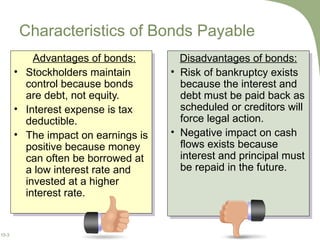

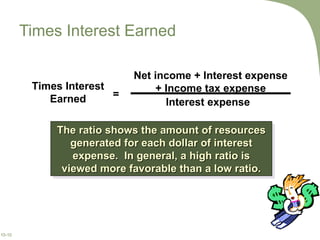

- Bonds are used to finance a company's operations and are considered debt, while equity refers to funds from owners. There are advantages like tax deductibility of interest expense but also risks like bankruptcy if obligations cannot be met.

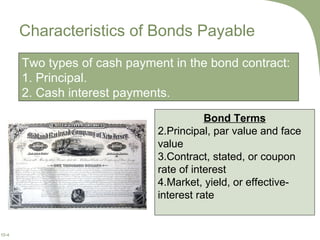

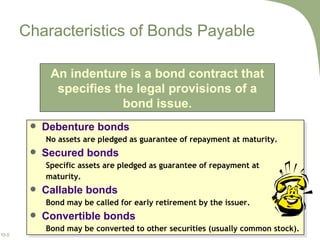

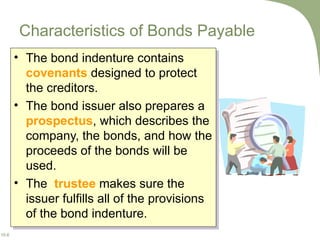

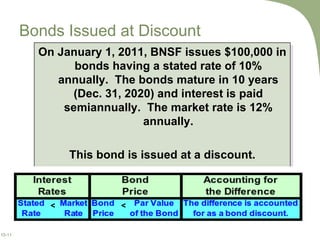

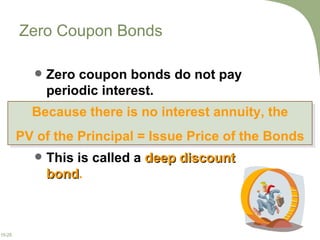

- Bonds have a principal amount, coupon/stated interest rate, and maturity date. They can be secured by assets or callable/convertible. An indenture contract specifies legal provisions.

