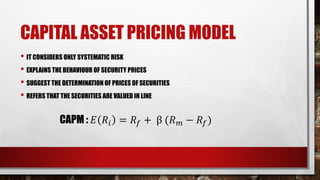

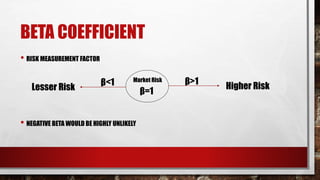

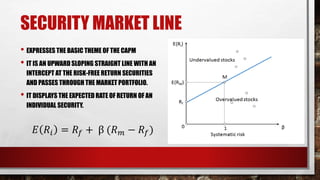

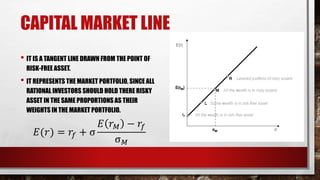

This document provides an overview of the Capital Asset Pricing Model (CAPM). It defines key terms like systematic and unsystematic risk. It explains that CAPM considers only systematic risk and uses the beta coefficient to measure risk. It also describes the security market line and capital market line graphs that are used in CAPM. The document outlines the assumptions of CAPM and notes both the benefits and drawbacks of using the model to determine expected returns based on an asset's risk level.