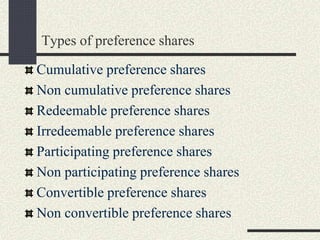

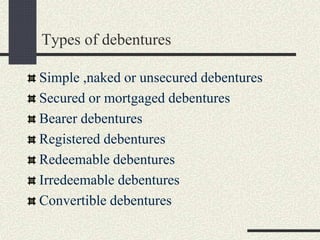

The document provides an in-depth overview of financial management, focusing on its definitions, objectives, functions, and evolution across traditional, transitional, and modern phases. It explores various sources of long-term finance, including equity capital, preference shares, debentures, venture capital, and public offerings, outlining their characteristics and advantages. Additionally, it highlights the relationship of financial management with other business functions and the significance of financial analysis for efficient resource allocation.