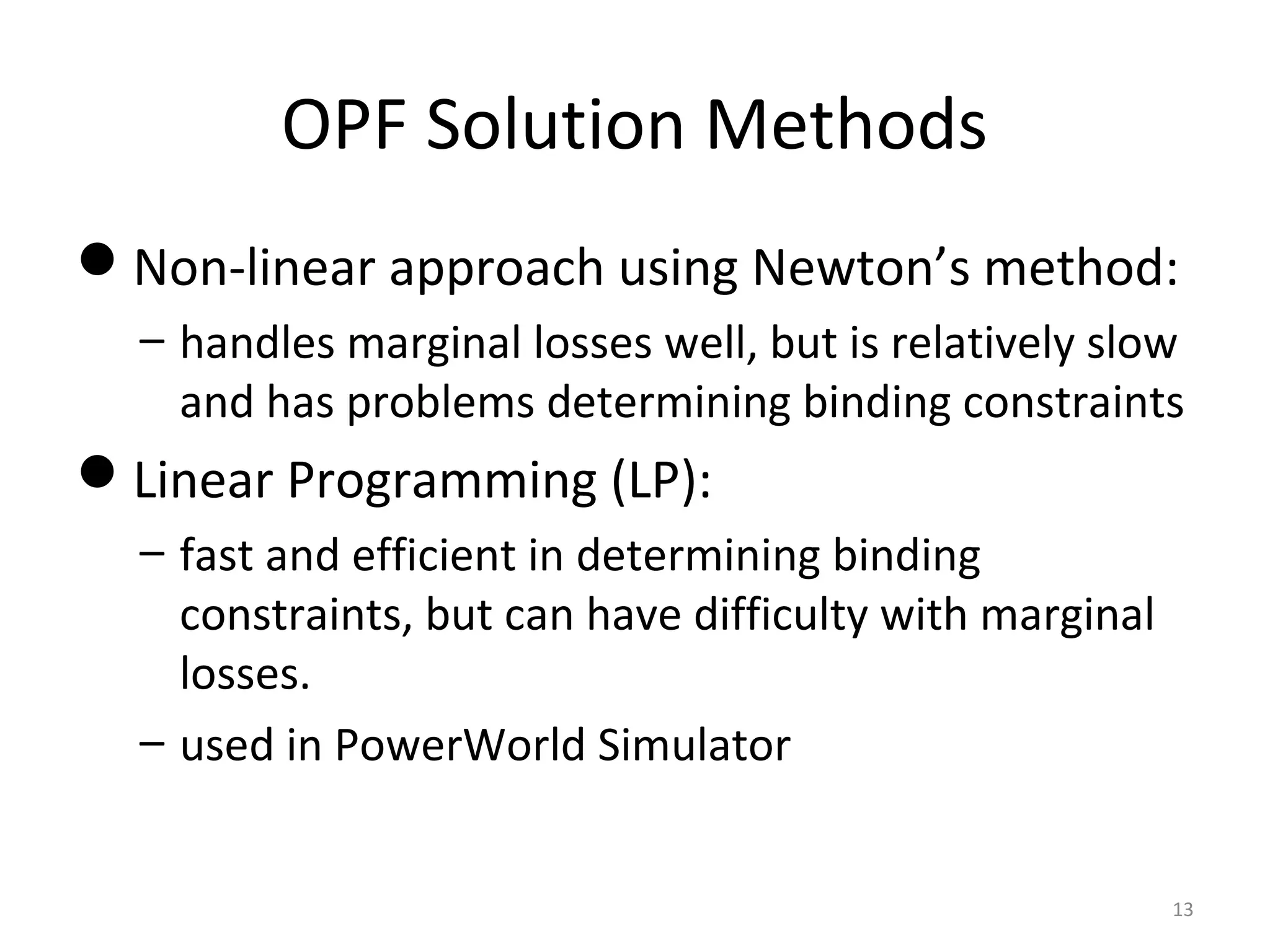

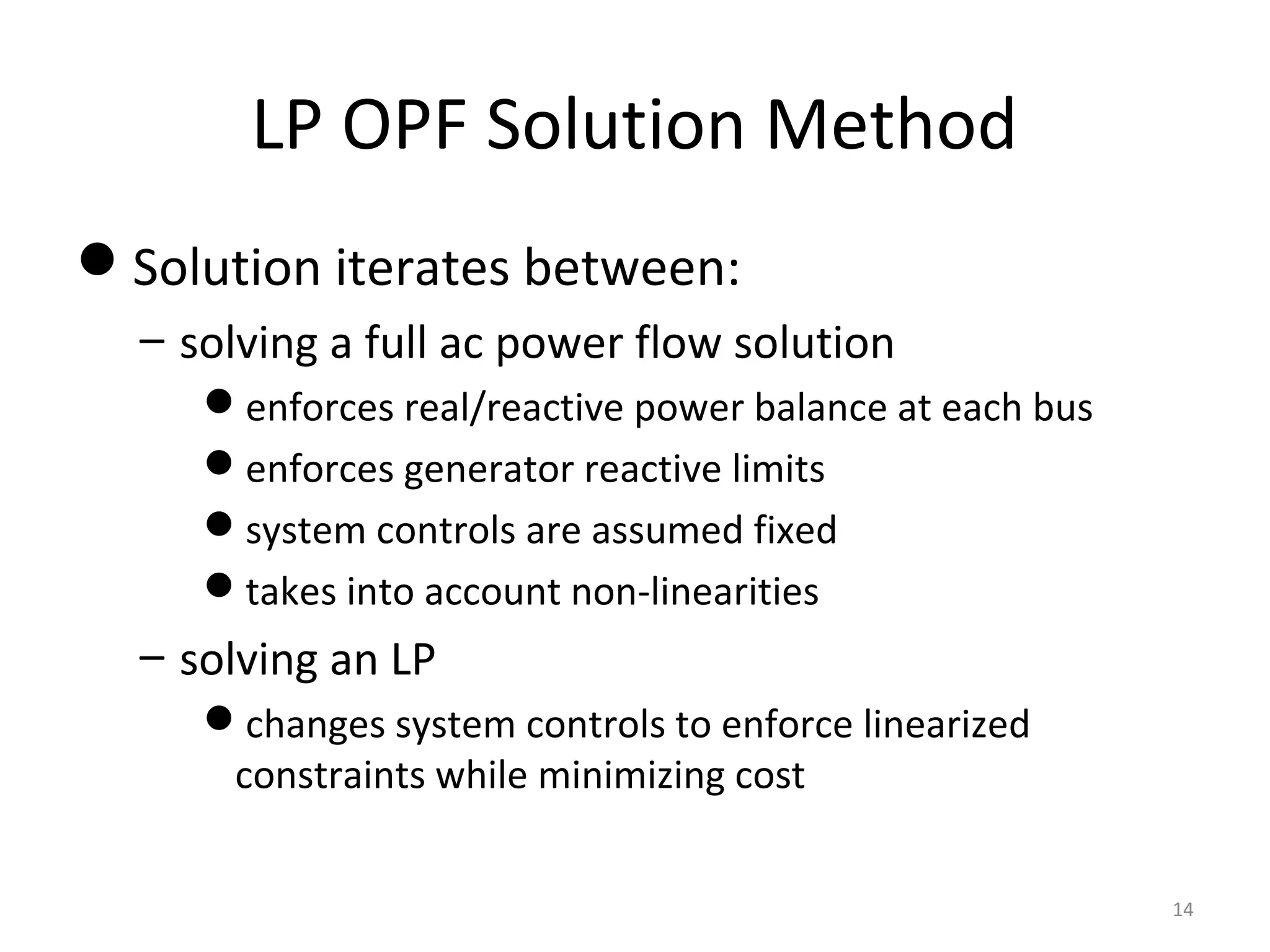

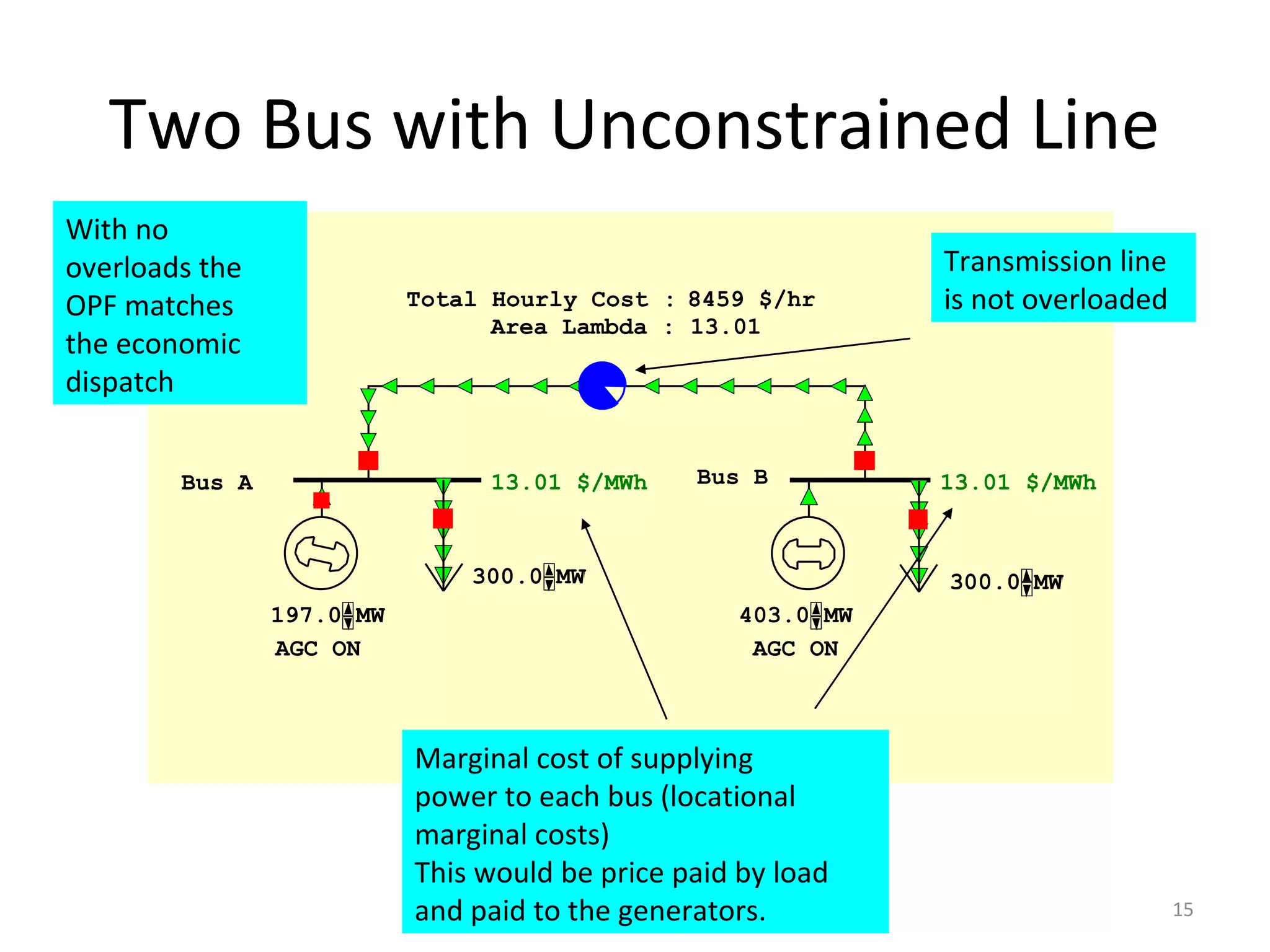

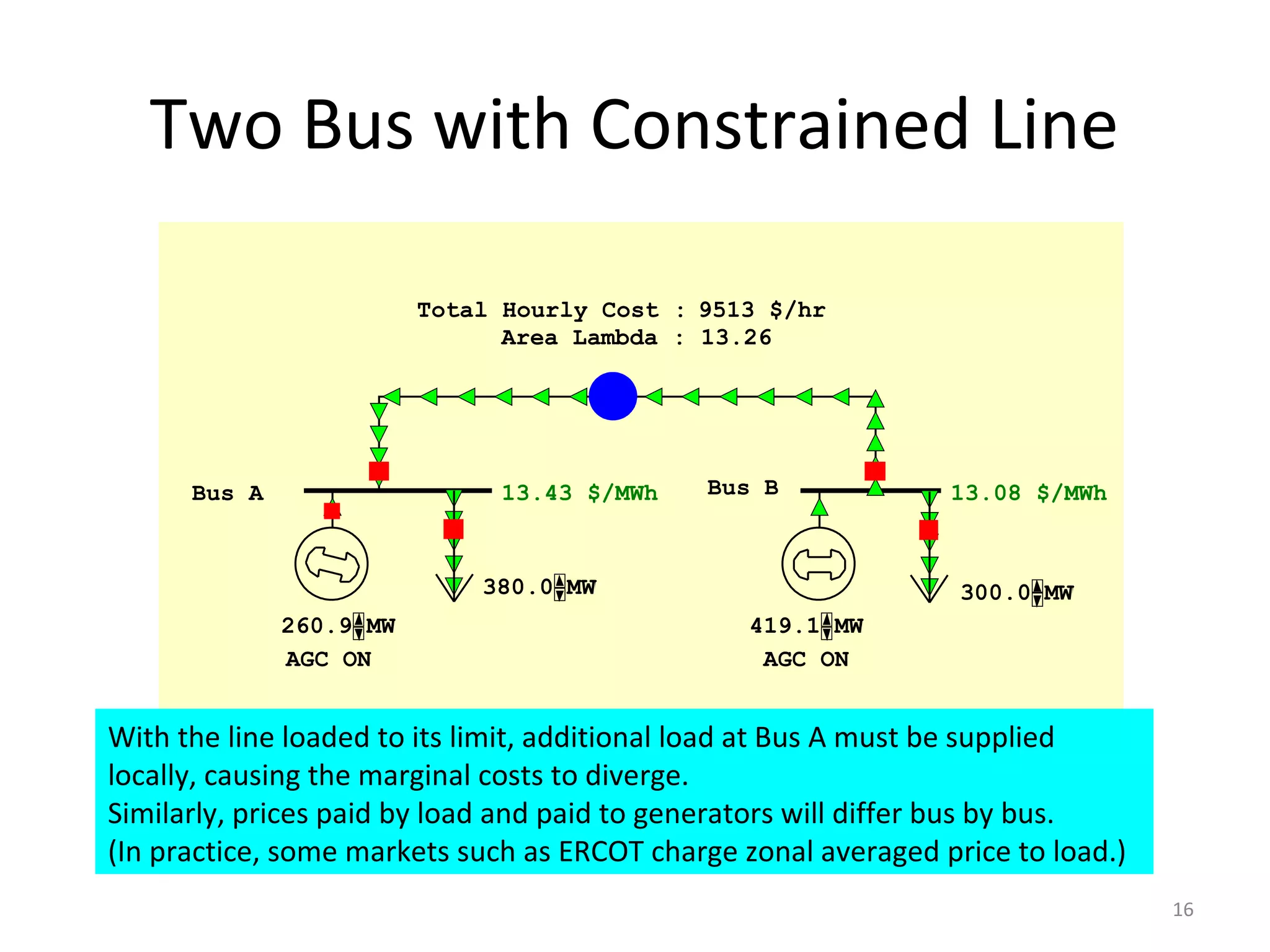

This document discusses optimal power flow (OPF) and locational marginal pricing (LMP) in electricity markets. It provides the following key points:

