent. Variable costs that vary with production like materials. Semi-variable costs that vary but not proportionately.

- Controllable costs a manager can influence like direct labor. Uncontrollable costs outside a manager's control like depreciation.

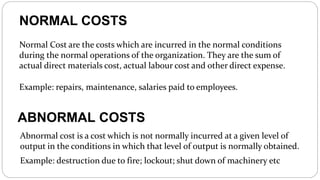

- Normal costs incurred during regular operations. Abnormal costs from unexpected events like fires.