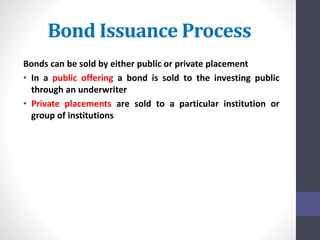

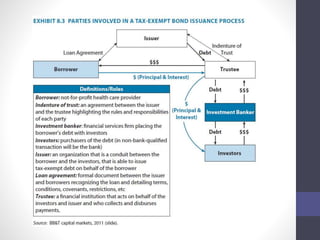

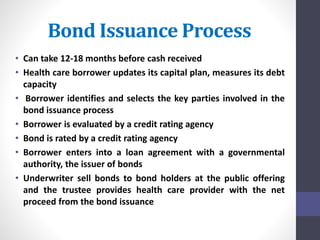

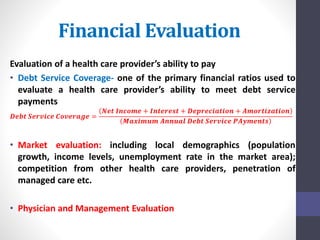

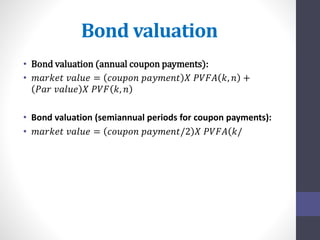

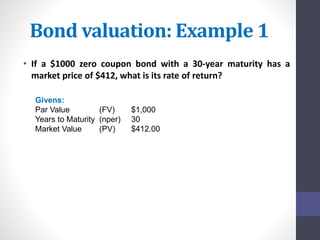

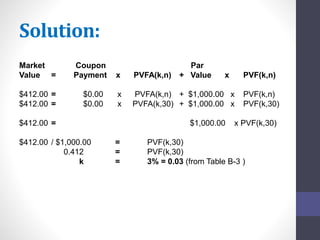

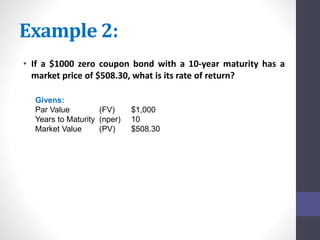

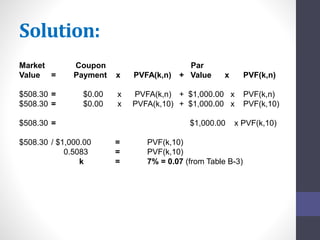

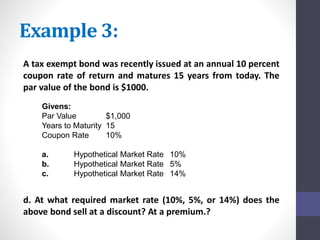

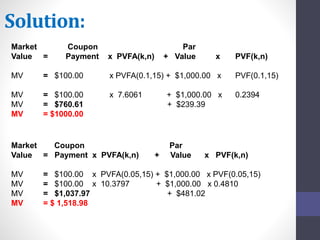

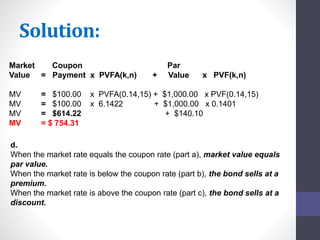

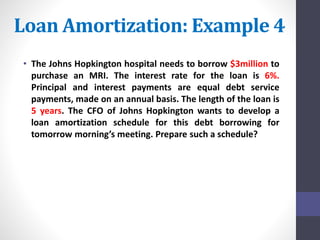

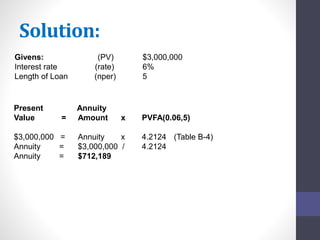

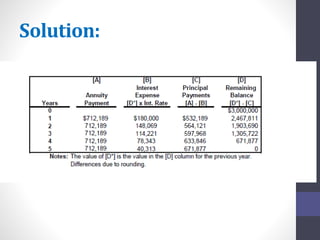

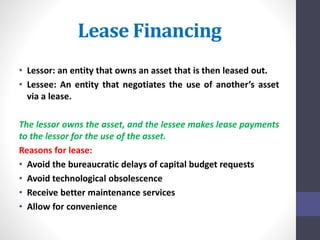

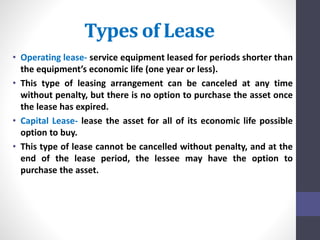

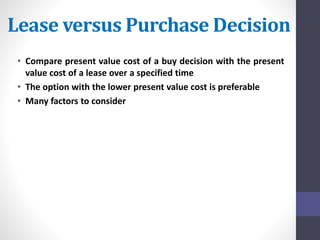

This document discusses various methods of capital financing for health care providers, including equity financing through retained earnings or stock issuance, and debt financing through loans, bonds, and lease agreements. It provides examples of calculating bond valuation and rates of return, as well as amortization schedules for loans. Key terms defined include debt service coverage, tax-exempt versus taxable bonds, and operating versus capital leases.

