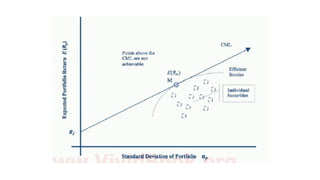

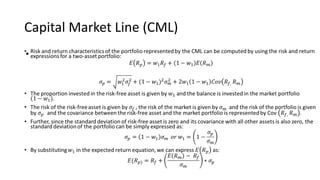

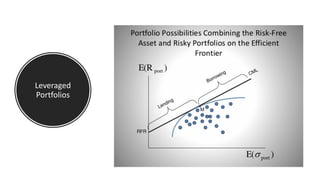

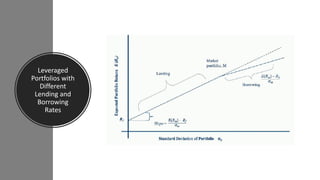

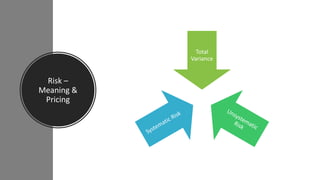

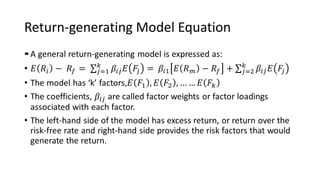

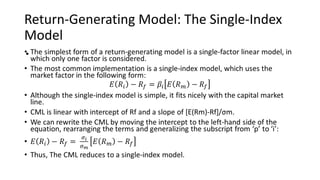

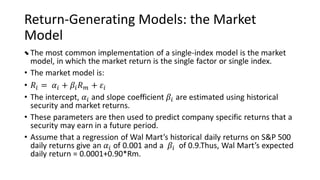

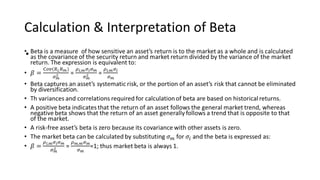

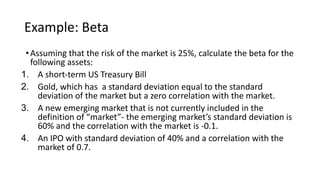

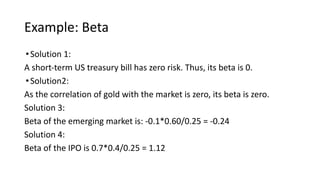

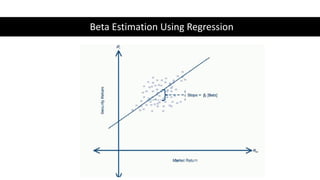

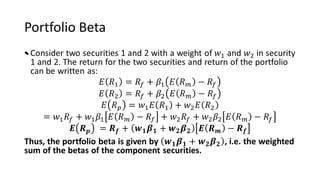

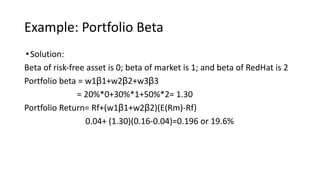

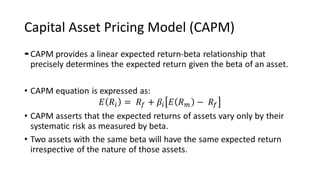

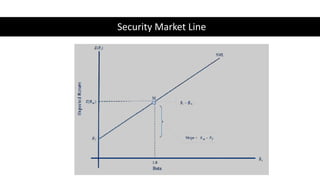

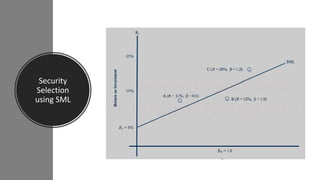

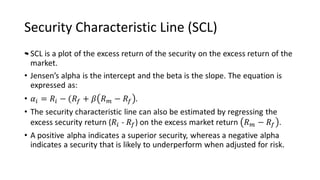

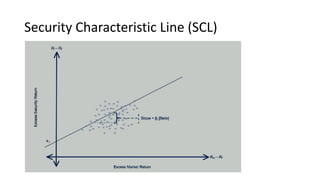

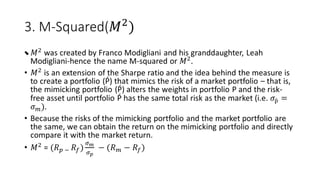

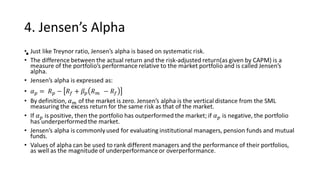

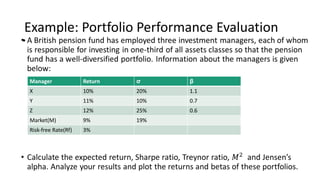

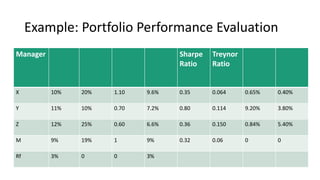

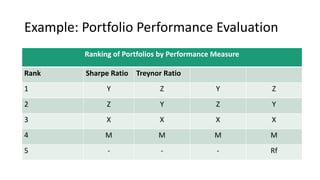

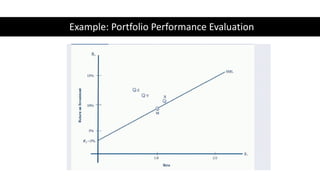

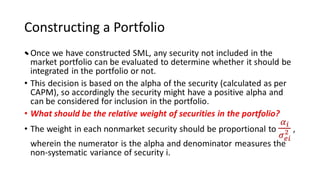

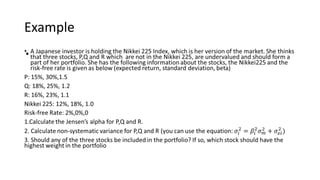

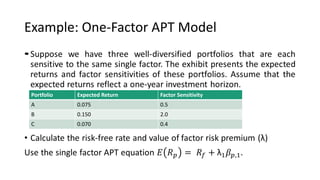

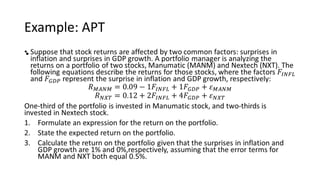

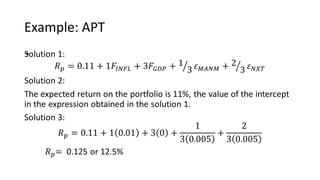

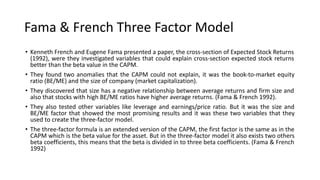

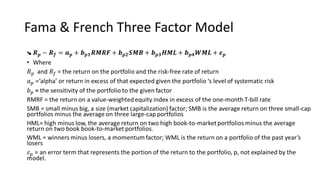

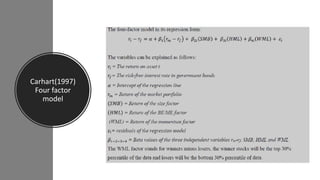

The document discusses various models for analyzing portfolio risk and return, including the Capital Market Line (CML) and different types of return-generating models. It also covers the Capital Asset Pricing Model (CAPM) and its assumptions, the Security Market Line (SML), and techniques for evaluating portfolio performance such as the Sharpe Ratio and Treynor Ratio. The Fama-French three-factor model and Carhart four-factor model, which extend the CAPM, are also summarized.