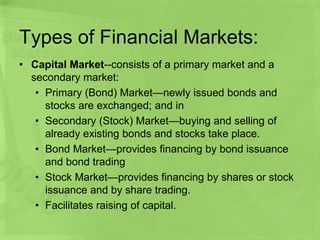

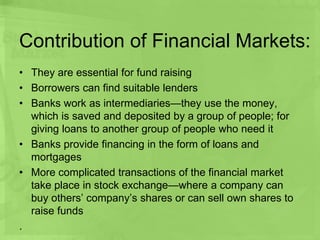

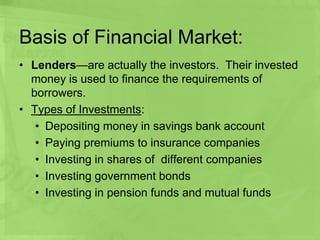

Financial markets facilitate various types of financial transactions that help businesses grow and investors earn money. They include capital markets, stock markets, bond markets, money markets, derivatives markets, foreign exchange markets, insurance markets, and commodity markets. Financial markets allow companies and governments to raise funds by issuing stocks, bonds, and other financial instruments, while also enabling investors to buy and sell existing securities. They play a vital role in the economy by connecting those who need to borrow money with those who have money to lend.