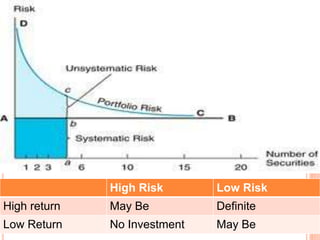

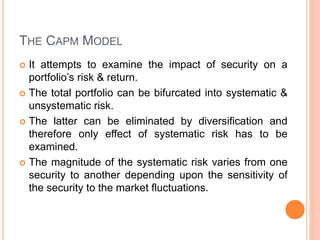

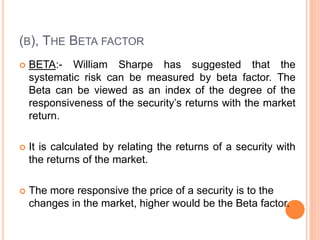

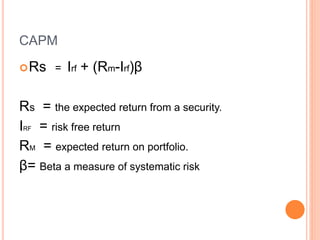

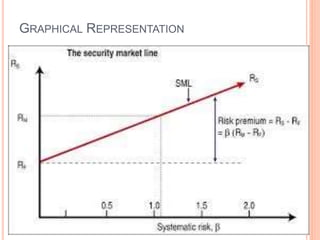

The Capital Asset Pricing Model (CAPM) uses beta to measure the non-diversifiable risk of a security and determine its expected return. CAPM assumes investors want to maximize returns and only consider systematic risk. It models expected return as the risk-free rate plus a risk premium based on the security's beta. The Security Market Line graphs this relationship between beta and expected return. Some researchers like Fama and French have expanded CAPM with additional size and value factors.