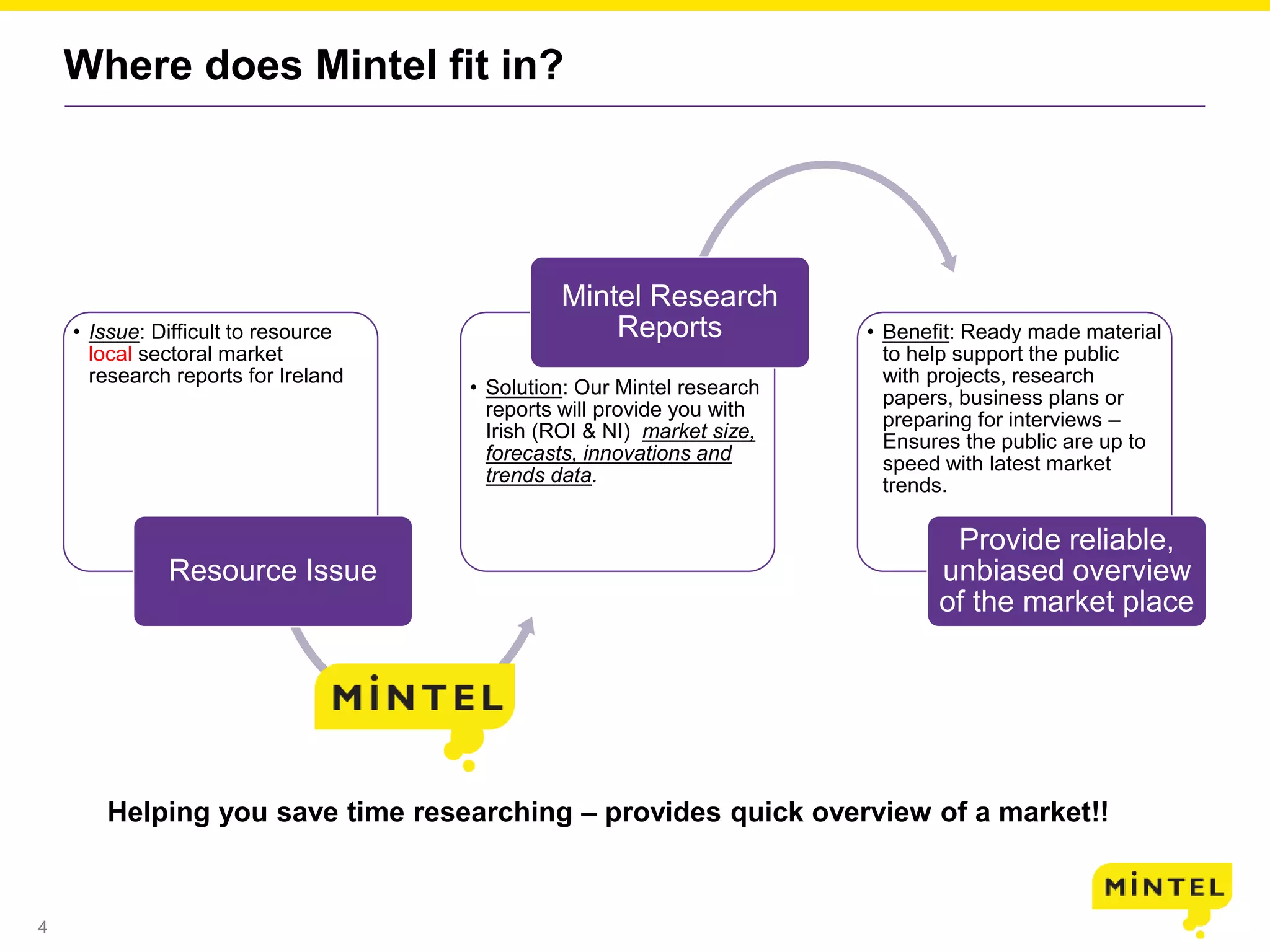

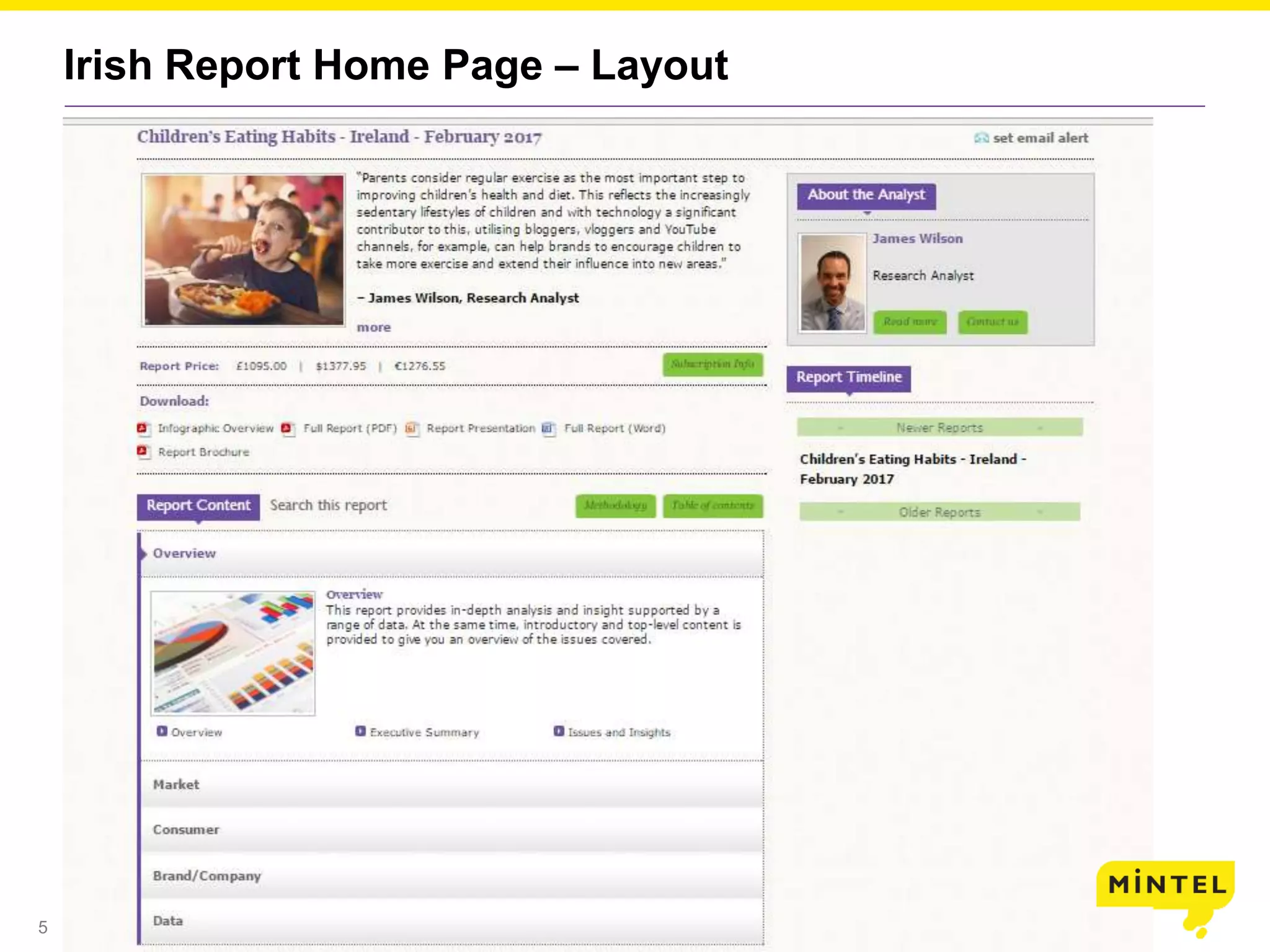

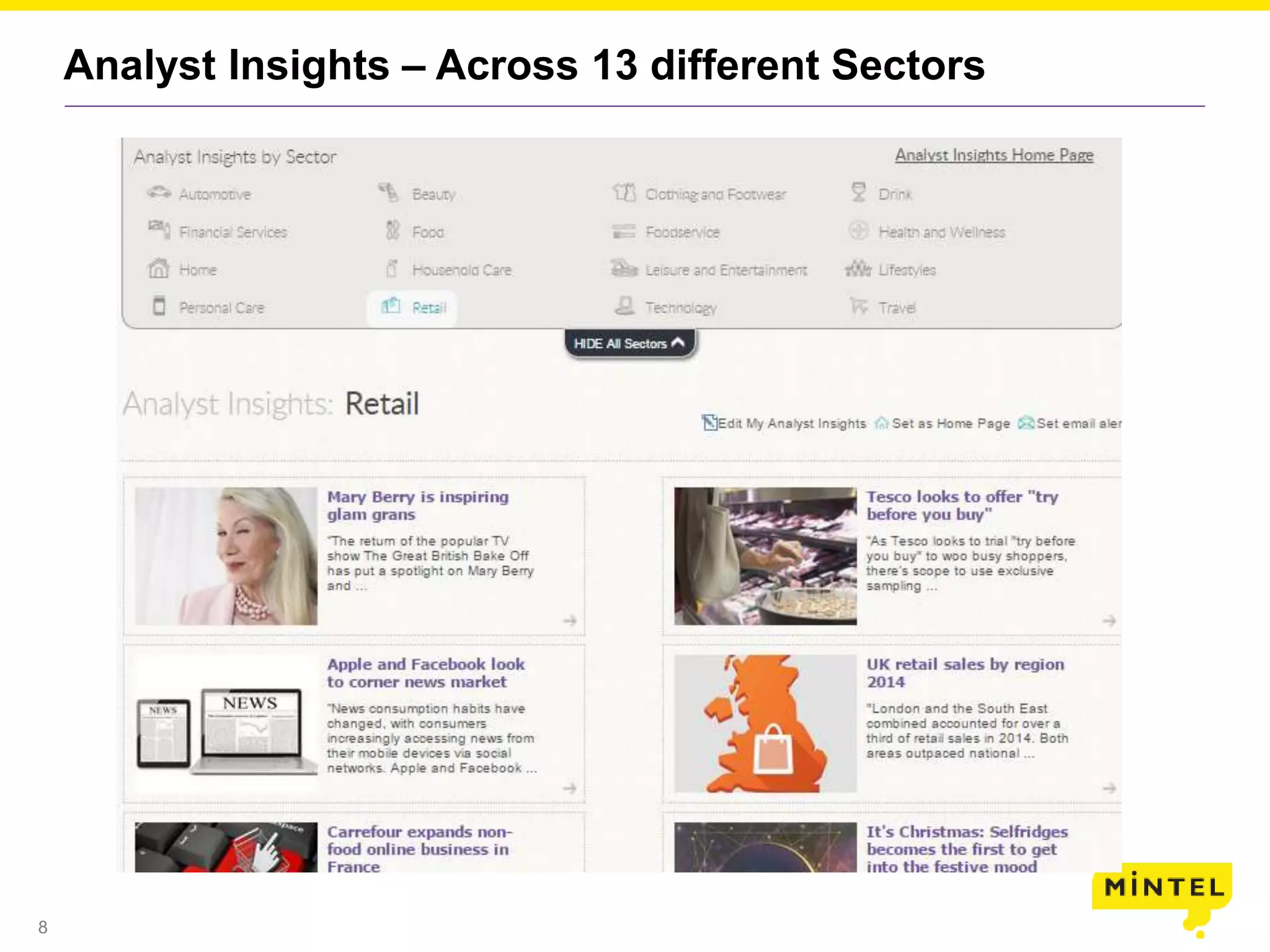

