Bonds payable (1)

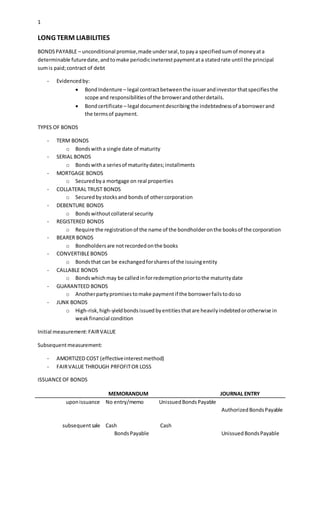

- 1. 1 LONG TERM LIABILITIES BONDSPAYABLE – unconditional promise,made underseal,topaya specifiedsumof moneyata determinable futuredate,andtomake periodicineterestpaymentata statedrate until the principal sumis paid;contract of debt - Evidencedby: BondIndenture – legal contractbetweenthe issuerandinvestor thatspecifiesthe scope and responsibilitiesof the brrowerandotherdetails. Bondcertificate – legal documentdescribingthe indebtednessof aborrowerand the termsof payment. TYPES OF BONDS - TERM BONDS o Bondswitha single date of maturity - SERIAL BONDS o Bondswitha seriesof maturitydates;installments - MORTGAGE BONDS o Securedbya mortgage on real properties - COLLATERAL TRUST BONDS o Securedbystocksand bondsof othercorporation - DEBENTURE BONDS o Bondswithoutcollateral security - REGISTERED BONDS o Require the registrationof the name of the bondholderonthe booksof the corporation - BEARER BONDS o Bondholdersare notrecordedonthe books - CONVERTIBLEBONDS o Bondsthat can be exchangedforsharesof the issuingentity - CALLABLE BONDS o Bondswhichmay be calledinforredemptionpriortothe maturitydate - GUARANTEED BONDS o Anotherpartypromisestomake paymentif the borrowerfailstodoso - JUNK BONDS o High-risk,high-yieldbondsissued byentitiesthatare heavilyindebtedorotherwise in weakfinancial condition Initial measurement:FAIRVALUE Subsequentmeasurement: - AMORTIZED COST (effectiveinterestmethod) - FAIRVALUE THROUGH PRFOFITOR LOSS ISSUANCEOF BONDS JOURNAL ENTRYMEMORANDUM UnissuedBondsPayableNo entry/memouponissuance AuthorizedBondsPayable CashCashsubsequentsale UnissuedBondsPayableBondsPayable

- 2. 2 below par/discountabove par/premiumat PAR ER>NRER<NRER=NR ISSUANCEOF BONDSAT A PREMIUM - Salesprice ismore than the face value of the bonds - Effective rate <Nominal Rate Illustration: A entityissuedbondswithaface amountof 2M at a quotedprice of 103. Cash (2M x 1.03) 2,060,000 BondsPayable 2,000,000 PremiumonBondsPayable 60,000 ISSUANCEOF BONDSAT A DISCOUNT - Salesprice islessthanthe face value of bonds - Effective rate >Nominal Rate Illustration: An entityissuedbondswithaface amountof 2M at a quotedprice of 98. Cash (2M x 0.95) 1,900,000 DiscountonBonds Payable 100,000 BondsPayable 2,000,000 INTEREST ON BONDS On May 31, 2018, an entityissiuedbondswithaface amountof 1M and10% ineterestpayable semiannuallyonMay 1 and October1. - Paymentof interestduringthe year 10/31/18 InterestExpense (1Mx 0.10 x ½) 50,000 Cash 50,000 - Accrual of interest 12/31/18 InterestExpense (1Mx 0.10 x 3/12) 25,000 AccruedInterestPayable 25,000 BOND ISSUE COST - Tansactioncosts thatae directlyattributableto the issue of bondspayable o Printingandengraving o Legal and accountingfee o Registrationfee withregulatoryauhtorities o Commissionspaidtoagentsandunderwriters - Shall be deductedfromthe fairvalue orissue price - Expensedif bondsare measuredatfair value throughprofitorloss ISSUANCEOF BONDSON INTEREST DATES On August1, 2018, the entityissued 1M4-yr bondswitha face amountof 1M at 102 that pays 10% semiannuallyon August1and November1.

