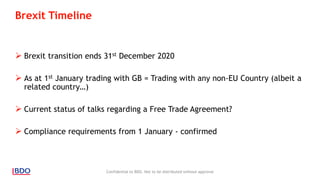

The document outlines preparations for Brexit effective January 1, 2021, detailing the transition from trading with the UK as part of the EU to treating it as a non-EU country. It highlights key compliance requirements, expected increases in customs declarations, and essential steps businesses must take to prepare, such as obtaining an EU/UK EORI and ensuring customs agents are in place. The document also emphasizes the importance of understanding new trade tariffs and customs procedures.