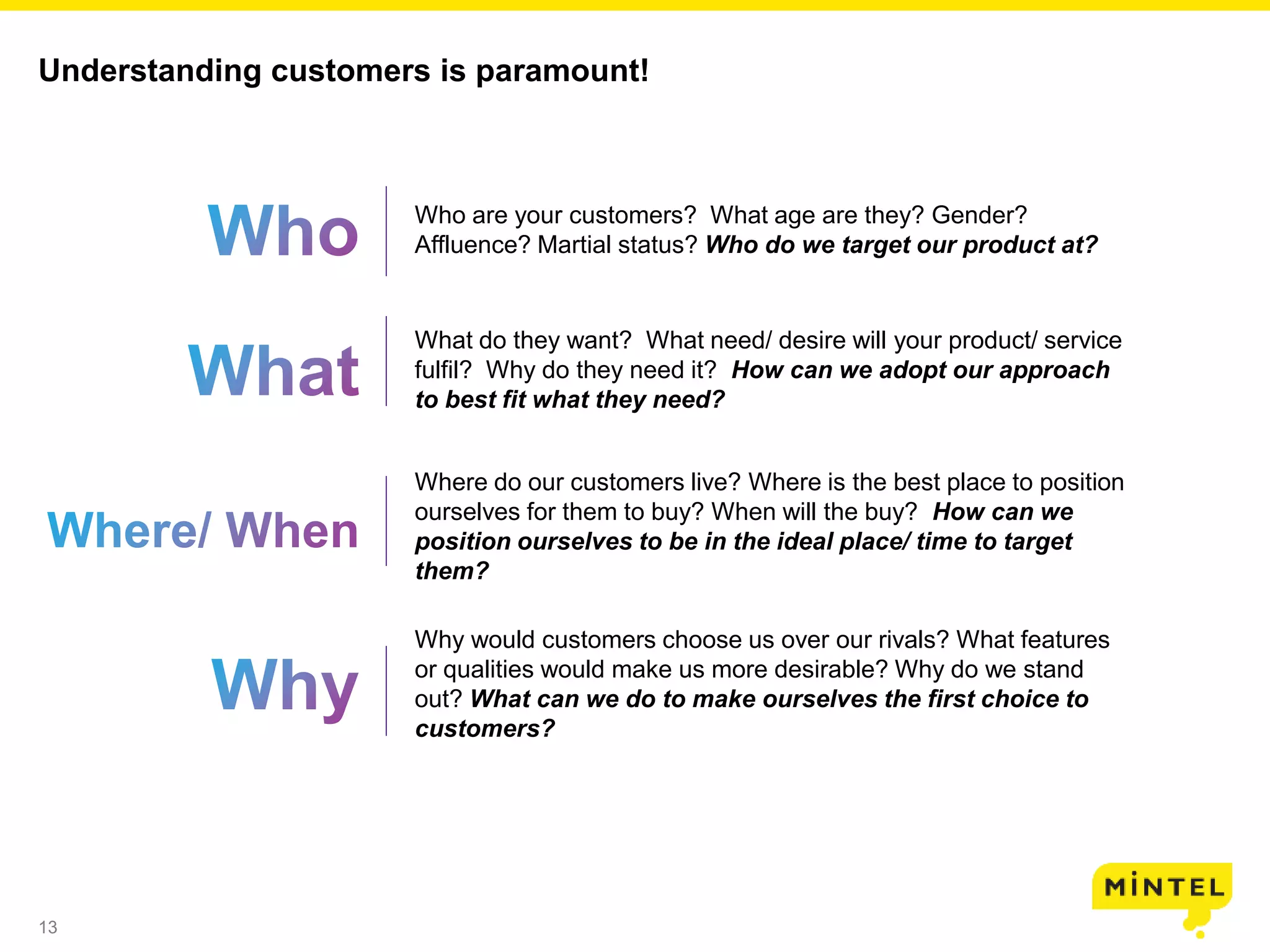

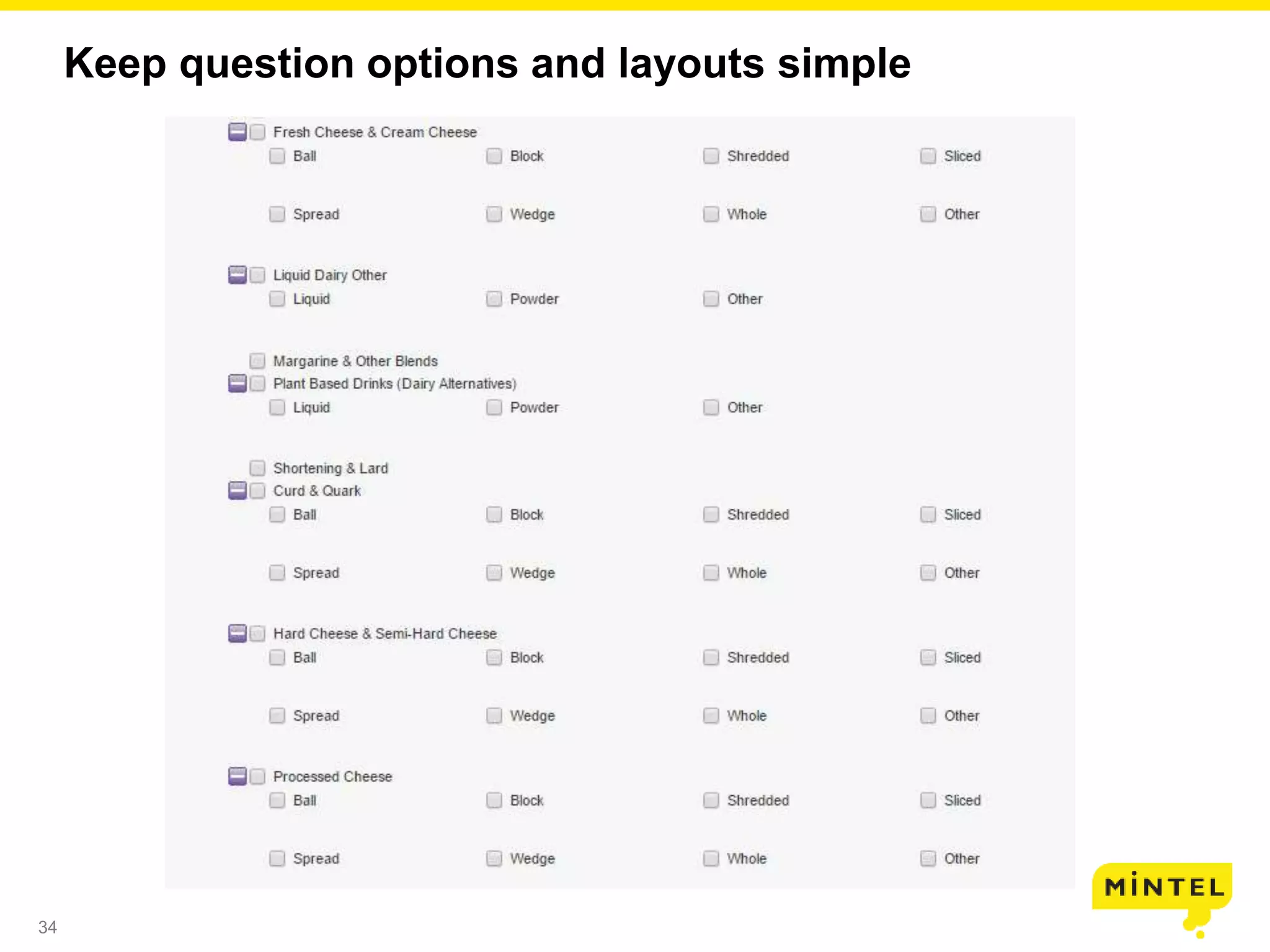

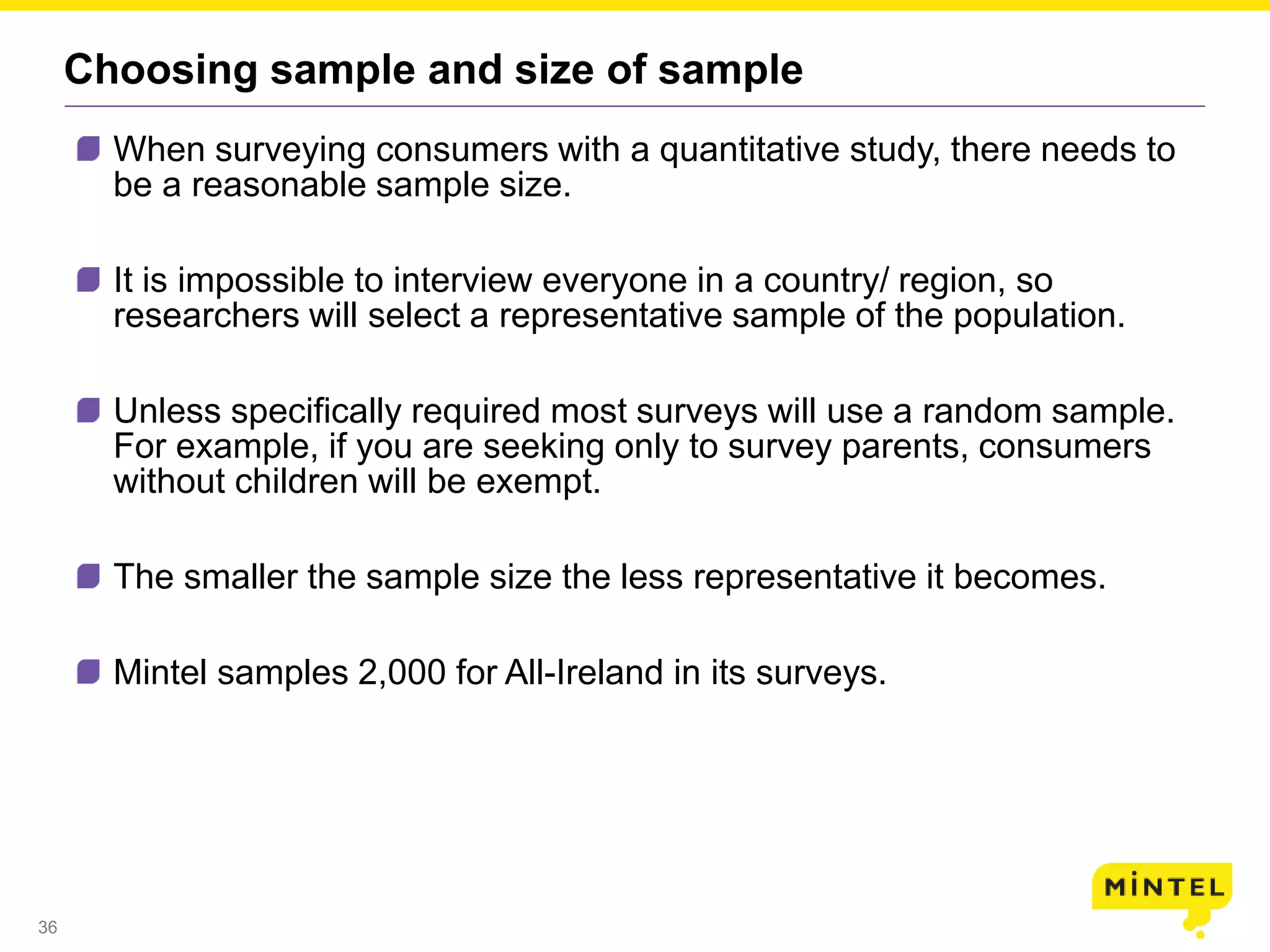

