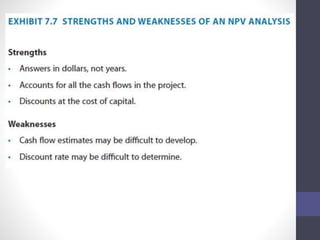

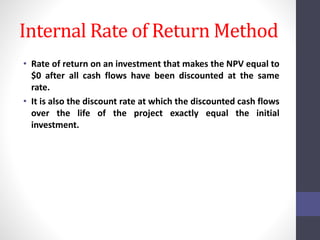

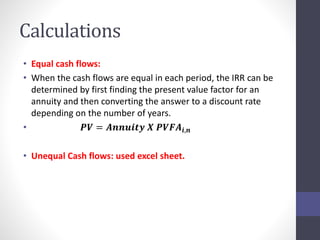

The document discusses methods for evaluating capital investment decisions in healthcare organizations. It introduces the payback period method, which calculates the number of years to recover an initial investment without considering the time value of money. The net present value (NPV) method is presented, which discounts future cash flows to account for the cost of capital and calculates the difference between the initial investment and discounted cash flows. The internal rate of return (IRR) method is also covered, which is the discount rate that makes the NPV equal to zero. Decision rules for accepting or rejecting projects using NPV and IRR are provided.

![Example 1:

Givens Years 0 1 2 3 4 5

1. Initial investment ($15,000,0

00)

2. Net opening cash

flows

$2,000,000 $4,000,000 $5,000,000 $8,000,000 $16,000,000

Givens 0 1 2 3 4 5

A. Initial

investment

[Given 1] ($15,000,0

00)

B. Net opening cash

flows

[Given 2] $2,000,000 $4,000,000 $5,000,000 $8,000,000 $16,000,000

C. Cumulative Cash

Flows

(a) ($15,000,0

00)

$13,000,00

0

$9,000,000 $4,000,000 $4,000,000 $20,000,000

Solution:

Payback = year 3.5](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-8-320.jpg)

![Example 2:

Givens Years 0 1 2 3 4 5

1. Initial investment ($28,000)

2. Net opening cash

flows

$8,000 $8,000 $8,000 $8,000 $8,000

Givens 0 1 2 3 4 5

A. Initial

investment

[Given 1] ($28,000)

B. Net opening cash

flows

[Given 2] $8,000 $8,000 $8,000 $8,000 $8,000

C. Cumulative Cash

Flows

(a) ($28,000) $20,000 $12,000 $4,000 $4,000 $12,000

Solution:

Payback = year 3.5](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-9-320.jpg)

![Taking example 1: discount rate = 15%

Givens 0 1 2 3 4 5

A. Initial

investment

[Given 1] ($15,000,0

00)

B. Net opening cash

flows

[Given 2] $2,000,000 $4,000,000 $5,000,000 $8,000,000 $16,000,000

C. Cumulative Cash

Flows

(a) ($15,000,0

00)

$13,000,00

0

$9,000,000 $4,000,000 $4,000,000 $20,000,000

Givens 0 1 2 3 4 5

D. Present value

interest factors

for 15%

ퟏ

(ퟏ + 풊)풏

[Table

B3]

0.8696 0.7561 0.6575 0.5718 0.4972

E. Present value

of cash flows

[B X D] $1,739,13

0

$3,024,57

5

$3,287,581 $4,574,026 $7,954,828

F. Sum of annual

Cash Flows

[Sum E] $20,580,1

40

G1. Net Present

Value

[A + F] $5,580,14

0

G2. Net Present

value function

$5,580,14

0](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-12-320.jpg)

![Taking example 2: discount rate = 20%

Givens 0 1 2 3 4 5

A. Initial

investment

[Given 1] ($28,000)

B. Net opening cash

flows

[Given 2] $8,000 $8,000 $8,000 $8,000 $8,000

C. Cumulative Cash

Flows

(a) ($28,000) $20,000 $12,000 $4,000 $4,000 $12,000

Givens 0 1 2 3 4 5

D. Present value

interest factors

for 15%

ퟏ

(ퟏ + 풊)풏

[Table

B3]

0.8333 0.6944 0.5787 0.4823 0.4019

E. Present value

of cash flows

[B X D] $6,667 $5,556 $4,630 $3,868 $3,215

F. Sum of annual

Cash Flows

[Sum E] $23,925

G1. Net Present

Value

[A + F] $4,075

G2. Net Present

value function

$4,075](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-13-320.jpg)

