The document discusses key concepts in break-even analysis including:

1. Assumptions made in break-even analysis like fixed costs remaining constant and variable costs varying proportionally with output.

2. Merits of break-even analysis like easily understanding cost-volume-profit relationships and aiding management decision making.

3. Demerits of break-even analysis like ignoring other business factors and assuming costs are perfectly linear.

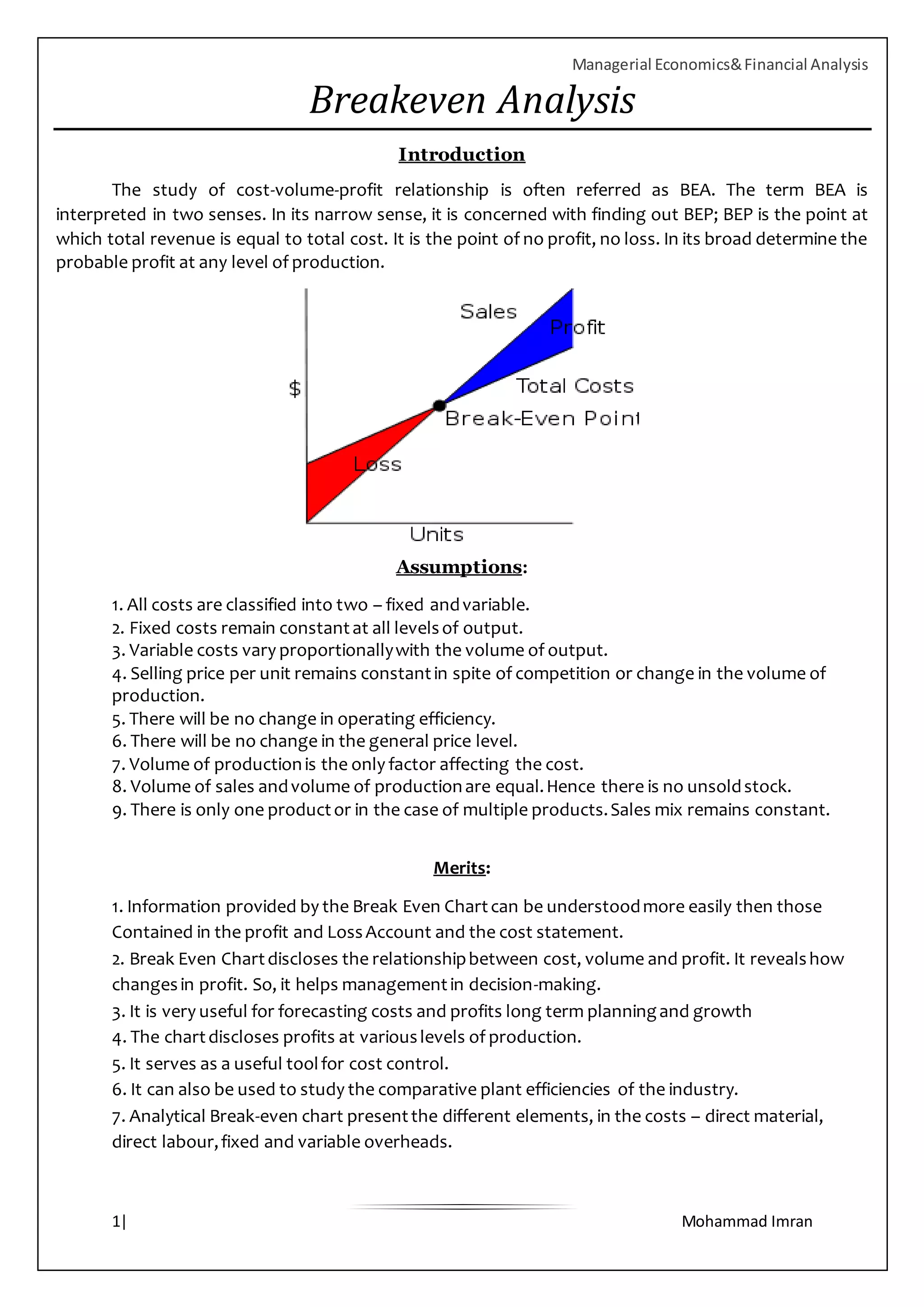

4. Key terms used in break-even analysis like fixed costs, variable costs, contribution, margin of safety, angle of incidence, profit-volume ratio, and break-even point.

5. Formulas for calculating items like contribution, margin of safety, and break-even point