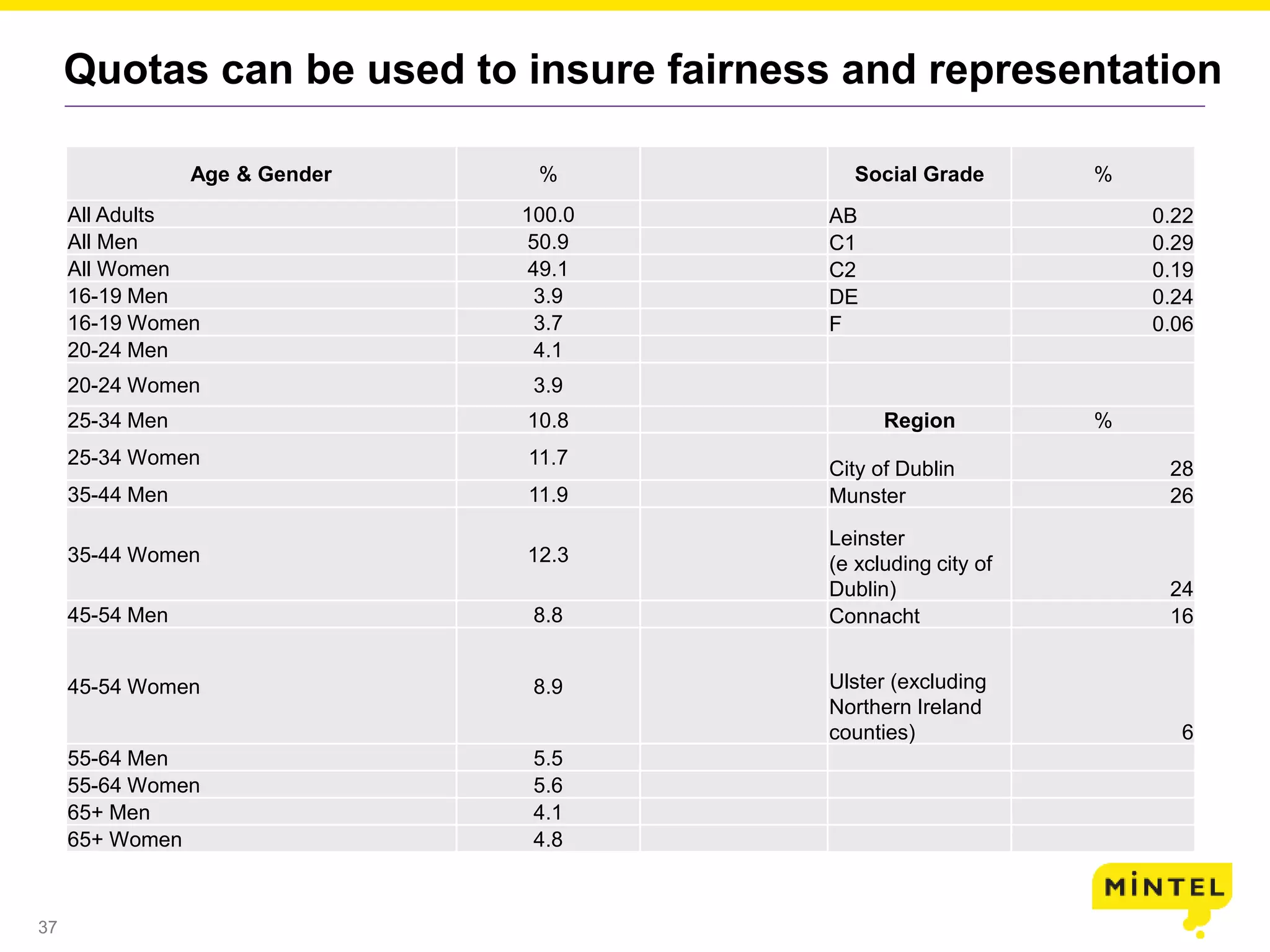

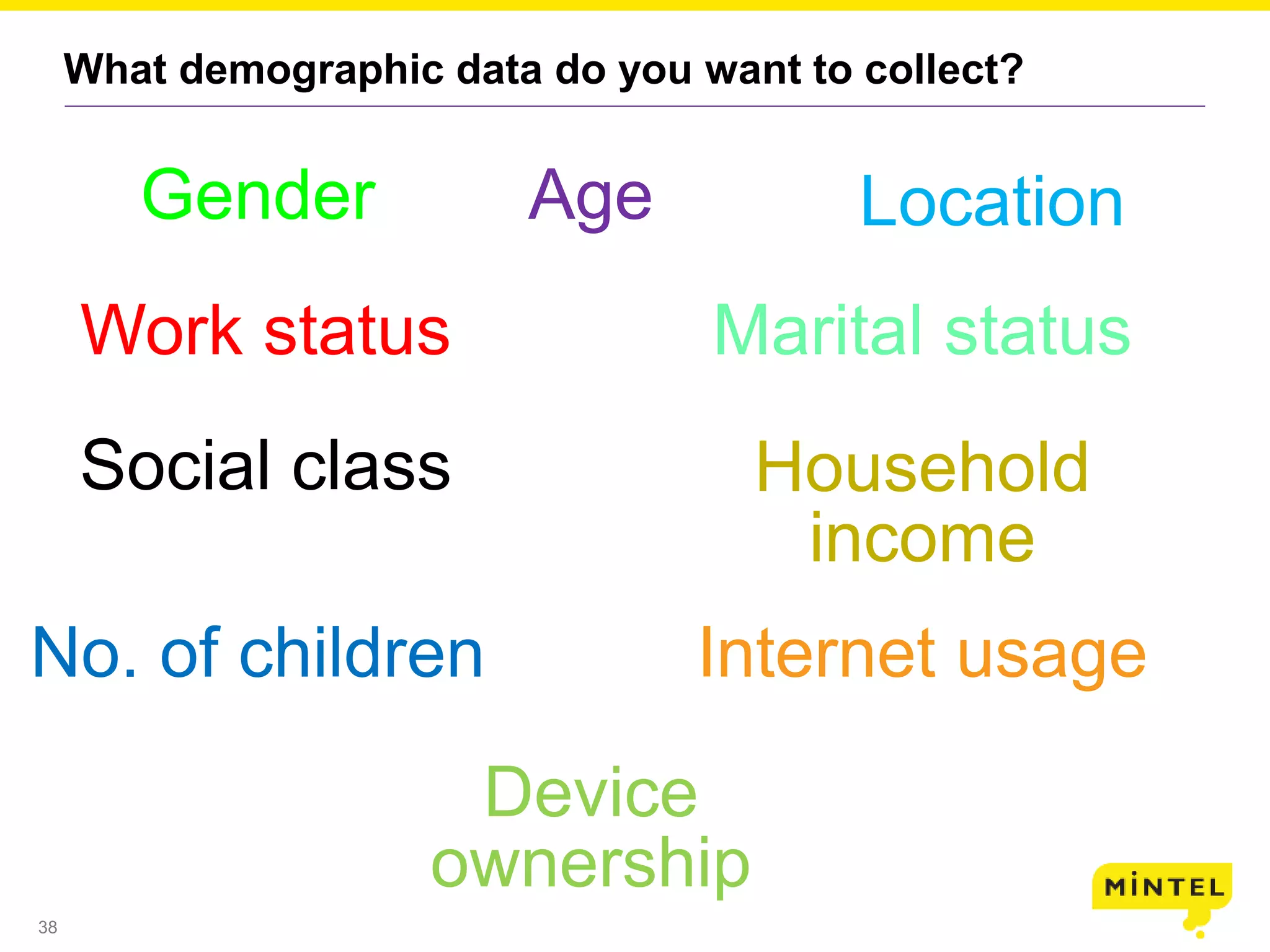

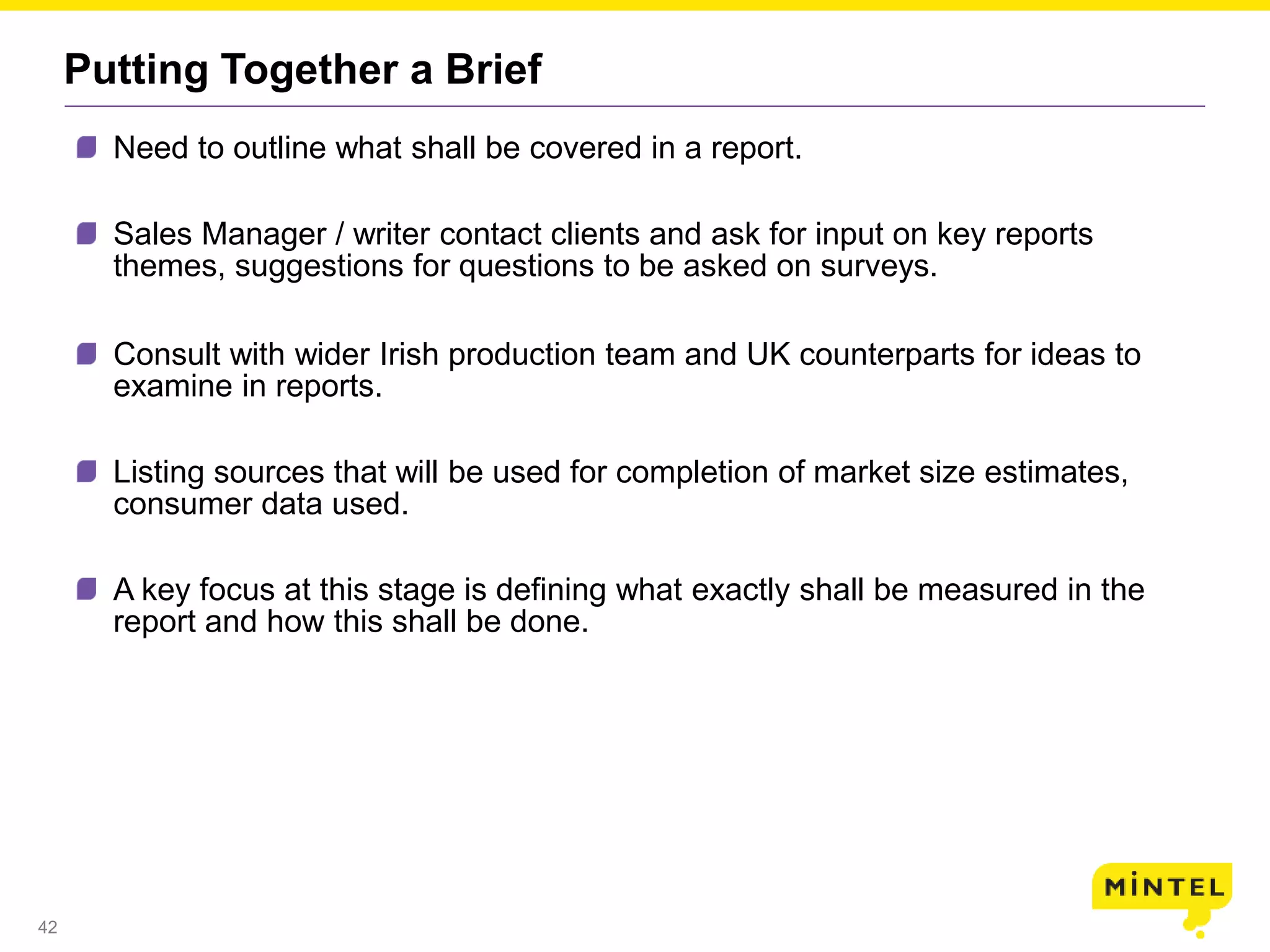