![Purchase vs. Lease: Example

Givens: (in thousands)

1. Before tax lease payments $15,000

2. Loan amount (PV) $55,000

3. Length of loan/lease (nper) 5

4. Interest rate (rate) 8%

5. After tax cost of debt 5%

6. Tax rate 40%

7. Annual depreciation expense [a] $11,000

8. Annual depreciation tax shield [b] $4,400

9. Annual loan payment [c] $13,775

10. Present value of lease @ interest rate [d] $59,891](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-31-320.jpg)

![Solution: Purchasing arrangement

Year [A]

Loan payment

(given 9)

[B]

Interest expense

[D]X[given 4]

[C]

Principal payment

[A]-[B]

[D]

Remaining balance

[D]-[C]

0 $55,000

1 $13,775 $4400 $9,375 45,625](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-32-320.jpg)

![Solution: Purchasing arrangement

Year [A]

Loan payment

(given 9)

[B]

Interest expense

[D]X[given 4]

[C]

Principal payment

[A]-[B]

[D]

Remaining balance

[D]-[C]

0 $55,000

1 $13,775 $4400 $9,375 45,625

2 $13,775 3,650 10,125 35,500](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-33-320.jpg)

![Solution: Purchasing arrangement

Year [A]

Loan payment

(given 9)

[B]

Interest expense

[D]X[given 4]

[C]

Principal payment

[A]-[B]

[D]

Remaining balance

[D]-[C]

0 $55,000

1 $13,775 $4400 $9,375 45,625

2 $13,775 3,650 10,125 35,500

3 $13,775 2840 10935 24,565](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-34-320.jpg)

![Solution: Purchasing arrangement

Year [A]

Loan payment

(given 9)

[B]

Interest expense

[D]X[given 4]

[C]

Principal payment

[A]-[B]

[D]

Remaining balance

[D]-[C]

0 $55,000

1 $13,775 $4400 $9,375 45,625

2 $13,775 3,650 10,125 35,500

3 $13,775 2840 10935 24,565

4 $13,775 1965 11810 12755](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-35-320.jpg)

![Solution: Purchasing arrangement

Year [A]

Loan payment

(given 9)

[B]

Interest expense

[D]X[given 4]

[C]

Principal payment

[A]-[B]

[D]

Remaining balance

[D]-[C]

0 $55,000

1 $13,775 $4400 $9,375 45,625

2 $13,775 3,650 10,125 35,500

3 $13,775 2840 10935 24,565

4 $13,775 1965 11810 12755

5 $13,775 1020 12755 0](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-36-320.jpg)

![Solution:

Year [E]

Depreciation

expense shield

[given 7]X[given 6]

[F]

Interest expense

Tax shield

[B]X[given 6]

[G]

Net cash outflow (if

owned)

[A]-[E]-[F]

[H]

PVF (from table B-

3)

After tax

Cost of debt

[given 5]

[I]

PV of net cash outflows

(if owned)

[G]X[H]

0 $55,000

1 $4400 $1760 7615 0.9542 $7,266

2 $4400 1460 7915 0.9105 7,207

3 $4400 1136 8239 0.8688 7,158

4 $4400 786 8589 0.8290 7,120

5 $4400 408 8967 0.7910 7,093

$35,845](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-37-320.jpg)

![Leasing arrangement

Year [A]

Before Tax

Lease Payments

[Given 1]

[B]

Lease tax

shield

[A]X[given 6]

[C]

After tax

Net lease payments

[A]-[B]

[D]

PVF

After tax

Cost of debt

[given 5]

[E]

Cash outflows

(if leased)

[C]X[D]

0

1 $15,000 $6,000 $9,000 0.9542 $8,588

2 $15,000 $6,000 $9,000 0.9105 8,194

3 $15,000 $6,000 $9,000 0.8688 7,819

4 $15,000 $6,000 $9,000 0.8290 7,461

5 $15,000 $6,000 $9,000 0.7910 7,119

$39,182

It is more expensive to lease the asset since the present value

of the lease payments ($39,182)is greater than that for

borrowing ($35,845).](https://image.slidesharecdn.com/08chap-141214164513-conversion-gate01/85/Chapter-8-Capital-Financing-for-Health-Care-Providers-38-320.jpg)