![Example 3:

Givens (in thousands) Years 0 1 2 3 4 5

1. Initial investment ($5,500)

2. Net Revenues $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

3. Cash operating

expenses

$1,200 $1,200 $1,200 $1,200 $1,200 $1,200

4. Depreciation

Expenses

[a] $940 $940 $940 $940 $940 $940

5. Sale of Asset at

salvage value

$800

6. Cost of capital 12%

7. Change in net

working capital

$0 $0 $0 $0 $0 $0

[a] ($5,500,000 Purchase price - $800,000 salvage value) / 5 years = $940 (in ‘000)](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-14-320.jpg)

![Solution:

Non-Profit Analysis Years 0 1 2 3 4 5

A. Initial investment [Given 1] ($5,500)

B. Net Revenues [Given 2] $3,000 $3,000 $3,000 $3,000 $3,000 $3,000

C. Less: cash operating

expenses before

depreciation

[Given 3] $1,200 $1,200 $1,200 $1,200 $1,200 $1,200

D. Less: Depreciation

Expense

[Given 4] $940 $940 $940 $940 $940 $940

E. Operating Income [B – C - D] 860 860 860 860 860 860

F. Add: Depreciation

Expense

[Given 4] $940 $940 $940 $940 $940 $940

G. Net Operating Cash

Flows

[E+F] 1,800 1,800 1,800 1,800 1,800 1,800

H. Add: sale of assets at

salvage value

[Given 5] 800

I. Adjustments for

changing in working

capital

-[Given 7) $0 $0 $0 $0 $0 $0

J. Recapture of Net

working capital

-[Sum I] $ 0

K. Project cash flows [G+H+I+J] (5,500) $1,800 $1,800 $1,800 $1,800 $2,600](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-15-320.jpg)

![Non-Profit Analysis Years 0 1 2 3 4 5

L. Cost of Capital [Given 6] 12% 12% 12% 12% 12%

M. Present value interest

factors

ퟏ

(ퟏ + 풊)풏

[Table B3] 0.8929 0.7972 0.7118 0.6355 0.5674

N. Annual PV of Cash

flows

[K X M] 1,607 1,435 1,281 1,144 1,475

O. PV of cash Flows [Sum N] $6,943

P. Net Present Value [A + O] $ 1,443

Q. Net Present Value

function check

$ 1,443

Accept Project because NPV is Positive](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-16-320.jpg)

![Example 4: Taking example 1 discount rate = 20%

Givens 0 1 2 3 4 5

A. Initial

investment

[Given 1] ($15,000,0

00)

B. Net opening cash

flows

[Given 2] $2,000,000 $4,000,000 $5,000,000 $8,000,000 $16,000,000

C. Cumulative Cash

Flows

(a) ($15,000,0

00)

$13,000,00

0

$9,000,000 $4,000,000 $4,000,000 $20,000,000

Givens 0 1 2 3 4 5

D. Present value

interest factors

for 15%

ퟏ

(ퟏ + 풊)풏

[Table

B3]

0.8696 0.7561 0.6575 0.5718 0.4972

E. Present value

of cash flows

[B X D] $1,739,13

0

$3,024,57

5

$3,287,581 $4,574,026 $7,954,828

F. Sum of annual

Cash Flows

[Sum E] $20,580,1

40

G1. Net Present

Value

[A + F] $5,580,14

0

G2. Net Present

value function

$5,580,14

0](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-21-320.jpg)

![Givens 0 1 2 3 4 5

H. Present Value

interest factors

for 20%

ퟏ

(ퟏ + 풊)풏

[Table

B3]

0.6944 0.5787 0.4823 0.5718 0.4019

I. Present Values

of Cash Flows

[B X H] $1,666,66

7

$2,777,77

8

$2,893,519 $3,858,025 $6,430,041

J. Sum of Present

Value of cash

flows

[Sum I] $17,626,0

29

K1. Net Present

Value

[A + J] $2, 626,

029

K2. Net Present

Value Function

$2, 626,

029

L. Internal Rate

of Return

25.56%](https://image.slidesharecdn.com/07chap-141214164505-conversion-gate01/85/Chapter-7-The-Investment-Decision-22-320.jpg)