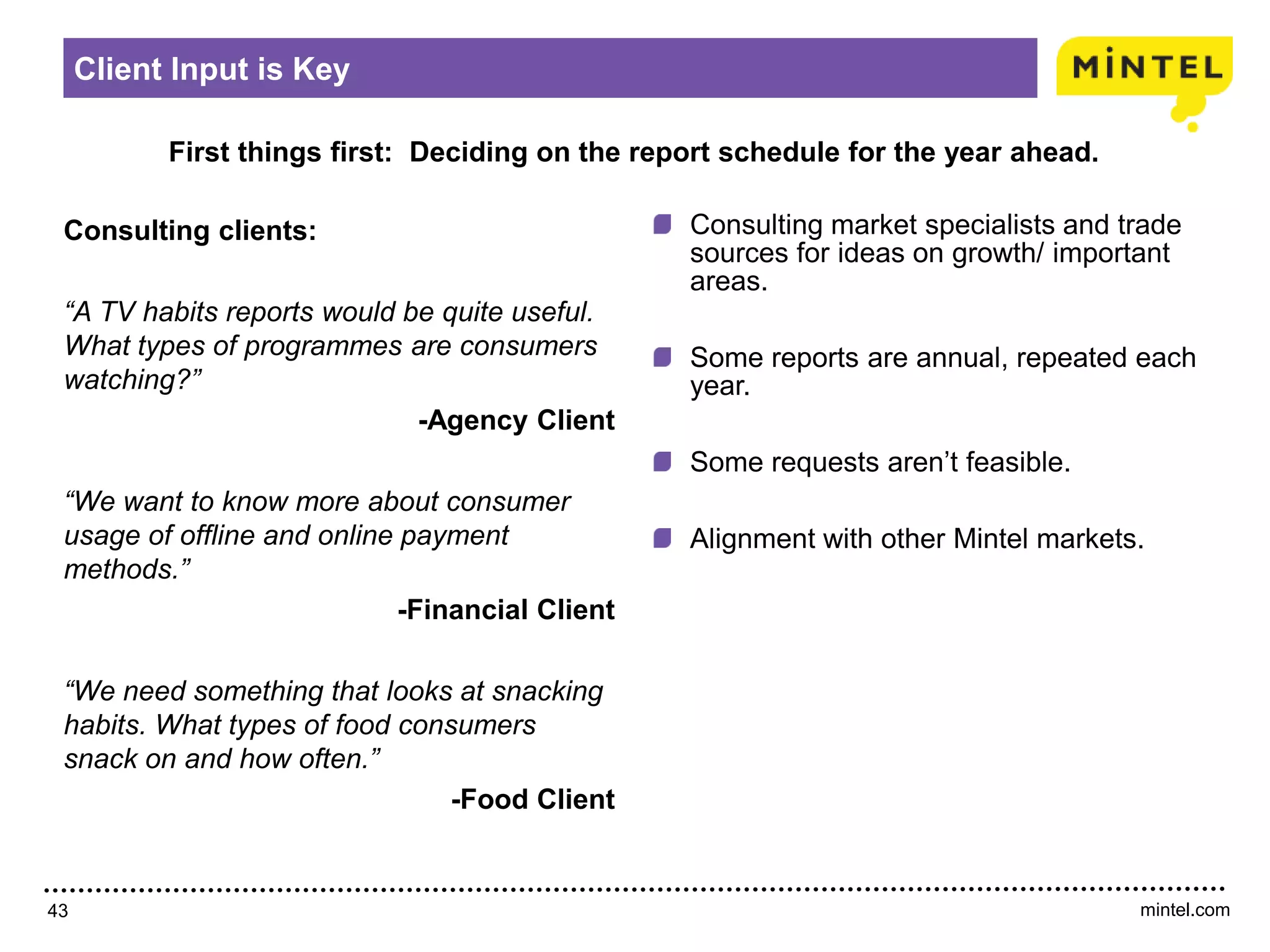

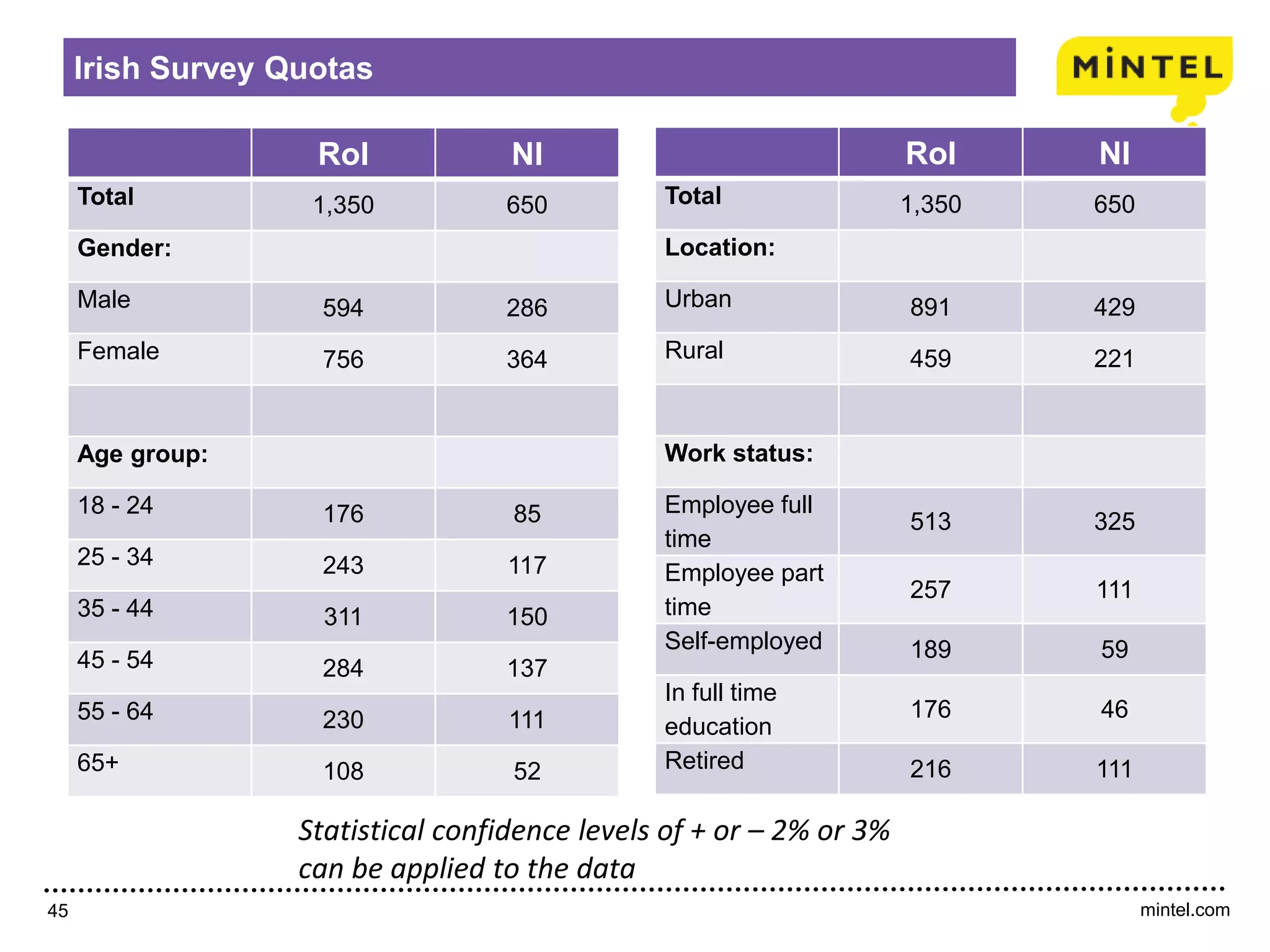

The document outlines the importance of market research in Ireland, detailing methods such as secondary and primary research, along with the necessity of understanding consumer demographics. Mintel reports provide insights into various sectors including food, drink, and retail, offering comprehensive data to support business plans and research projects. It emphasizes the significance of avoiding bias in surveys and the need for well-designed questionnaires to gather accurate consumer insights.