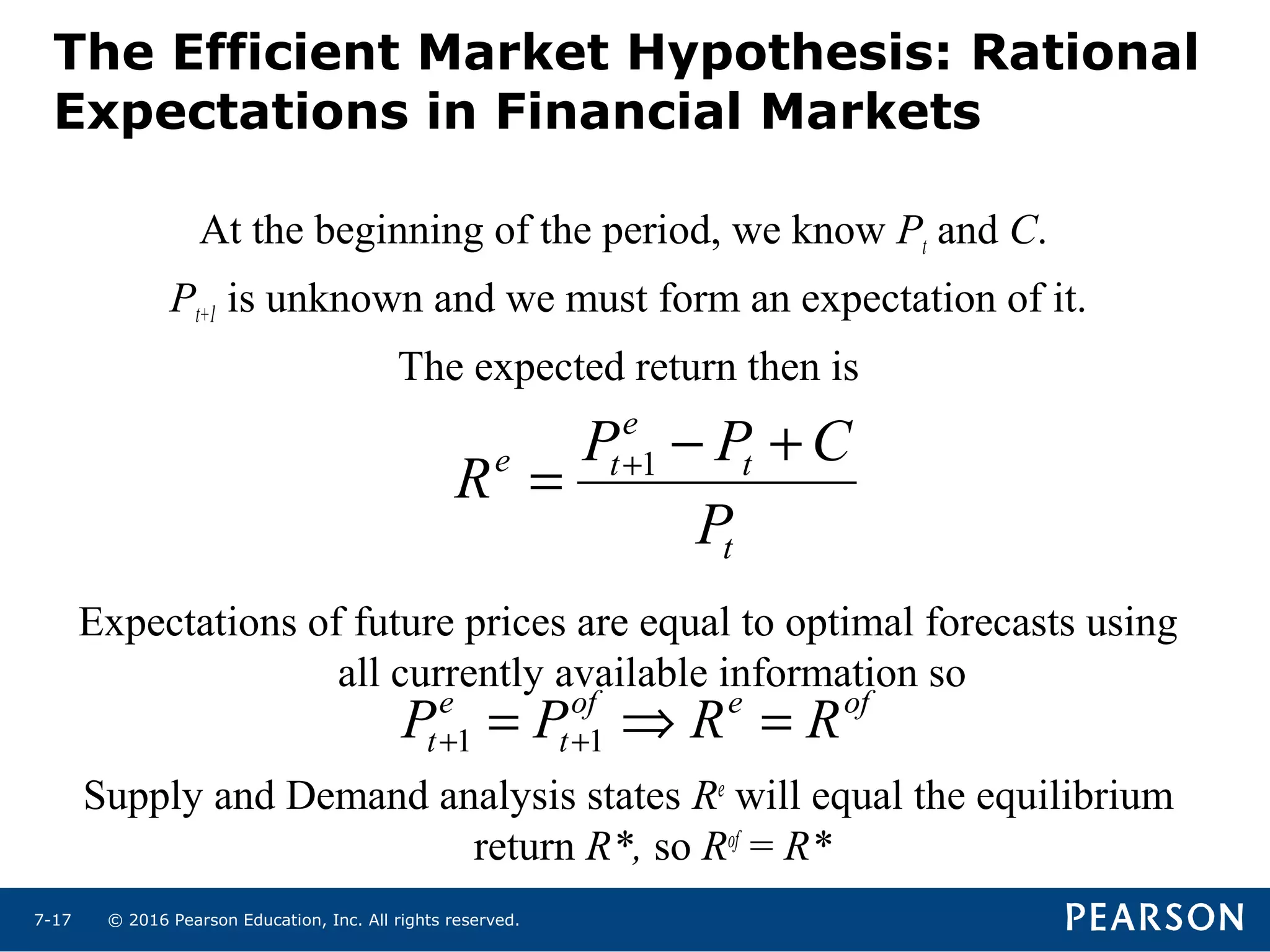

This chapter discusses the efficient market hypothesis, which states that security prices fully reflect all available information. It is based on the theory of rational expectations, which says that expectations will equal optimal forecasts using all available information. Under the efficient market hypothesis, arbitrage forces will cause the expected return of a security to equal its required market return. While published investment reports are readily available, acting on this information will not yield abnormal returns as it is already reflected in prices. The chapter also discusses criticisms of the efficient market hypothesis from behavioral finance perspectives.