This document discusses various concepts related to bond valuation including:

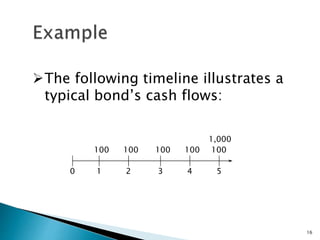

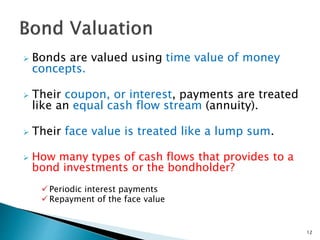

- Bonds provide periodic interest payments and repayment of face value at maturity as cash flows for valuation.

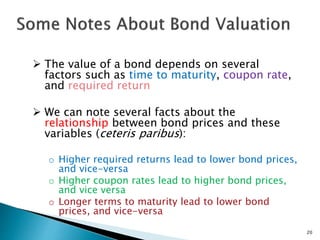

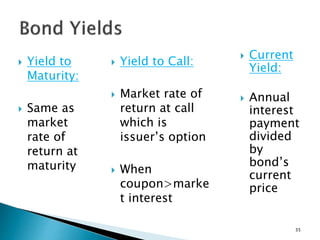

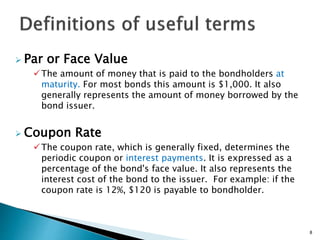

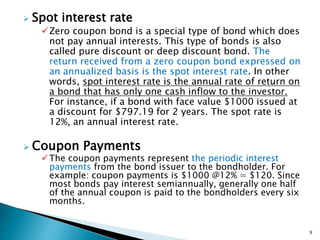

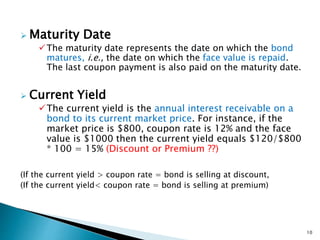

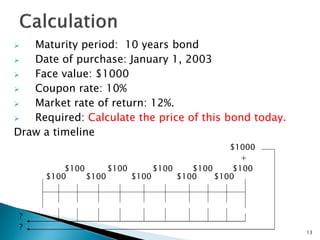

- Key bond features that impact valuation are coupon rate, maturity date, par/face value, current yield.

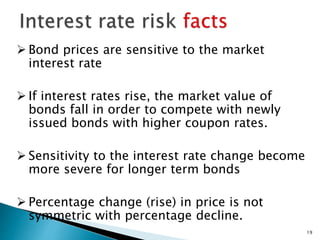

- Bond prices are sensitive to changes in market interest rates, with prices falling when rates rise.

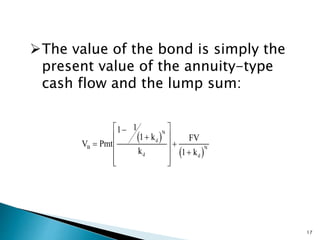

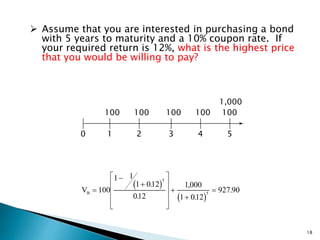

- Bond valuation involves discounting the coupon payments and face value repayment to their present value using the required rate of return.

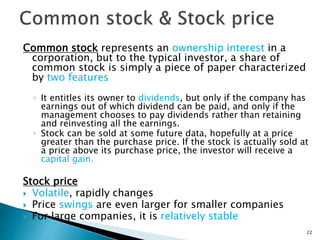

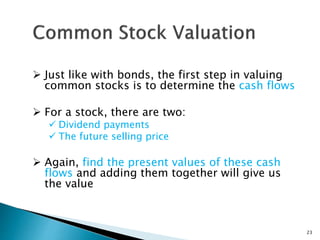

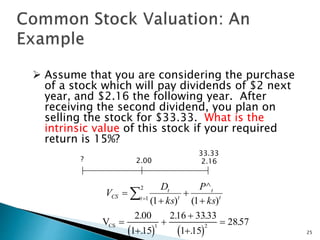

The document provides examples of calculating bond prices and yields using time value of money concepts. It also briefly discusses common stock valuation based on dividend payments and expected future sale price.

![1. First of all calculate the present value of the coupon

stream

PV = $100/(1+.12)1 + $100/(1+.12)2 + $100/(1+.12)3 +

$100/(1+.12)4 + $100/(1+.12)5 + $100/(1+.12)6 +

$100/(1+.12)7 + $100/(1+.12)8 + $100/(1+.12)9+

$100/(1+.12)10

Or, we can find the PV of an annuity

PVA = $100 * {[1-(1+.12)-10]/.12} (PVIFA12%,10 years = 5.650)

PV = $565.02

2. Find the PV of the face value

PV = CFt / (1+r)t

PV = $1000/ (1+.12)10 (PVIF 12%, 10 years = 0.3219)

PV = $321.97

3. Add the two values to get the total PV

Therefore, the price of bond today is $565.02 + $321.97 =

$886.99

14](https://image.slidesharecdn.com/securityvaluationbondsupdated-140525135757-phpapp01/85/Security-valuation-bonds-updated-14-320.jpg)

![ If you purchased a bond for $800 5-years ago and sold

the bond today for $1200. The bond paid an annual 10%

coupon. What is the realized rate of return?

n

PV = S [CFt / (1+r)t]

t=0

$800 = [$100/(1+r) + $100/(1+r)2 + $100/(1+r)3 +

$100/(1+r)4 + $100/(1+r)5] + [$1200/(1+r)5]

To solve, you need to use a “trail and error” approach.

The realized rate of return on this bond is 19.3%.

931.8276 (15%) & 781.3143 (20%)

15](https://image.slidesharecdn.com/securityvaluationbondsupdated-140525135757-phpapp01/85/Security-valuation-bonds-updated-15-320.jpg)