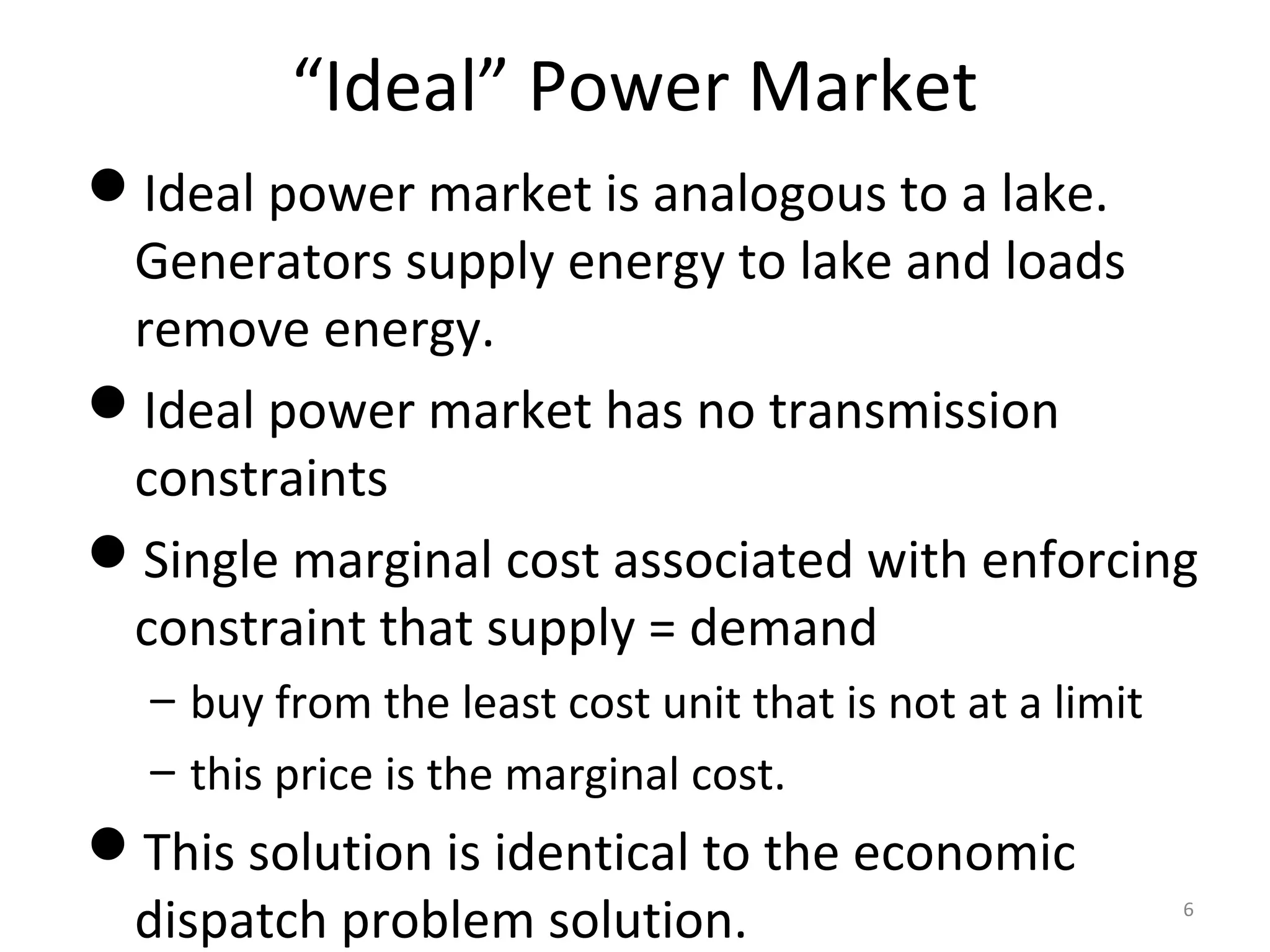

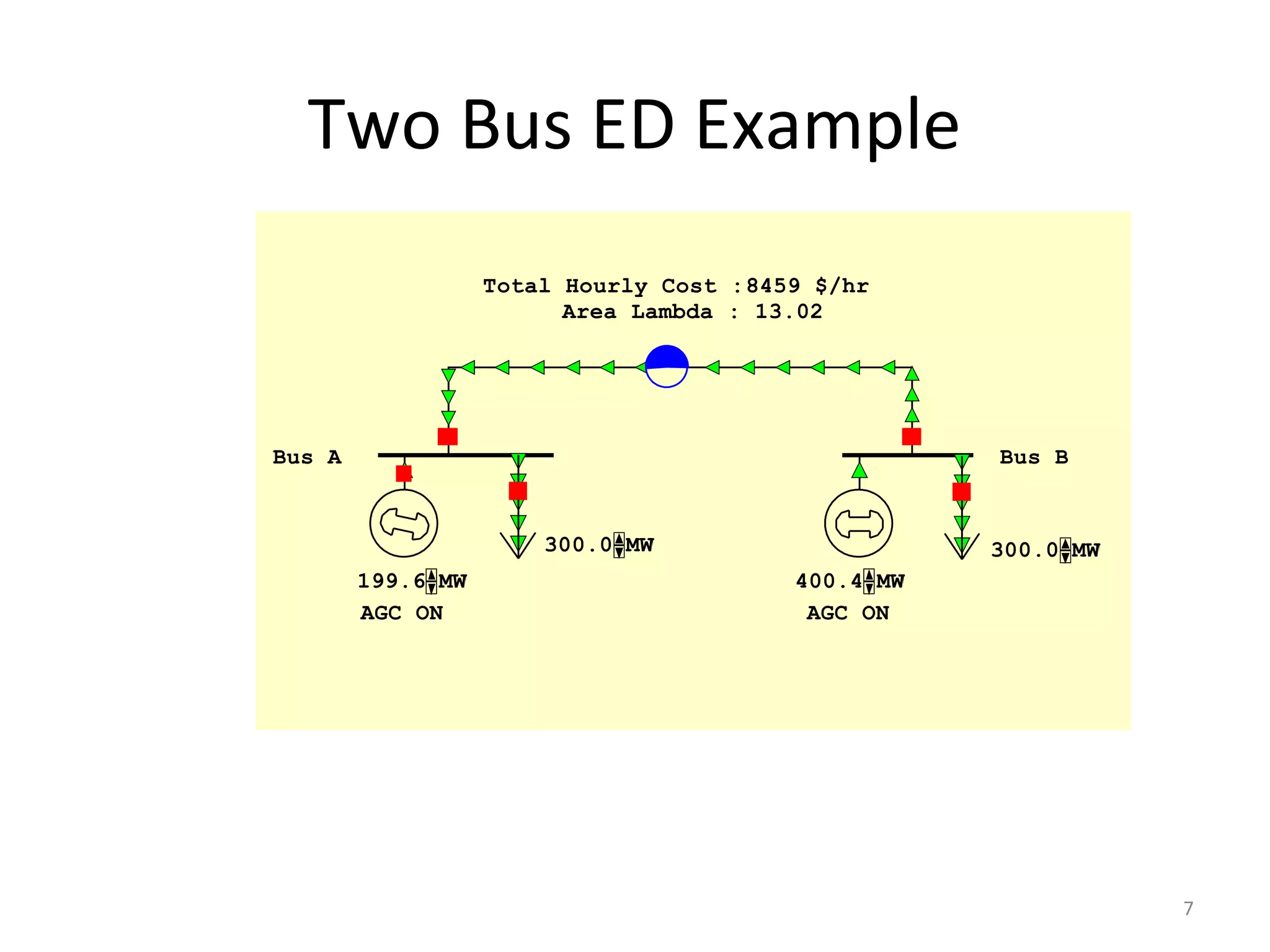

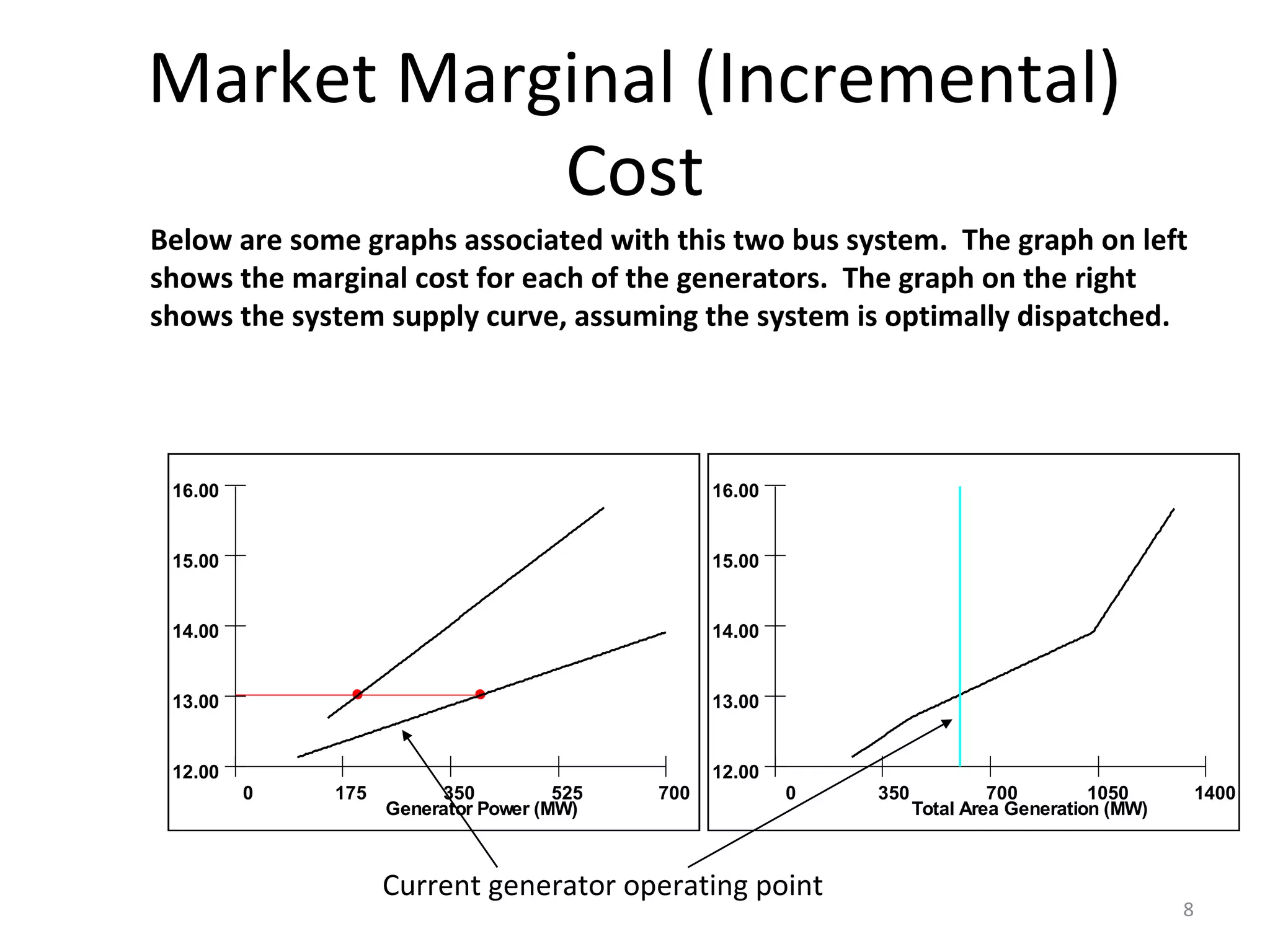

