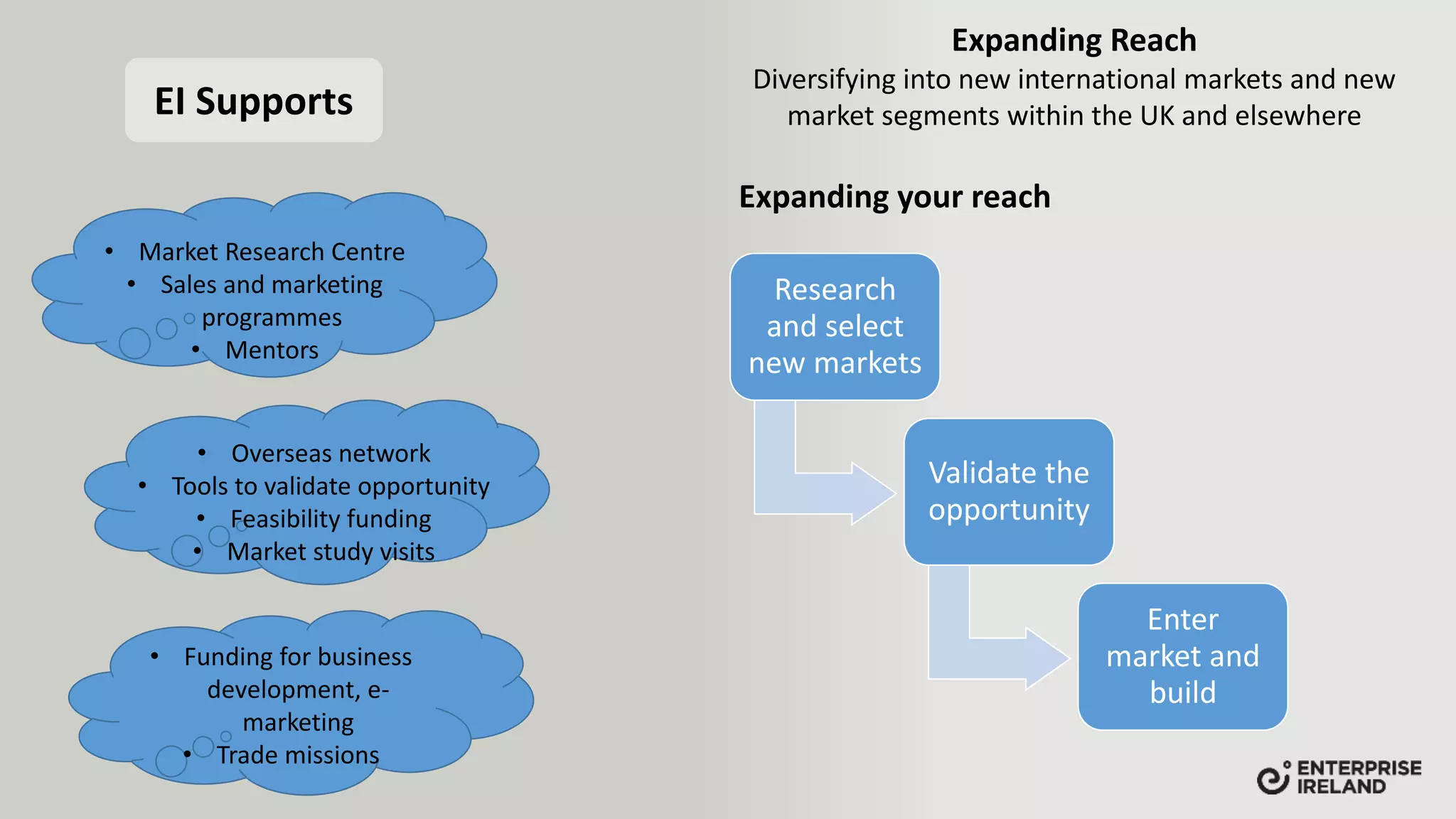

This document discusses opportunities for Irish businesses to expand exports to European markets in light of Brexit. It outlines Enterprise Ireland's role in supporting Irish businesses and driving growth. It identifies nine areas of exposure for businesses due to Brexit, including dependency on the UK market and changes to regulations and customs. The document then discusses four building blocks for competitiveness, including expanding reach into new international markets. It provides examples of market opportunities in countries like the Netherlands, Nordic countries, France, and Germany. It also offers guidance on how to research and select new markets and validate opportunities. Finally, it outlines the supports available from Enterprise Ireland to help businesses expand their export footprint.