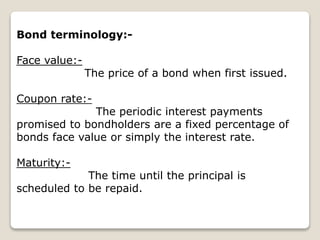

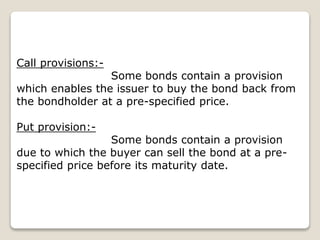

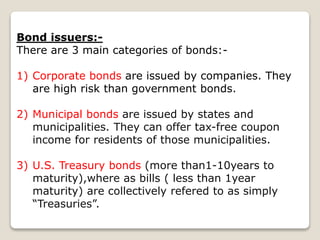

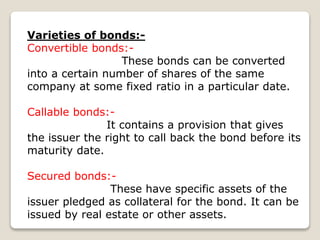

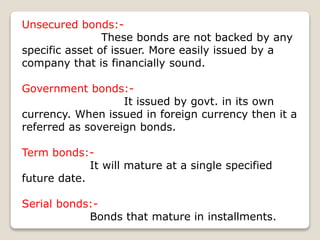

Bonds are debt instruments where an investor loans money to an entity for a set period of time at a fixed or variable interest rate. There are various types of bonds including corporate bonds issued by companies, municipal bonds issued by state and local governments, and U.S. Treasury bonds issued by the federal government. Bonds can have different features such as being callable or convertible. They can also be secured by specific assets or unsecured. Bond issuers look to bonds as a way to raise funds for a period of time while investors seek bonds as a conservative way to earn income. However, bonds carry various risks including interest rate risk, credit risk, and liquidity risk.