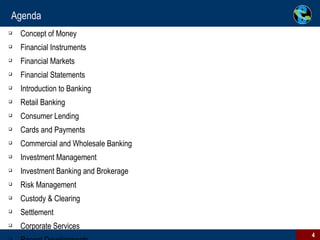

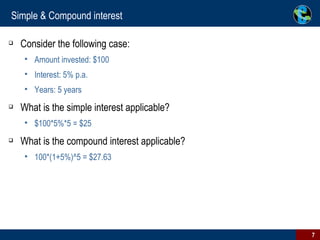

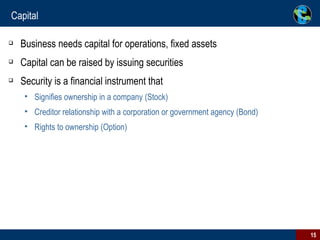

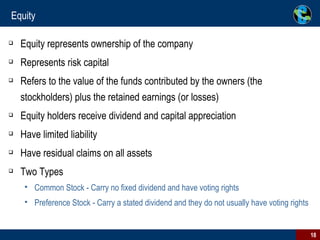

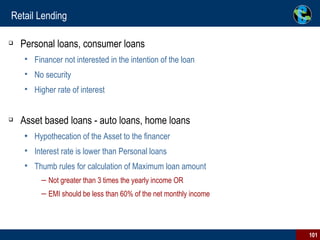

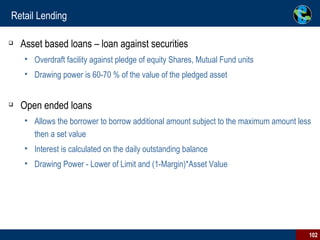

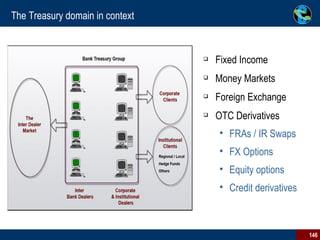

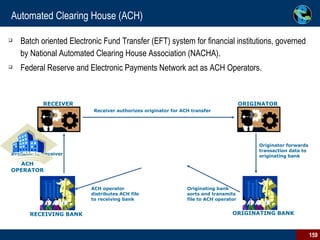

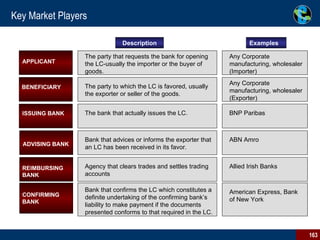

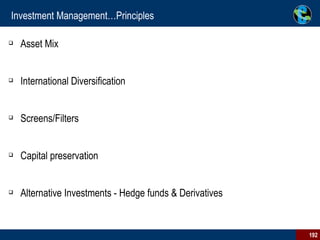

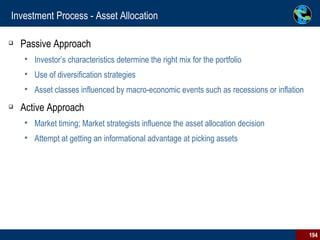

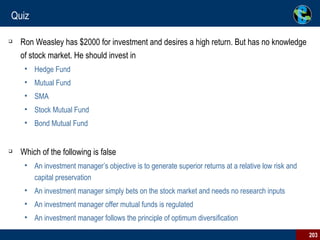

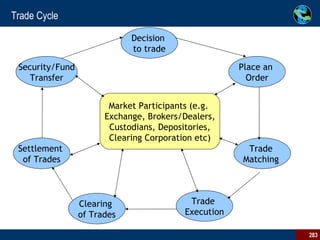

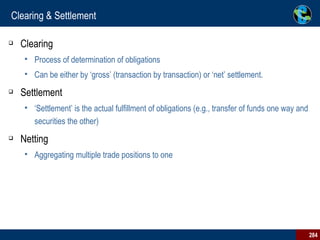

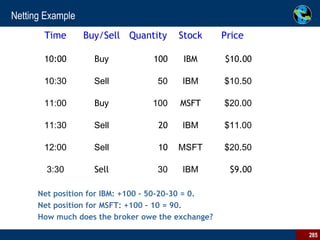

The document provides an overview and agenda for a banking and capital markets program. The program aims to introduce non-technical people to key banking concepts and operations. It covers topics like money, financial instruments, markets, statements, retail/commercial banking, investment management, and risk management. Recent developments in banking are also discussed. The program does not aim to make participants banking experts and excludes India-specific practices.