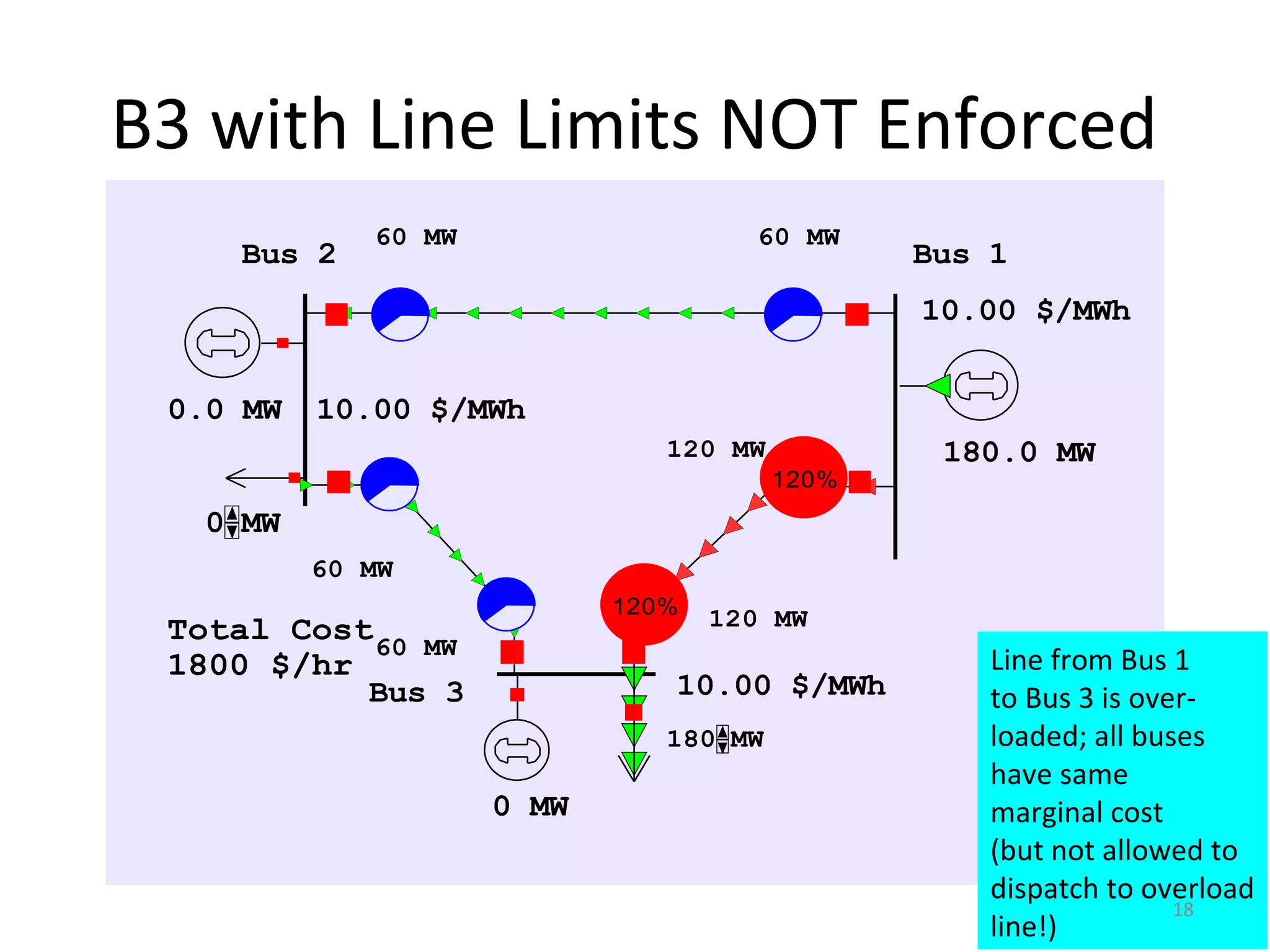

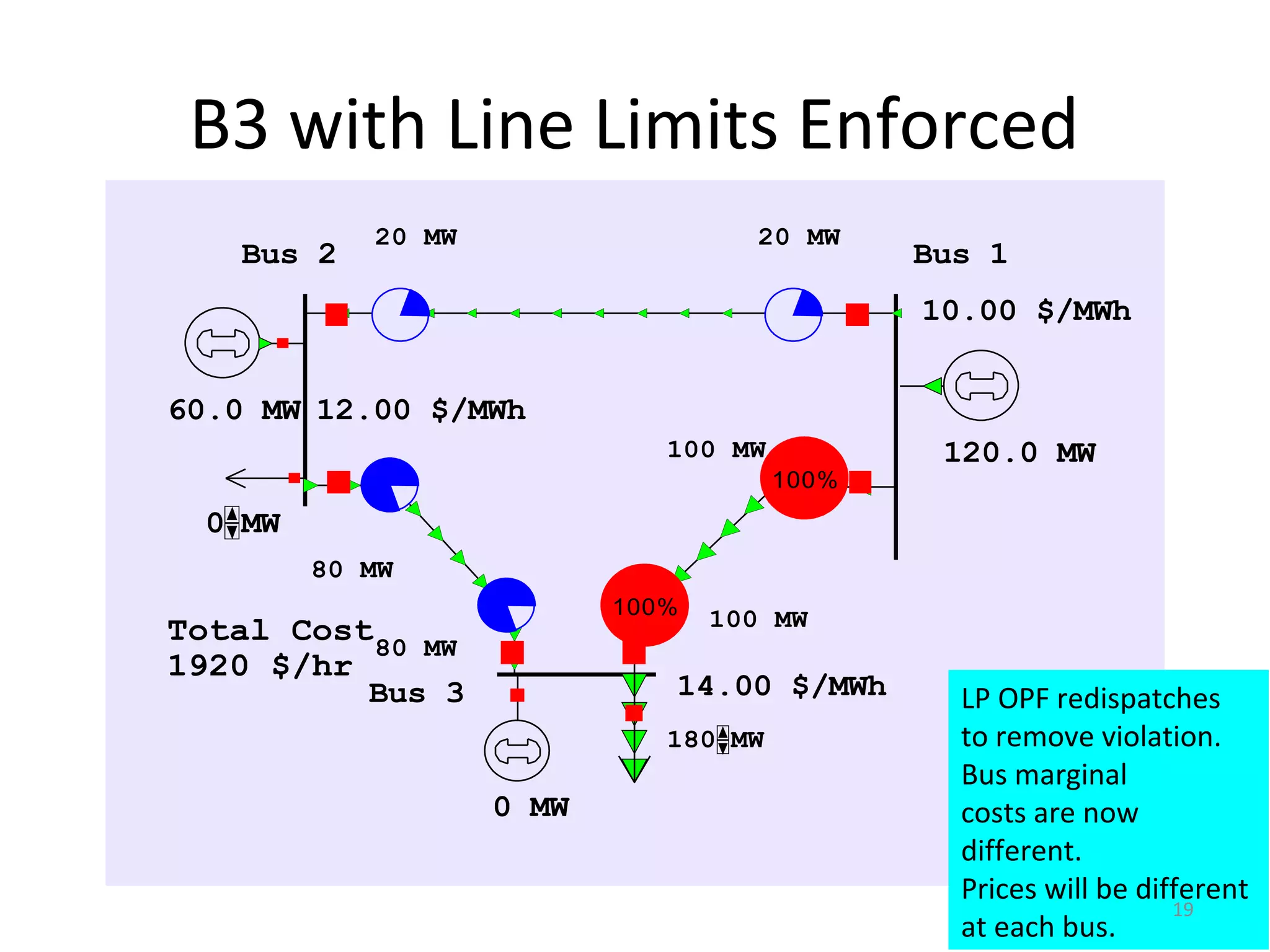

1) OPF is used by Independent System Operators to determine day-ahead and real-time dispatch pricing based on generators' marginal costs while accounting for transmission constraints.