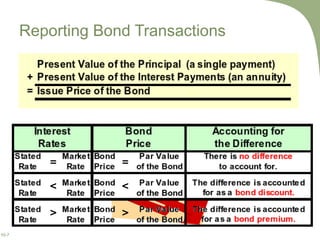

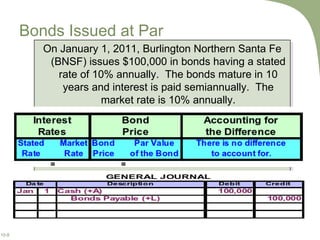

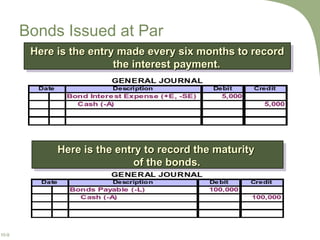

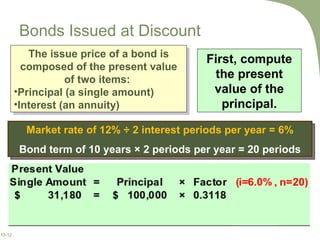

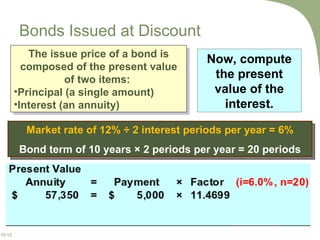

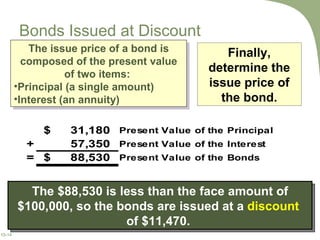

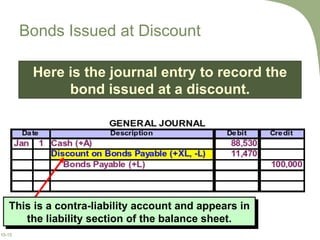

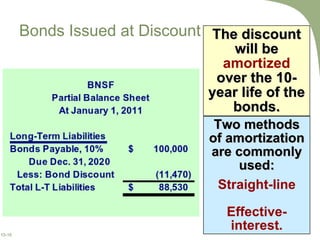

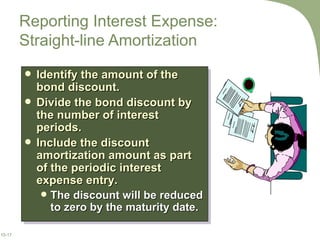

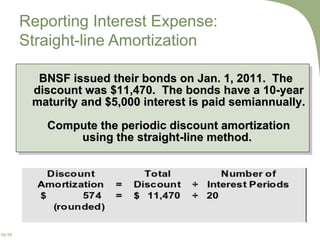

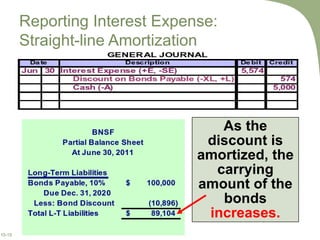

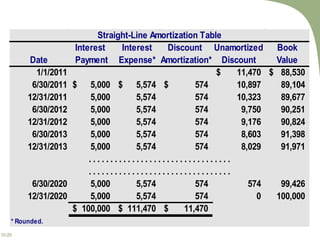

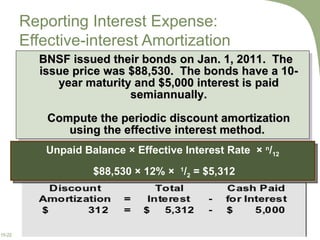

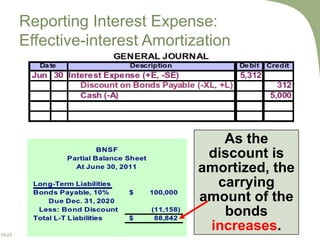

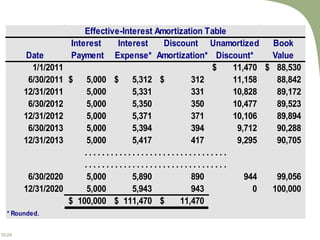

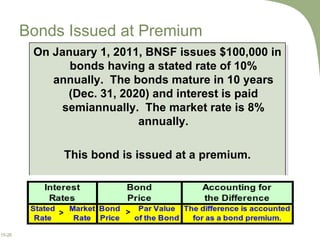

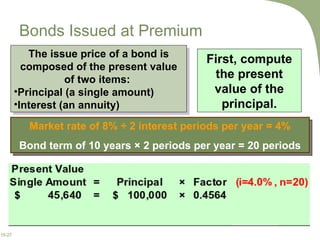

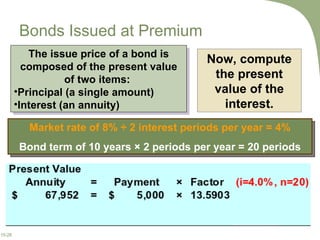

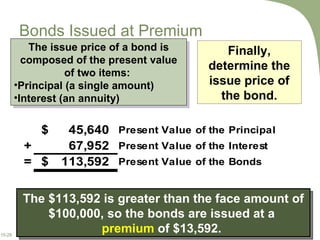

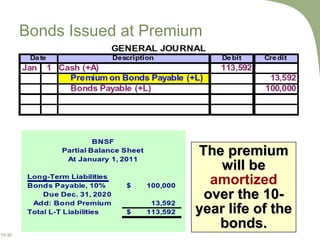

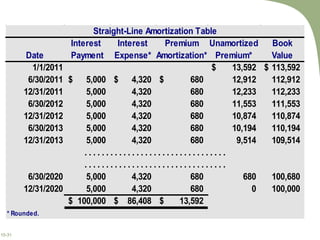

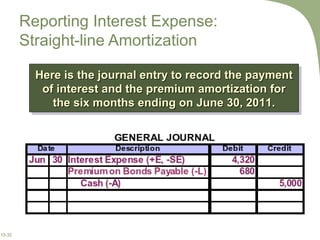

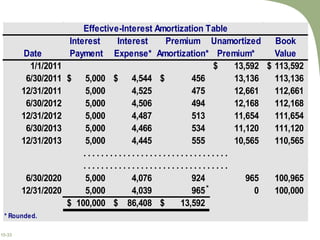

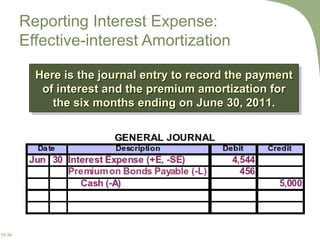

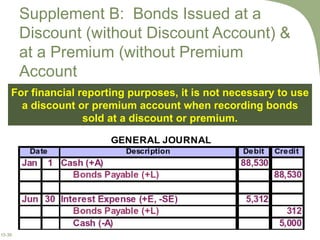

- Bonds can be issued at par value, at a discount if below par, or at a premium if above par. Discounts/premiums are amortized over the bond term using straight-line or effective interest methods to calculate periodic interest expense.