- 3. 3 8/1/18 Cash (1Mx 1.02) 1,020,000 PremiumonBondsPayable 20,000 BondsPayable 1,000,000 11/01/18 InterestExpense (1Mx 0.10 x ½) 50,000 Cash 50,000 12/31/18 InterestExpense (1Mx 0.10 x 2/12) 16,667 AccruedInterestPayable 16,667 PremiumonBondsPayable 2,083 InterestExpense 2,083 [(20,000/4) x 5/12] ISSUANCEOF BONDSBETWEEN INTEREST DATES On September1,2018, the entityissued1M4-yr bondswitha face amountof 1M at 102 that pays10% semiannuallyonAugust1and November1. Issue Price 1,020,000 AccruedInterest(1Mx 0.10 x 1/12) 8,333 Total cash received 1,028,333 9/1/18 Cash 1,028,333 PremiumonBondsPayable 20,000 BondsPayable 1,000,000 InterestExpense 8,333 11/01/18 InterestExpense (1Mx 0.10 x ½) 50,000 Cash 50,000 12/31/18 InterestExpense (1Mx 0.10 x 2/12) 16,667 AccruedInterestPayable 16,667 PremiumonBondsPayable 1,702 InterestExpense 1,702 (20,000/47months x 4) Original life of bonds (4yrs x 12) 48months Less:Expiredlife 1month Remaininglife 47months BOND RETIREMENT On August1, 2018, the entityissued1M4-yr bondswitha face amountof 1M at 98 that pays 10% semiannuallyonAugust1and November1.

- 4. 4 Retirementon Maturity Date 8/1/22 BondsPayable 1,000,000 InterestExpense 50,000 DiscountonBonds Payable 70,000 Cash 980,000 Retirementon February1, 2020 at 92 Amortizationof bonddiscount: 70,000/4 = 17, 500 annual amortization InterestExpense (17,500/2) 8,750 DiscountonBonds Payable 8,750 8/1/18 70,000 8/1/18 – 2/1/20 [(18months/48) * 70,000] (26,250 ) Balance, 2/1/20 43,750 Cash payment: RetirementPrice 920,000 Accruedinterest (1M x 10% x 3/12 = 25,000) 25,000 Total Cashpayment 945,000 CarryingAmount: BondsPayable 1,000,000 DiscountonBonds Payable ( 43,750) CarryingAmount,2/1/20 956,250 2/1/20 BondsPayable 1,000,000 InterestExpense 25,000 Loss onEarly retirementof bonds Cash 945,000 DiscountonBonds Payable 43,750 Gain onearlyretirementof bonds 36,250 TREASURY BONDS - Entity’sownbondsoriginallyissuedandreacquiredbutnotcancelled Illustration: A 1M bondwas originallyissuedat105, subsequently,the entityreacquired500,000 face amountat 102. Atreacquisition,unamortizedpremiumbalance is45,000 and accrued interestis4,000.

- 5. 5 Acquisition: Face amount 500,000 Premium(500,000/1M * 45,000) 22,500 CarryingAmount 522,500 Reacquisitionprice (500,000 * 102) (510,000) Gain onreacquisition 12,500 Reacquisitionprice 510,000 AccruedInterest 45,000 Cash Payment 555,000 Entry: TreasuryBonds 500,000 PremiumonBondsPayable 22,500 InterestExpense 45,000 Cash 555,000 Gain onacquisitionof TB 12,500 Subsequentsale at 102: Cash 510,000 TreasuryBonds 500,000 PremiumonBondsPayable 10,000 Subsequentsale at 98: Cash 490,000 DiscountonBonds Payable 10,000 TreasuryBonds 500,000 BOND REFUNDING/REFINANCING 1. Issuance of new4-yr 10% with1M face amountat 1,100,000 2. Refundingof old10% bondswithremaininglife of 2yearsat 104 BondsPayable-old 1,000,000 DiscountonBonds Payable 10, 000 Retirementprice (1M* 1.04) 1,040,000 Entry: 1. Cash 1,100,000 BondsPayable 1,000,000 PremiumonBondsPayable 100,000

- 6. 6 2. BondsPayable 1,000,000 Loss onExtinguishmentof bonds 50,000 Cash 1,040,000 DiscountonBonds Payable 10,000 FAIRVALUE OPTION - No amortization - Anytransaction/bondissue costare expensedoutright - InterestExpense isrecognizedusingthe stated/nominal rate Illustration: On January1, 2018, an entityissueda12% bondamountingto 1M at 103 to yield10%.Interest ispayable annuallyonDecember31.The entitypaidbondissue costof 50,000. OnDecember31, 2018, the fair value of the bondsisdecreasedby80,000. ENTRY: 1/1/18 Cash 1,030,000 BondsPayable 1,030,000 TransactionCost 50,000 Cash 50,000 12/31/18 InterestExpense 120,000 Cash 120,000 BondsPayable 80,000 Gain fromchange in FV 80,000 Suppose thaton December31,2018, the fair value of the bondsis increasedby100,000; 80,000 is attributable toincrease inthe marketinterestrate,the remainingisattributable tocreditrisk. 12/31/18 Loss oncreditrisk-OCI 20,000 Loss fromchange in FV 80,000 BondsPayable 100,000 Note:Creditriskdoesnotinclude marketrisks:interest,currencyandprice risk.