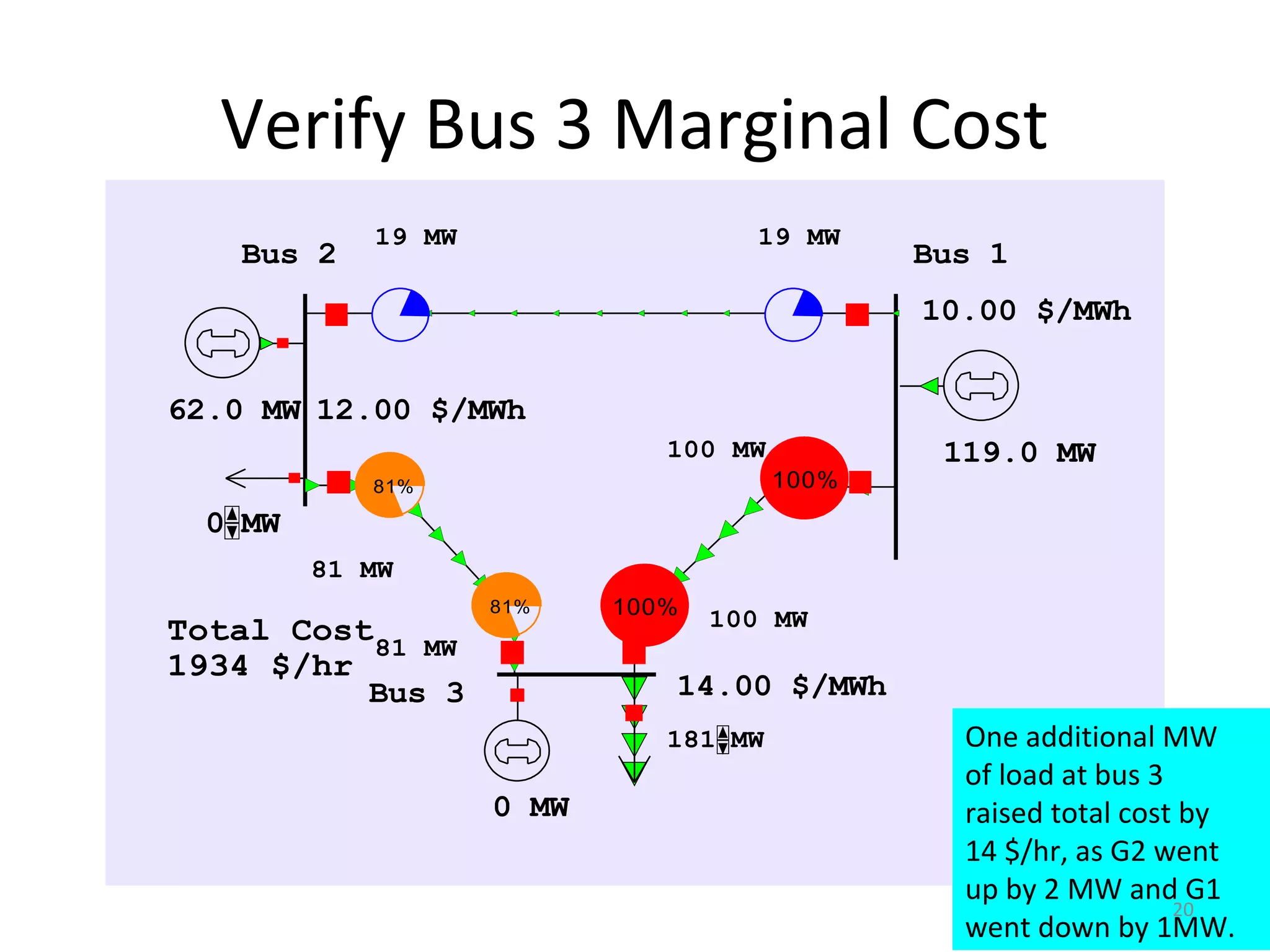

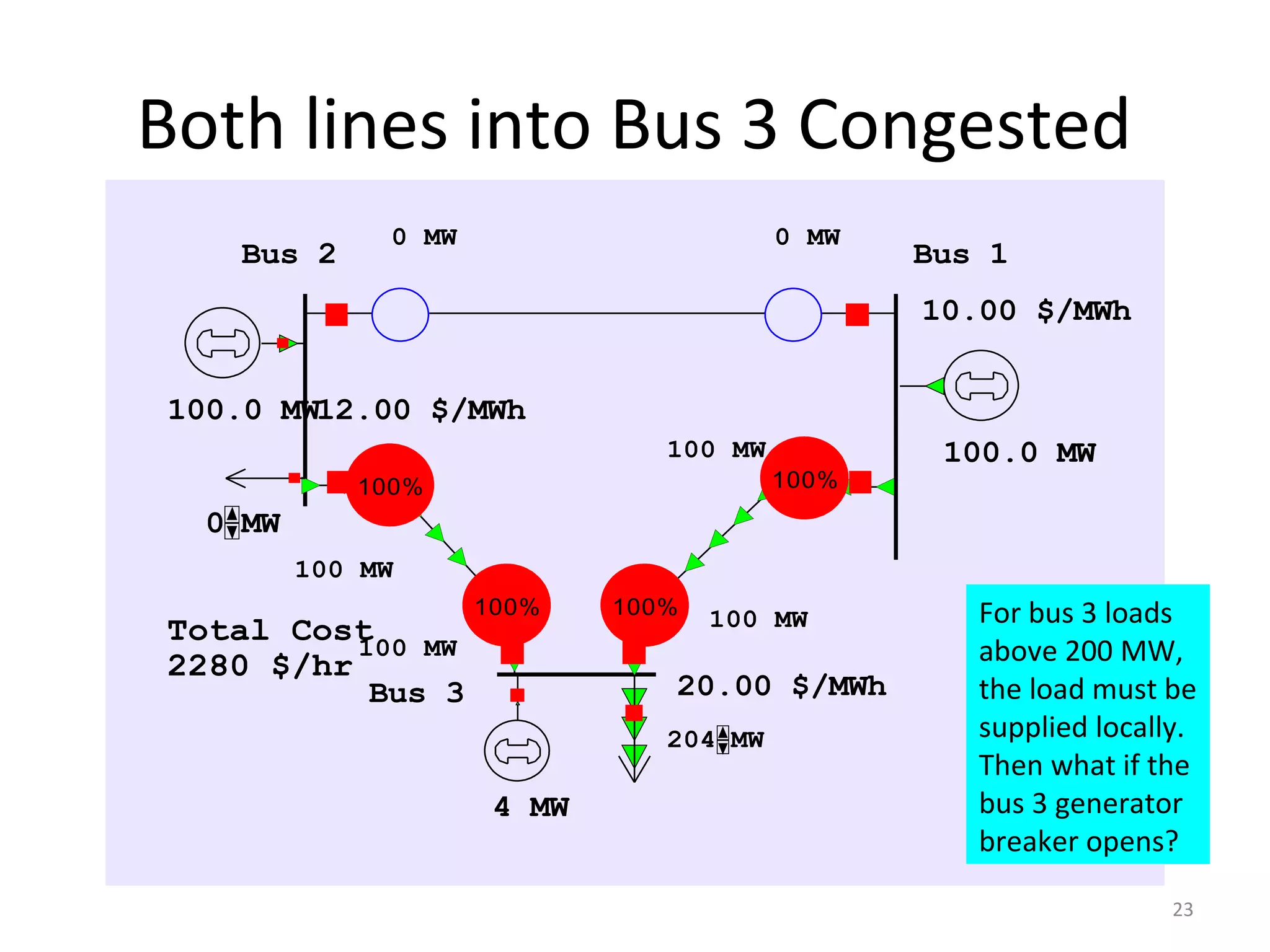

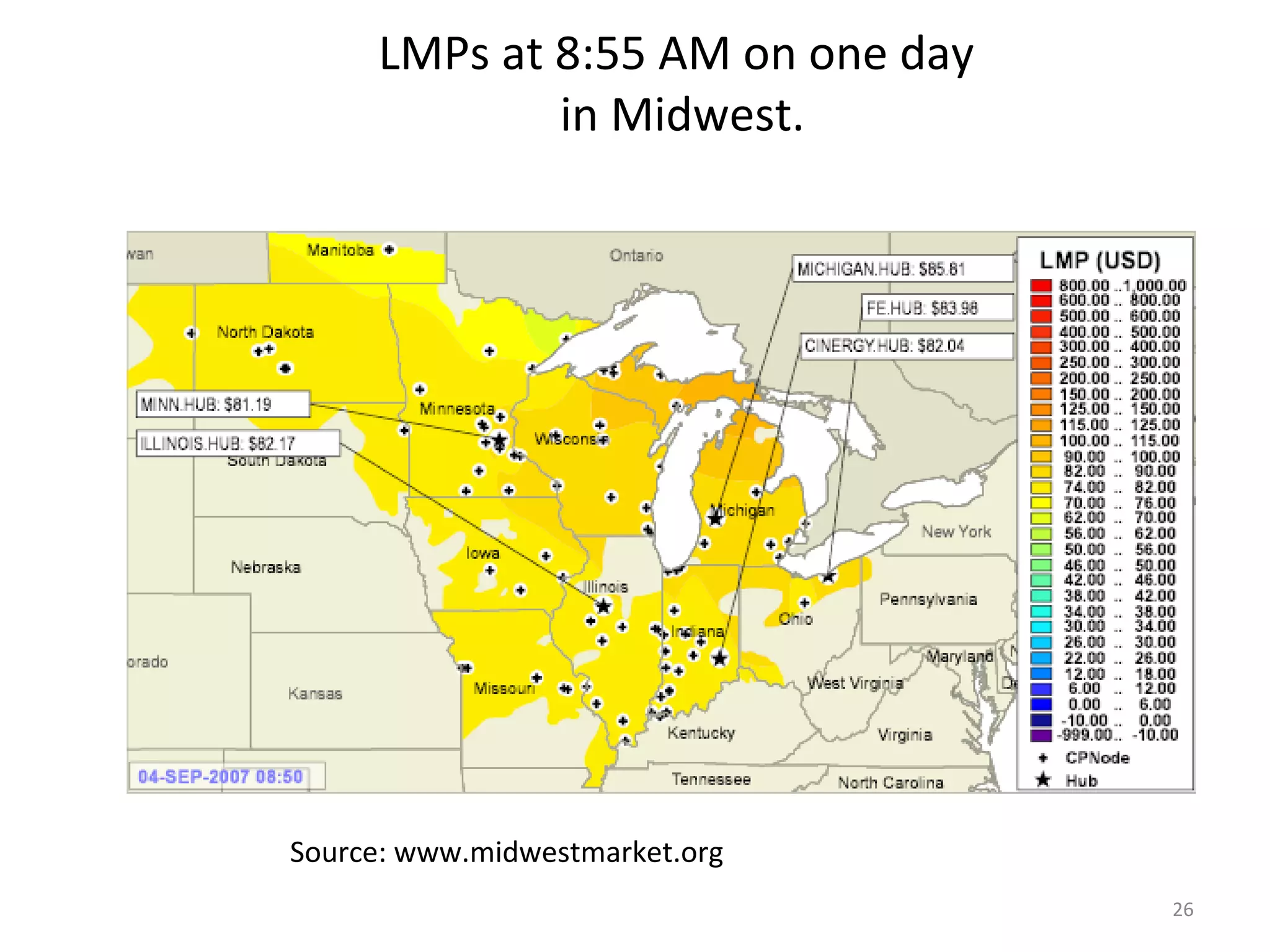

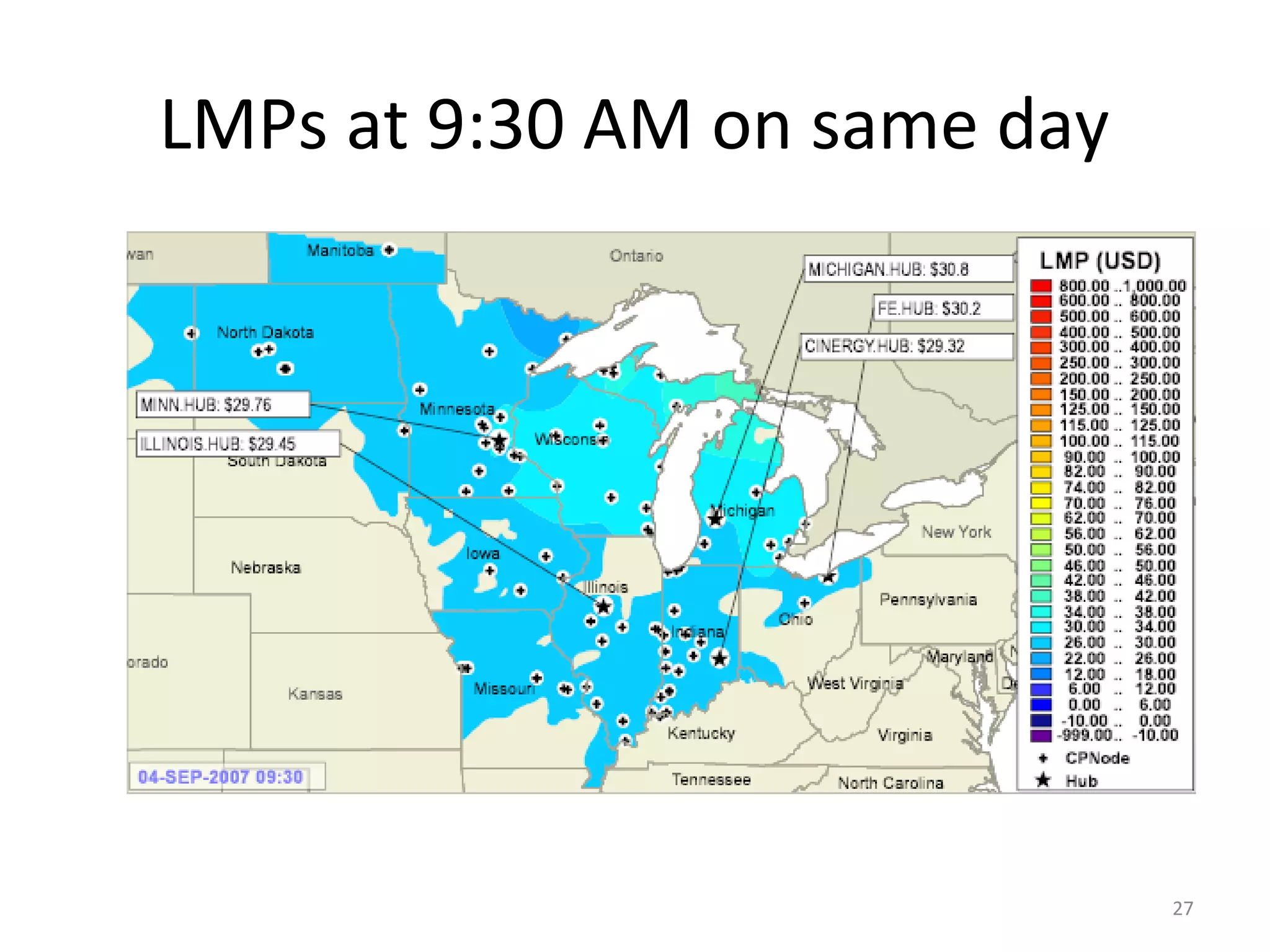

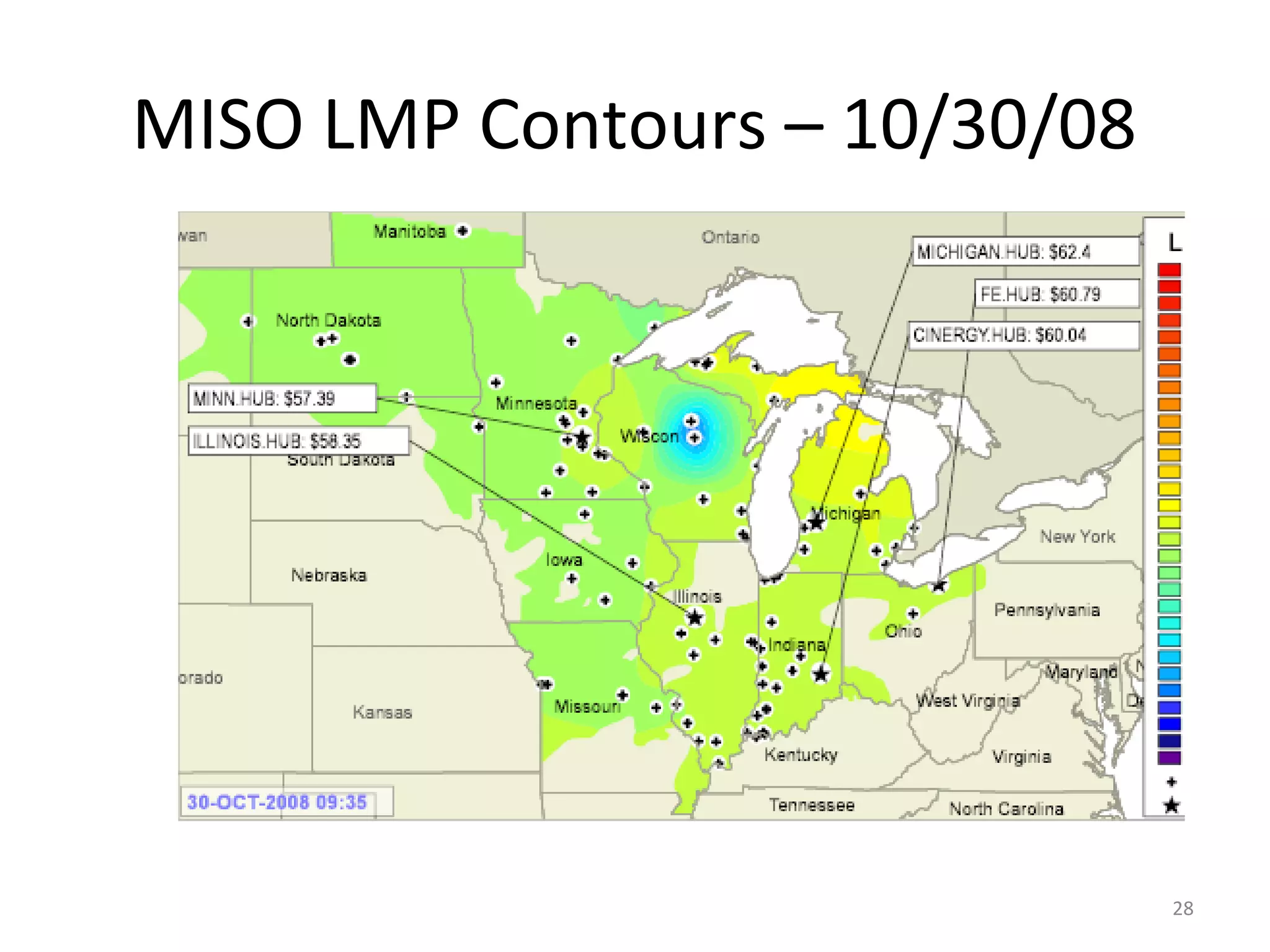

