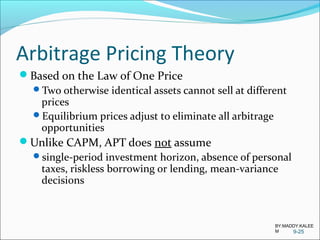

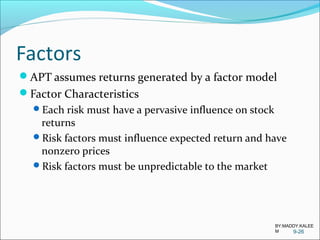

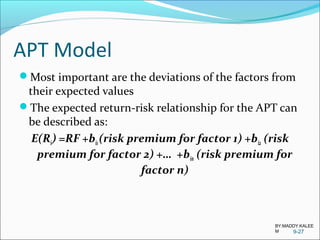

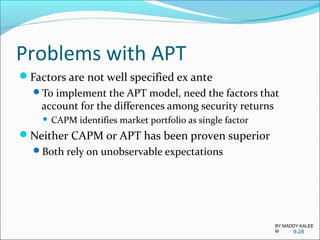

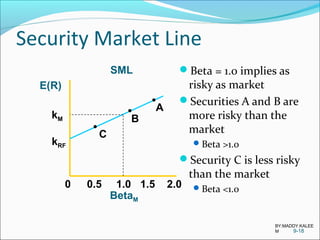

Chapter 9 of 'Investments: Analysis and Management' by Charles P. Jones discusses the Capital Asset Pricing Model (CAPM), which analyzes the relationship between risk and expected return in financial assets. It introduces concepts such as the market portfolio, capital market line, and security market line, emphasizing the assumptions of market equilibrium and the impact of borrowing and lending on investment choices. The chapter also contrasts CAPM with Arbitrage Pricing Theory (APT) and highlights the importance of beta in measuring systematic risk.

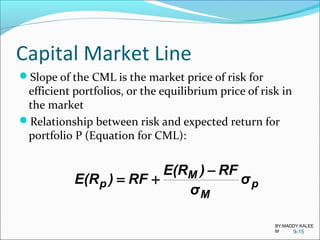

![Capital Market Line

Line from RF to L is

capital market line

(CML)

x = risk premium

=E(RM) - RF

y =risk =σM

Slope =x/y

=[E(RM) - RF]/σM

y-intercept = RF

9-12

E(RM)

RF

Risk

σM

L

M

y

x

BY:MADDY.KALEE

M](https://image.slidesharecdn.com/jones10eab-180731222216/85/Asset-Pricing-Models-12-320.jpg)

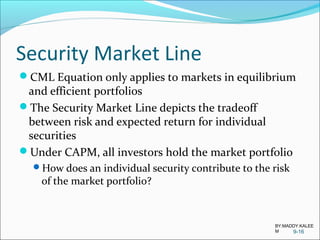

![Security Market Line

A security’s contribution to the risk of the market

portfolio is based on beta

Equation for expected return for an individual stock

9-17

[ ]RF)E(RβRF)E(R Mii −+=

BY:MADDY.KALEE

M](https://image.slidesharecdn.com/jones10eab-180731222216/85/Asset-Pricing-Models-17-320.jpg)

![CAPM’s Expected

Return-Beta Relationship

Required rate of return on an asset (ki) is composed of

risk-free rate (RF)

risk premium (βi [ E(RM) - RF ])

Market risk premium adjusted for specific security

ki = RF +βi [ E(RM) - RF ]

The greater the systematic risk, the greater the required

return

9-20

BY:MADDY.KALEE

M](https://image.slidesharecdn.com/jones10eab-180731222216/85/Asset-Pricing-Models-20-320.jpg)