- 7. 7 AMORTIZATION OFBOND DISCOUNTOR PREMIUM 1. StraightLine Amortization=BondDiscountor Premium/Life of the bonds 2. BondOutstandingMethod(serial bonds) Illustration 1: On January1, 2018, an entityissuesa10% bondwitha face amountof 1M at 102 that pays200,000 yearlyforfive years. Table of amortization PremiumAmortizationFractionBond OutstandingYear 6,666.001000/30001,000,000.002018 5,333.00800/3000800,000.002019 4,000.00600/3000600,000.002020 2,666.00400/3000400,000.002021 1,333.00200/3000200,000.002022 20,000.003,000,000.00

- 8. 8 NOTES PAYABLE – a liabilityinwritingmade byone persontoanother,signedbythe maker, promisingtopaya specificamountof moneyata future date or on demand Initial Measurement:FAIRVALUE/PRESENT VALUE Subsequentmeasurement: - AMORTIZED COST (effectiveinterestmethod) - FAIRVALUE THROUGH PRFOFITOR LOSS INTEREST BEARING- CASH PresentValue =CashProceeds Illustration: A 1M note is discountedat10% for one yearon October1, 2018. Note Payable 1,000,000 Less:Discount(10% x 1M) 100,000 NetProceeds 900,000 Entry: October1, 2018 Cash 900,000 DiscountonNote Payable 100,000 Note Payable 1,000,000 Amortization:December31,2018 (straightline method) InterestExpense (100,000 * 3/12) 25,000 DiscountonNote Payable 25,000 INTEREST BEARING– PROPERTY PresentValue =Purchase Price Illustration: An entityacquiredamachineryfor1M payable in4 annual equal installmentsonDecember31. Interestis10% on the unpaid. Entry: Jan 1, 2018 Machinery 1,000,000 Note Payable 1,000,000 FirstPayment:December31,2018 InterestExpense (1M* 10%) 100,000 Note Payable (1M/4) 250,000 Cash 350,000 SecondPayment:December31, 2019 InterestExpense (10%*750, 000) 75,000 Note Payable 250,000 Cash 325,000

- 9. 9 ... NONINTERESTBEARING– PROPERTY PresentValue =Cashprice ImputedInterest=CashPrice – Face Value Illustration: An entityacquiredamachinerywithacash price of 1M for1.2M; 200,000 downand the balance in5 equal annual installments. ENTRY: Jan 1, 2018 Machinery 1,000,000 DiscountonNote Payable (1.2M-1M) 200,000 Cash 200,000 Note Payable 1,000,000 FIRST PAYMENT:December31, 2018 Note Payable (1.2M – 200,000)/5 200,000 Cash 200,000 InterestExpense 50,000 DiscountonNote Payable 50,000 YEAR NOTE PAYABLE FRACTION DISCOUNT AMORTIZATION 2018 1,000,000.00 0.33 150,000.00 50,000.00 2019 800,000.00 0.27 150,000.00 40,000.00 2020 600,000.00 0.20 150,000.00 30,000.00 2021 400,000.00 0.13 150,000.00 20,000.00 2022 200,000.00 0.07 150,000.00 10,000.00 3,000,000.00 150,000.00 NONINTERESTBEARINGNOTE - PROPERTY (NOCASH PRICE) ; INSTALLMENT NO AGREED INTEREST,NO CASHPRICE COST OF PROPERTY= PRESENTVALUE Illustration: An entityacquired amachineryfor1M payable in5 equal annual payments.The prevailing marketrate of interestis10%. PV of 5 P200,000 = 3.7908 200,000 * 3.7908 = 758,160 ENTRY: Jan 1, 2018 Machinery 758,160 DiscountonNote Payable (1M – 758,160) 241,840 Note Payable 1,000,000 FIRST PAYMENT: Note Payable 200,000 Cash 200,000

- 10. 10 10% PAYMENT - INT PV-PRINCIPAL YEAR PAYMENT INTEREST PRINCIPAL PRESENT VALUE 1/1/2018 758,160 12/31/2018 200,000.00 75,816 124,184 633,976 12/31/2019 200,000.00 63,398 136,602 497,374 12/31/2020 200,000.00 49,737 150,263 347,111 12/31/2021 200,000.00 34,711 165,289 181,822 12/31/2022 200,000.00 18,182 181,818 - NONINTERESTBEARINGNOTE - PROPERTY (NOCASH PRICE) ; LUMP SUM Illustration: An entityacquiredequipmentfor1M. The entitypaid100,000 downand the balance isdue afterthree years.The prevailinginterestrate is10%. The PV of 1 for 3 periodsis.7513. Downpayment 100,000 PresentValue (900,000*7513) (676,170) Cost of Equipment 776,170 Face Value 900,000 PresentValue (676,170) ImputedInterest 223,830 ENTRY: January1, 2018 Equipment 776,170 DiscountonNote Payable 223, 830 Cash 100,000 Note Payable 900,000 ENTRY: December31, 2018