2) LMP indicates the marginal cost of supplying additional electricity to a bus. It differs across buses due to transmission constraints identified through OPF.

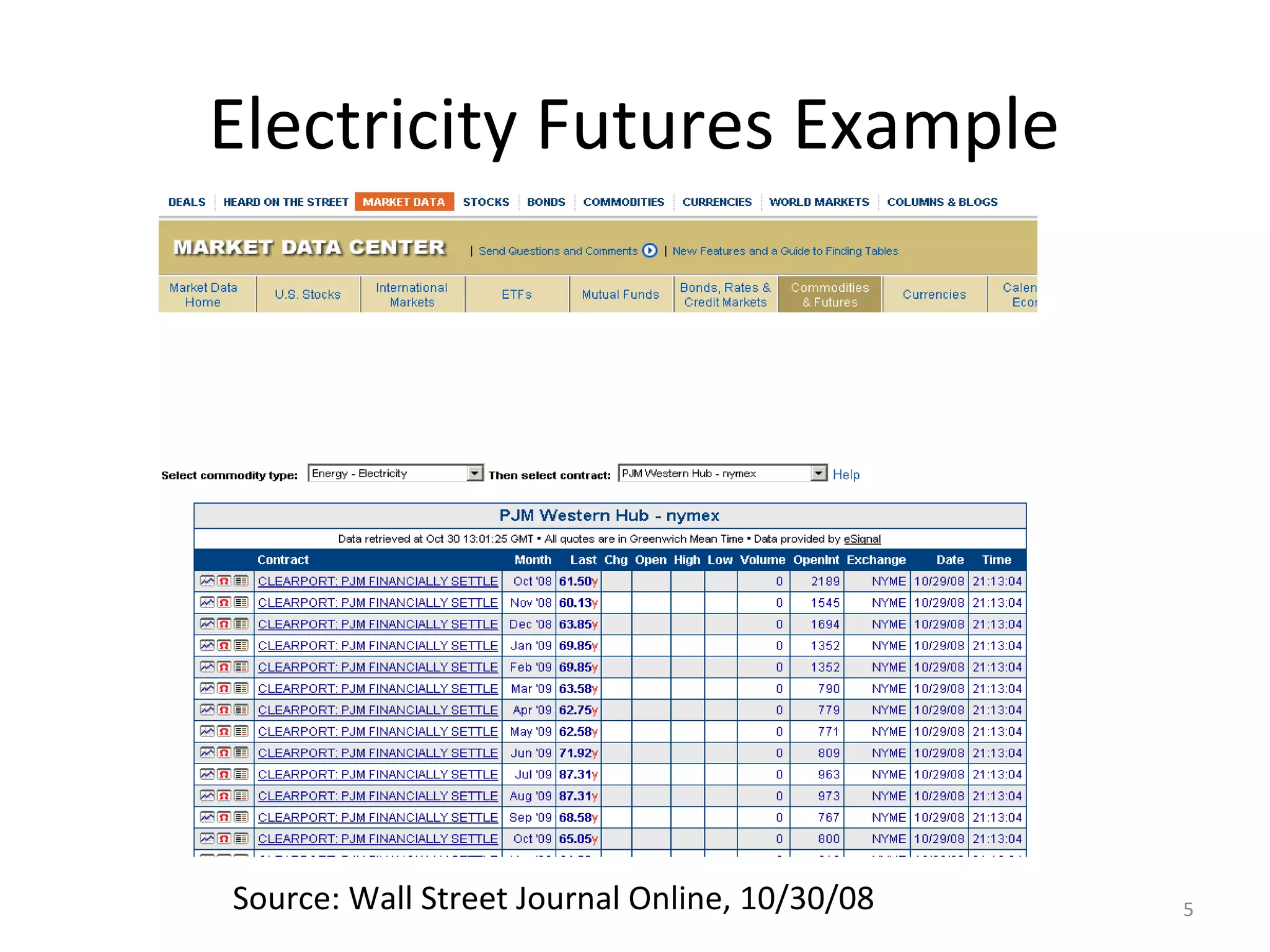

3) Electricity markets have moved from bilateral contracts to centralized day-ahead and real-time markets operated by ISOs using OPF and LMP to function like commodity markets while respecting transmission limits.